Trump’s illegal tariffs left the US government sitting on $133 billion, triggering a complex legal battle over who gets refunds and how the money will be returned.

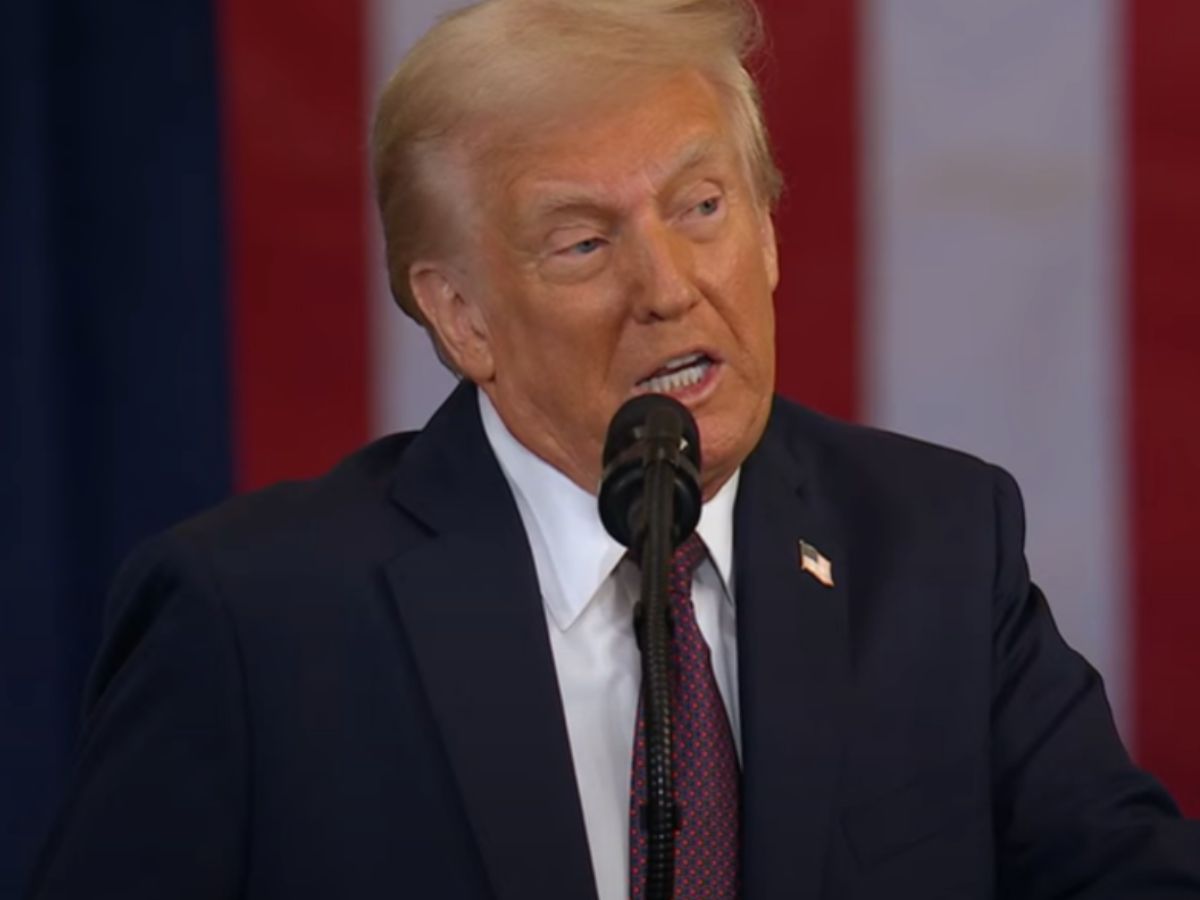

Trump Tariff Collections Explained Does the Money Go Back to Taxpayers (Source: X)

The United States Supreme Court has invalidated the emergency tariffs introduced by Donald Trump, a significant setback to his trade policy. Although the ruling was that the tariffs were illegal, it has left in its wake a huge and puzzling question: what will happen to the $133 billion that has already been collected through import taxes?

This ruling has caused political pressure, legal ambiguity, and growing demands for refunds.

Trump used his emergency powers under the International Emergency Economic Powers Act (IEEPA) to impose broad import tariffs. The tariffs were imposed on imported goods that entered the US from various trading partners.

By mid-December, the US government had already collected $133 billion in tariffs, according to US Customs data. This amount was largely borne by businesses, which in turn raised prices for consumers.

In a landmark ruling, the Supreme Court held that the Trump administration overstepped its authority by imposing broad tariffs through the use of emergency laws without the approval of Congress. The ruling nullified import taxes amounting to billions of dollars but did not clarify how the funds are to be refunded.

After the verdict, JB Pritzker, the Governor of Illinois, sent Trump a bill for almost $9 billion for refunds to families in his state. In his letter, Pritzker said, “Your tariff taxes wreaked havoc on farmers, enraged our allies, and sent grocery prices through the roof.” He asked for about $1,700 per family, based on estimates by Yale University economists of what the average US family paid because of tariffs. Some firms, including large retailers and manufacturers, have also sued for refunds in an attempt to get back the money they paid at the ports of entry.

Cut the check, @realDonaldTrump. pic.twitter.com/NjVJ0tABme

— JB Pritzker (@JBPritzker) February 20, 2026

However, despite the public’s outrage, it is unlikely that regular Americans will be able to get direct refunds. Although the companies were able to transfer the cost of tariffs to consumers by raising prices, the legal system considers tariffs to be payments made by importers, not consumers. As such, refunds, if any, will primarily go to businesses. US Treasury officials have also been skeptical about the possibility of consumers getting direct compensation.

Trump himself acknowledged that returning the money would not be quick. “I guess it has to get litigated for the next two years,” he told reporters. He later added, “We'll end up being in court for the next five years.”

This sharply contrasts with his earlier claims that Americans would receive “a little rebate” because the government was collecting so much money from tariffs.

In a dissenting opinion, conservative Justice Brett Kavanaugh noted that the ruling “says nothing today about whether, and if so how, the government should go about returning the billions of dollars that it has collected from importers.”

He warned that the refund process could become “a ‘mess.’” Legal experts agree. While US Customs has procedures to refund wrongly collected duties, it has never handled refunds on this scale, involving thousands of companies and tens of billions of dollars.

Trade lawyers say the government may try to build on existing customs systems, possibly setting up a special claims process or online portal for importers.

There is some precedent. In the 1990s, courts struck down an export fee and allowed companies to apply for refunds. However, experts say this situation is far larger and more complex.

“It’s going to be a bumpy ride for a while,” said trade lawyer Joyce Adetutu. She added, “The amount of money is substantial. The courts are going to have a hard time. Importers are going to have a hard time.”

Several companies had already sued for refunds even before the Supreme Court ruling, hoping to secure an early advantage. More lawsuits are expected, including possible disputes between manufacturers and suppliers over who ultimately bears the cost.

Another trade expert warned that administrative difficulty does not justify keeping money collected unlawfully, increasing pressure on the government to act.

While Trump’s tariffs have been declared illegal, the fate of the $133 billion already collected remains uncertain. Businesses are likely to get refunds first if at all while consumers may be left out entirely. With no clear roadmap from the Supreme Court, the issue is expected to drag through courts for years, turning Trump’s tariff legacy into a costly legal and political battle.