New Delhi: China is the undisputed global leader in shipbuilding and in 2024 had 71% of all global shipbuilding orders. China owns 400 naval ships, the largest fleet in the world. Over the last two decades China has built a formidable indigenous shipbuilding capacity, for example it builds a frigate every 25 months and a destroyer every 2.5 years. China’s capacity to replace and maintain naval ships outpaces that of any country in the world.

It also owns the largest fleet of oceangoing commercial ships, including ships registered in third countries. Additionally, Chinese firms control at least 110 commercial ports across 67 countries, strengthening Beijing’s influence over global maritime trade. China’s shipbuilding capabilities have significantly increased over the last two decades, driven by various government policies including subsidies for shipyards and related industries, provision of low-interest loans to ship buyers, establishment of secure in-house supply chains, development of shipyards with modern infrastructure and technologies, and investments in creating a highly skilled workforce. China has invested heavily in technical schools and engineering colleges, ensuring a steady supply of skilled workers. Incentives are provided to the workers with complimentary accommodation and meals, together with performance-based bonuses, further enhancing productivity. It ensures adequate order for the shipyard that its workforce remain employed throughout the year. Chinese shipbuilders are cautious that laying off workers, who have acquired proficiency and skills over the years, would mean either hiring new employees or retraining them. This is expensive and time consuming.

China’s shipbuilding industry is dominated by state-owned enterprises, especially the China State Shipbuilding Corporation (CSSC), which operates under government oversight to meet national goals. CSSC, the world’s largest shipbuilder, has 36 research institutes working closely with naval personnel to develop advanced vessels. These institutes collaborate with Chinese universities and benefit from foreign technology acquired through partnerships, joint ventures, and overseas acquisitions. The Chinese government actively promotes these efforts to absorb and apply innovations in both military and civilian shipbuilding, enabling rapid technological progress. The use of smart manufacturing, automation, and digitization has further boosted the industry’s capacity and efficiency.

The 2003 National Maritime Economic Development Plan, the 2006 Medium and Long-Term Development Plan of the Shipbuilding Industry, and the National Five-Year Economic Plan (2006-2010), all of which defined the shipbuilding industry as strategic for the state’s economy, played a crucial role in promoting the sector. Further, initiatives like Made in China 2025, and China’s Five-Year plans from the 11th to 14th, prioritised shipbuilding as a key industry, also boosted production capacity and technological advancement. In 2023, China constructed the largest container ship by capacity, “MSC Tessa”, which can carry up to 24,000 twenty-foot equivalent units (TEUs). Additionally, China is set to build 18 of the largest LNG carriers for Qatar Energy, each with a capacity of 271,000 cubic meters. In December 2023, China launched the Shipbuilding Industry Green Development Action Outline (2024-30), aiming to achieve 50% market share in ships using green fuel by 2025 and maintain leading market share through 2030.

China’s commercial shipping industry offers comprehensive shipping solutions, including container manufacturing, shipping logistics software, cargo cranes, and related infrastructure. The Shanghai Zhenhua Heavy Industries Company (ZPMC), a SOE, supplies approximately 70% of the world’s cargo cranes. LOGINK, a logistics management platform backed by the Chinese government, provides users with a centralized hub for logistics data management, shipment tracking, and information exchange between enterprises and government entities. This state-controlled platform potentially grants China access to data collected and stored on LOGINK, and gain insights into shipping information, cargo valuations, and routing details of the ships. This could give China an advantage in commerce and commercial shipping.

