In a major shift in global energy politics, the United States has made it clear that it plans to oversee Venezuela’s oil trade for an open-ended period following the dramatic capture of former President Nicolás Maduro. President Donald Trump and senior members of his administration have openly stated that Washington expects to manage and sell Venezuelan crude for years, tying the country’s economic recovery directly to US supervision.

Venezuela holds the world’s largest proven oil reserves, and US officials believe controlling how that oil reaches global markets is key to stabilising the crisis-hit nation while advancing American strategic and economic interests.

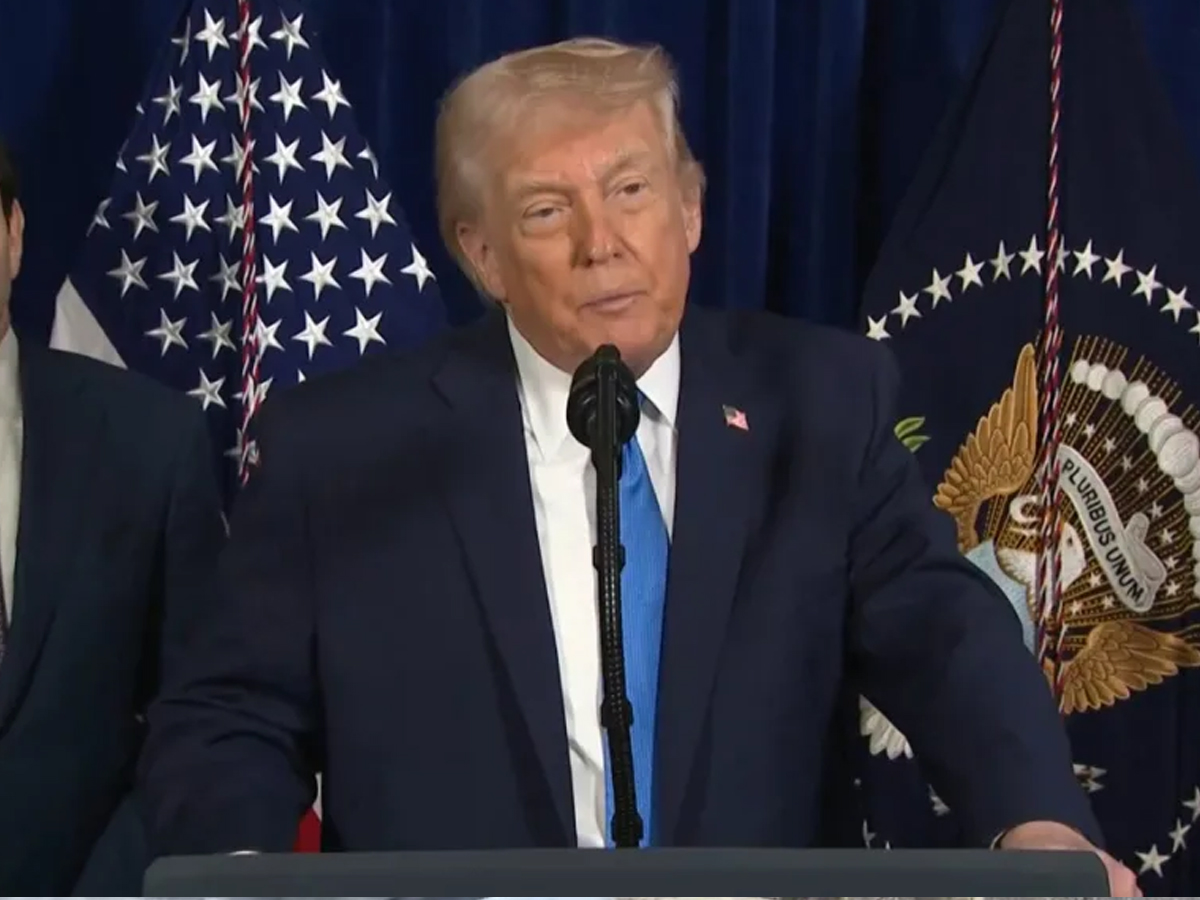

Trump’s Vision for Venezuela’s Oil Future

Speaking in an interview, Trump said he expects the United States to effectively “run” Venezuela’s oil operations for the foreseeable future. When asked how long Washington would remain in charge, he replied: “Only time will tell.” He added that US oversight would last “much longer” than a year.

Trump framed the plan as beneficial for both sides, saying: “We will rebuild it in a very profitable way. We’re going to be using oil, and we’re going to be taking oil. We’re getting oil prices down, and we’re going to be giving money to Venezuela, which they desperately need.”

According to the administration, the interim leadership in Caracas has agreed to allow the US to manage oil sales and revenue distribution as part of the transition following Maduro’s removal.

How the US Plans to Sell Venezuelan Crude

US Energy Secretary Chris Wright offered the clearest explanation of the strategy, stating that Washington intends to restart stalled oil exports immediately. He said the US will first sell oil already stored in Venezuela and then continue selling future production without a defined end date.

The administration has also confirmed that Venezuela will hand over tens of millions of barrels of crude to the US for sale on international markets. Officials say this approach will bring in much-needed cash while preventing corruption and misuse of oil revenue.

Sanctions, Oil Companies, and Export Control

To make the plan work, the US has begun selectively easing sanctions on Venezuela’s oil sector. This allows certain exports to resume under American oversight while keeping tight control over revenue flows.

Currently, Chevron is the only major US oil company operating in Venezuela under a special licence. Other American firms such as ExxonMobil and ConocoPhillips exited the country years ago after their assets were nationalised. The Trump administration has hinted that US companies could return if conditions stabilise.

At the same time, US forces have seized multiple oil tankers linked to sanctioned exports, signalling Washington’s intent to dominate Venezuela’s oil trade routes and prevent unauthorised sales.

What ‘Indefinite Control’ Means for Venezuela

US officials insist that indefinite oversight does not mean permanent occupation or ownership of Venezuela’s oil industry. Instead, they describe it as a supervisory role designed to rebuild infrastructure, restore production, and ensure transparency.

Revenue from oil sales will reportedly be directed toward rebuilding Venezuela’s economy, funding basic services, and supporting political stability during the transition period.

Global and Political Impact

Trump’s approach marks a sharp departure from traditional US foreign policy, replacing diplomacy with direct economic management. Supporters argue the strategy will bring order to a collapsed oil sector and help Venezuelans recover from years of crisis. Critics warn it risks appearing like economic domination and could fuel international backlash.

As the US moves forward, one thing is clear: Venezuela’s oil — and its future — will remain under American control for years to come, reshaping both the country’s recovery path and global energy markets.