Most beginners exploring affiliate marketing start with low commission niches. They promote physical products, wait for customers to make a purchase, and earn a few dollars per sale. It works, but it takes months to see noticeable results. The loan niche works differently. Instead of relying on a sale, a loan affiliate can earn every time a user completes a loan request form. This model is known as a pay per lead affiliate program and it has become one of the fastest paths to high ticket earnings online.

If you have never generated commissions online before, the idea of earning $200 to $350 for a single qualified lead may sound unreal. Yet thousands of affiliates across the world are already doing it every day. With the right traffic source, the right loan offer, and a platform that supports you with conversion focused tools, it is possible to scale from zero to four or five figures a month faster than most other niches.

Why the Loan Niche Pays More Than the Usual Affiliate Categories

Affiliate programs usually pay based on profitability and competition. A $30 skincare product cannot pay $300 to its affiliates because the brand makes less than that per transaction. Loan offers are different. When a user submits a loan form, lenders gain valuable revenue opportunities through loan origination fees, future renewals, and cross selling of financial services. That allows affiliate networks in the loan space to reward publishers generously for every accepted lead.

Some extra reasons why the loan niche pays more:

● High urgency drives fast conversions

● Wide availability of demand during all seasons

● Suitable for people with good credit, bad credit, and no credit

● Low friction because visitors only complete a form, not a purchase

● Traffic can be generated from different regions including USA, Canada, UK, and Australia

The structure gives affiliates an advantage that does not exist in most ecommerce niches. With the right landing page and targeted traffic, conversion rates can grow quickly and earnings compound fast.

Choosing the Platform That Can Scale Your Success

The loan market is competitive, so affiliates need a reliable platform that provides high paying offers, responsive support, and tracking tools. One of the most proven networks in this space is Lead Stack Media. They are known for paying up to $300 per accepted lead and giving affiliates VIP 90 percent commission rates regardless of their size. That level of reward is rare in the finance affiliate world and is one of the reasons why new affiliates can scale faster here than in most niches.

Lead Stack Media also offers:

● More than 20 exclusive personal loan and debt relief offers

● Weekly international payouts through bank wire or PayPal

● Responsive JS and iFrame loan request forms that take only seconds to integrate

