US expands sanctions on 18 Iranian entities to block oil revenue diversion, escalating pressure on Tehran with ripple effects across global energy markets.

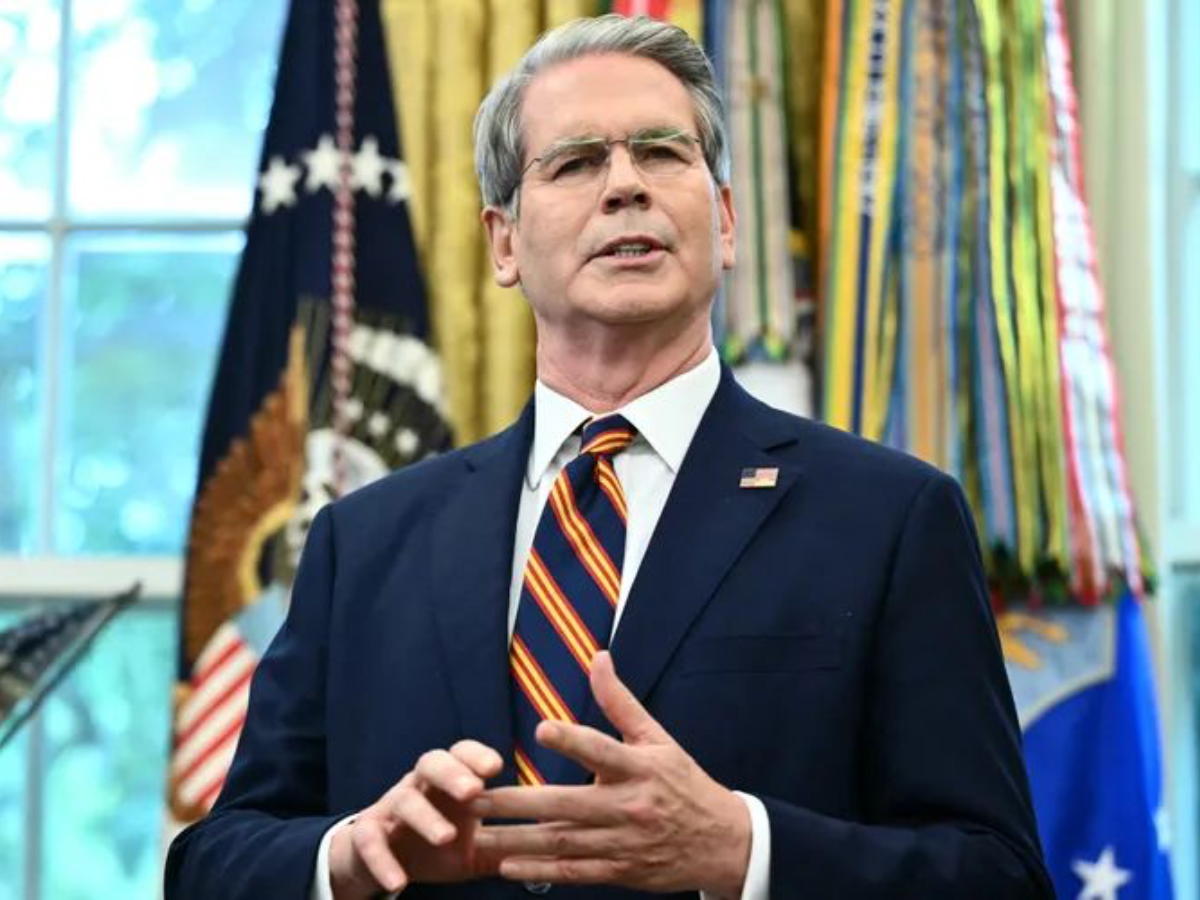

US Treasury Secretary Scott Bessent announces new sanctions targeting Iranian oil-linked entities as Washington tightens economic pressure on Tehran (Photo: X)

Washington has further tightened the economic screws on Tehran. The United States has now imposed a new round of sanctions on Iranian oil exports as it continues to exert economic pressure on Tehran amid growing Iranian instabilities in the country. Economic pressure still remains the principal focus of United States foreign policy against Iranian aggression.

US Treasury Secretary Scott Bessent: "We have designated today an additional 18 individuals and entities that have been determined to have assisted Iran in circumventing sanctions on its oil sales." US officials also reported that these groups are suspected of funneling oil sales revenue away from Iran's citizens and into government managed accounts.

Oil exports provide roughly 30% of Iran’s funds under sanctions. The U.S. is trying to shut down loopholes by which Iran has been exporting hundreds of thousands of barrels per day despite sanctions. The sanctions target middlemen, shipping agents and financial links through which Iran conducts oil exports.

Although US authorities have not specified the details on all 18 individuals, they confirmed that sanctions are against companies and individuals involved in oil logistics, financial arrangements and coordination of deals. Such individuals are thought to have operations across several countries through front companies and foreign bank accounts.

The intention, says the Treasury Department, is to create disruption, not symbolism. Oil revenue transfers will become more expensive, says the US, by restricting access to dollar-based systems. By freezing assets, that becomes possible.

Iran retains a prominent place among the world’s largest producers of energy, with access to about 9% of the world’s oil reserves by location alone. It doesn’t matter if it’s a threat of enforcement, any effort that limits the country’s exports creates market ripples internationally. A threat of enforcement, especially when tensions brew in the Strait of Hormuz, where about 20% of the world’s oil flows each day, contributes to price volatility in major markets internationally.

According to analysts, alternative sources can mitigate shortages, though insurance costs against shipping, route changes due to freight and geopolitical risk can result in prices increasing. In last few years, sanction related risks have caused fluctuations ranging from 5 to 10% a week due to major announcement news.

These sanctions are part of current sanctions that were devised under President Donald Trump's policy known as maximum pressure. Sanctions have also been threatened for states that have trade relations with Iran. The tariff threatened is a 25% tariff, but cumulative sanctions could be much higher.

Such threats have had a weaving pattern on trade patterns too. India has cut down its imports substantially, while China continues to be a major importer of Iranian oil, but with many of these deals done through non-dollar channels. The tariff plan aims at penalizing Iran, as well as ostracizing it through increased trade costs for other countries.

"The sanctions mean that Washington recognizes that economic power is a safer option than military escalation, although it is certainly not a threat that can cause immediate political change," added an analyst. However, history indicates that pressure will not result in immediate political change. Meanwhile, the free market as well as Iranians are caught in this conflict with little relief in sight.