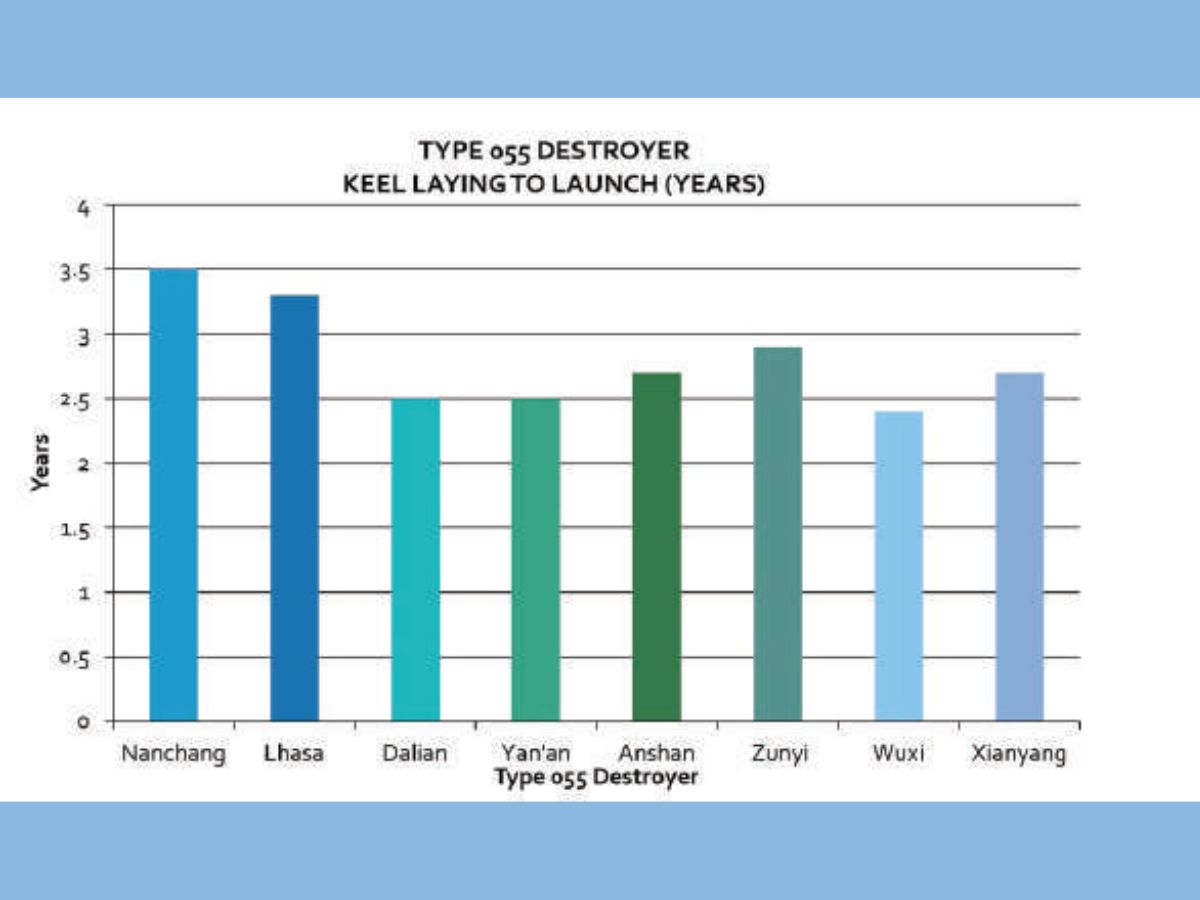

The Military-Civil Fusion (MCF) approach to secure key objectives has given a further boost to shipbuilding and sought to combine the expertise available in the military and civilian sectors. The simultaneous development of naval and commercial vessels in the same shipyard has allowed for the application of dual-use technologies across, civil and military projects. Commercial shipbuilding generates revenue, supports shipyard infrastructure, workforce development and reduce costs for naval production by leveraging the resources. It also generates employment. The Chinese navy places order for naval vessels in advance to prevent brain drain and loss of technical expertise, ensuring optimal utilisation of human and technological resources. Constructing naval vessels in multiple shipyards simultaneously has streamlined production lines for specific classes of ships. This facilitates the transfer of lessons learnt and best practices from one shipyard to another, thereby shortening the learning curve and reducing construction timelines. PLA Navy’s focus on induction of only a few classes of naval vessels enhances the advancements in shipbuilding, knowledge and skills. A case in point is the commissioning of eight Type-055 Destroyers into the Navy, which saw the time period from keel-laying to launch being reduced from 3.5 years to 2.5 years.

China has demonstrated its shipbuilding prowess by commissioning its third aircraft carrier, “Fujian”, the first with electromagnetically-powered catapults (EMC) technology, on 5 November 2025. At present only two countries—the United States and China—are known to operate ships equipped with EMC technology. China had launched “Fujian” in 2022; in a short span of three years, it was commissioned in Chinese navy. China’s latest amphibious assault ship, the Type-076 “Sichuan”, also equipped with EMC technology, was launched in December 2024. The ship undertook its maiden sea trial on November 14, 2025.

China’s strategic emphasis on shipbuilding, maritime, and logistics sectors has fostered global dependencies, heightening risks and undermining supply chain resilience. The global impact of such dependency became evident when China recently banned the supply of rare earth minerals—over which it has near monopoly—effectively weaponizing the global supply chain.

-

Vijayalakshmi Nair is Research Fellow, Centre for China Analysis and Strategy.