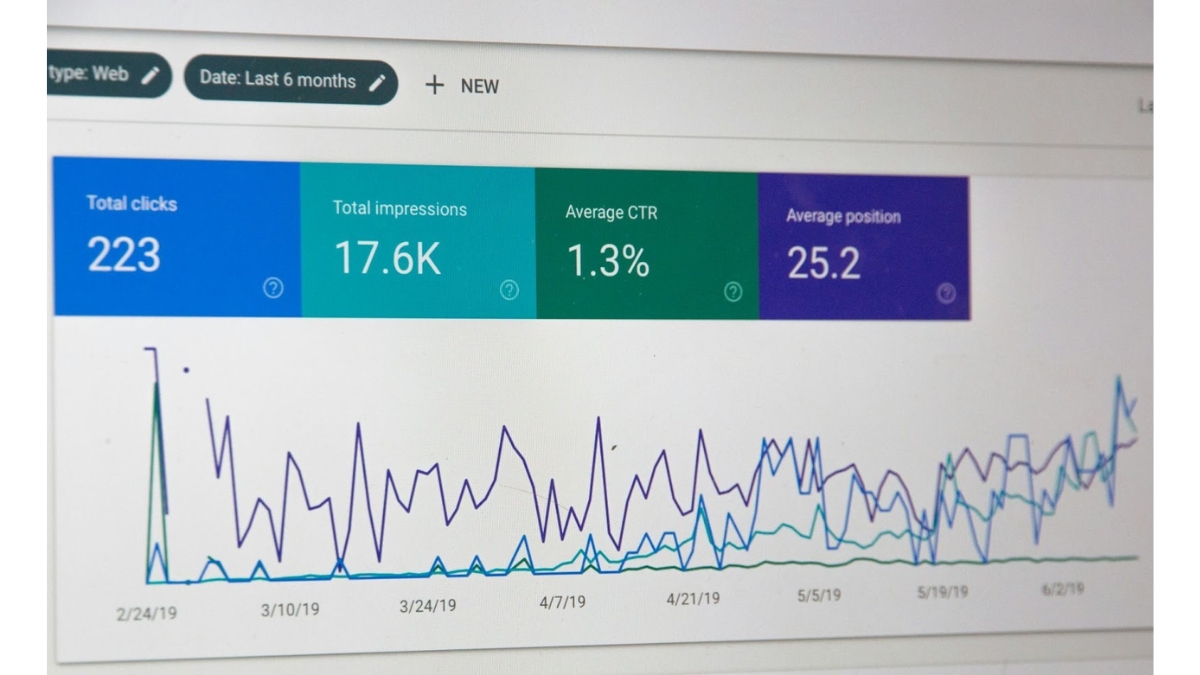

● Real time tracking dashboards and reporting for optimization

● Ability to work in multiple GEOs such as the USA, Canada, UK, and Australia

For someone trying to start fresh without experience, this kind of support matters. It minimizes the technical workload and allows the affiliate to focus on traffic generation and improving conversions.

What You Need to Start Even If You Are a Complete Beginner

Getting started in the loan niche does not require complex technical setups. Most successful affiliates begin with three basic assets:

A traffic channel

A content strategy

A fast landing page or loan request form

The traffic channel is simply the method through which visitors find the loan offer. Some affiliates use SEO blogs, some use Facebook or TikTok ads, some use YouTube tutorials, and others tap into email marketing or local business partnerships.

Beginners often overthink landing pages. In reality, a direct iFrame form from the offer source works incredibly well for the loan niche because it reduces the number of clicks between the visitor and the conversion. When a user can apply without navigating away from the page, the conversion rate is naturally higher.

Step by Step Example of Scaling from Zero

Below is a simple progression that many new affiliates follow when starting from scratch.

Step 1: Identify an audience with loan intent

Examples include job seekers, gig workers, new immigrants, and people facing temporary emergencies. These audiences actively search for financial solutions.

Step 2: Create helpful and ethical content

Blog posts, comparison articles, short videos, and email newsletters that explain the loan process work well. Content that reduces fear and clarifies terms boosts trust and clicks.

Step 3: Place call to actions in the right locations

CTAs should lead visitors directly to the loan request form. The fewer steps, the better.

Step 4: Track and optimize

If SEO traffic converts well, create more pages around related loan keywords. If Facebook ads convert well, duplicate the campaign targeting similar audiences.

Step 5: Scale when profitable

Successful affiliates reinvest profit into traffic acquisition. When conversion is predictable, scaling becomes straightforward.

The Psychological Side of High Ticket Affiliate Earnings

The first high ticket commission changes everything for a beginner. Going from earning nothing to receiving your first $250 commission shows that the system works and that scaling is possible. Motivation grows and discipline becomes easier. Instead of chasing tiny commissions, the affiliate starts building systems that generate consistent leads every day.

That mindset shift is what separates high earners from beginners who never take the first step.

Why Some Affiliates Fail and Others Win

The biggest reasons affiliates struggle in the loan niche:

● Jumping from offer to offer without optimizing

● Running traffic broadly instead of targeting users who actually need loans

● Expecting results without testing landing page variations

● Quitting after the first failed campaign

Successful affiliates follow a different pattern. They stick with one reliable platform, adjust their angles and creatives based on data, and scale gradually rather than chasing shortcuts. The business model rewards consistency more than luck.

Ethics and Responsibility Matter

The loan niche has high earnings potential, but trust must come first. Affiliates should always promote transparent, legal offers and encourage responsible borrowing. Focusing on genuine financial education not only helps visitors make informed decisions but also improves brand reputation and long term traffic quality.

Final Thoughts

Reaching high ticket earnings through a pay per lead affiliate program is realistic when partnered with the right network and supported by smart traffic sources. The loan niche pays significantly more than most traditional affiliate categories because the value per lead is high. Platforms like Lead Stack Media simplify the entry process by offering lenders, forms, tracking tools, and reliable payouts under one ecosystem.

For someone starting with zero experience, this niche removes many barriers that slow down new affiliate marketers. Instead of waiting for purchases, an affiliate can earn from every qualified loan request with only a few focused steps. With consistent effort, audience targeting, and ethical promotion, the path to long term earnings becomes clearer and more predictable.