Americans can expect potentially larger 2026 tax refunds, and filing electronically with direct deposit is the fastest and safest way to receive the money.

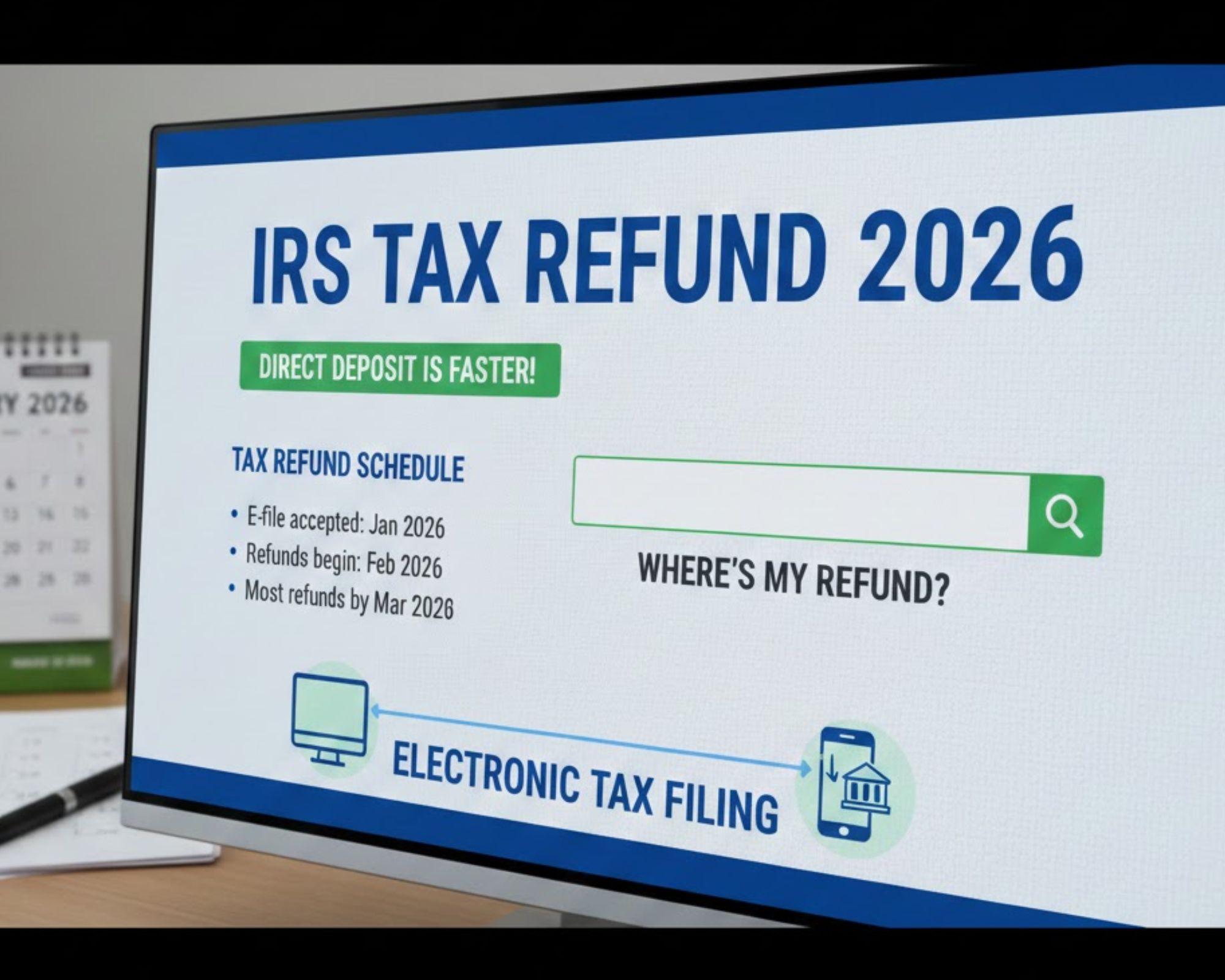

Tax Refund 2026 Schedule Explained Direct Deposit Is the Fastest Way (Source: Gemini AI)

Tax season is coming, and for many Americans, a tax refund is a big deal. It’s not just “extra money.” For a lot of families, that refund helps pay rent, clear bills, manage loans, or finally put something into savings. That’s why knowing when your refund might arrive in 2026 can make a real difference in planning your finances.

This year, refunds could actually be bigger than usual. In 2025, the average refund was $2,939, according to IRS data. Experts say 2026 refunds may be up to 30% higher because of changes in tax rules under President Donald Trump’s tax and spending bill. So naturally, people want their money as quickly and safely as possible. The IRS says the best way to do that is through free electronic direct deposit.

Once you file your tax return and the IRS accepts it, the review process begins. If you file online, things move faster because computers check most of the information. Paper returns take longer since they must be handled by people, which slows everything down.

The IRS is expected to start accepting 2025 tax returns in late January 2026. People who file early and have simple returns often see refunds first sometimes by late January or early February. Most refunds usually go out in February. If your return is more complicated or filed later, your money may arrive in March or April. Closer to the April 15 deadline, delays can happen simply because so many people are filing at once.

How you choose to receive your refund really matters. Direct deposit is the fastest and safest option. Many people who use it get their refund within two to three weeks after their return is accepted. Paper checks can take much longer.

The IRS explains it clearly: "Paper checks are over 16 times more likely to be lost, stolen, altered, or delayed than electronic payments." It also adds, "Direct deposit also avoids the possibility that a refund check could be returned to the IRS as undeliverable." In simple words, electronic deposit plus online filing equals the quickest refund.

If you use tax software, you just select direct deposit and enter your bank’s routing number and your account number. If you work with a tax preparer, tell them you want direct deposit — they’ll handle it. If you file on paper, you must carefully write your banking details on the form. Even one wrong digit can cause delays.

You don’t need a traditional bank account to get your refund electronically. You can open an account through a bank or credit union, often quite quickly. Some prepaid debit cards and mobile banking apps also accept direct deposits. Just double-check the routing and account numbers to make sure everything matches.

Expecting a bigger refund? You can divide it into different accounts. Some people send part to savings and keep some for spending. The IRS allows deposits into up to three accounts, as long as they’re in the U.S. and in your name (or your spouse’s, for joint returns).

For most people who file electronically and use direct deposit, refunds are sent in less than 21 days. After the IRS approves your refund, the money usually shows up in your account within about five days. Paper returns take longer — sometimes four weeks or more.

If you claimed the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (CTC), the IRS can’t release those refunds before mid-February by law. Many early filers in this group may see refunds around early March, if there are no problems.

You don’t have to guess. The IRS tool “Where’s My Refund?” lets you track your return. It shows when your return is received, approved, and paid. Updates happen once a day. You’ll need your Social Security number (or taxpayer ID), filing status, and refund amount.

In short, If you want your 2026 tax refund as fast as possible, file early, file online, and choose direct deposit. It’s quicker, safer, and helps you avoid the problems that come with paper checks. With refunds expected to be larger this year, a little preparation can help you get your money without stress or delay.

Disclaimer: This information is for general knowledge only and is not tax or financial advice. Refund times can vary based on individual situations and IRS rules. Always check the official IRS website or speak with a tax professional for guidance.