Trump donor Harry Sargeant, whom Maduro called "Abuelo," built a business on Venezuelan oil, faced US sanctions, and now advises on seizing the same sector. The full story.

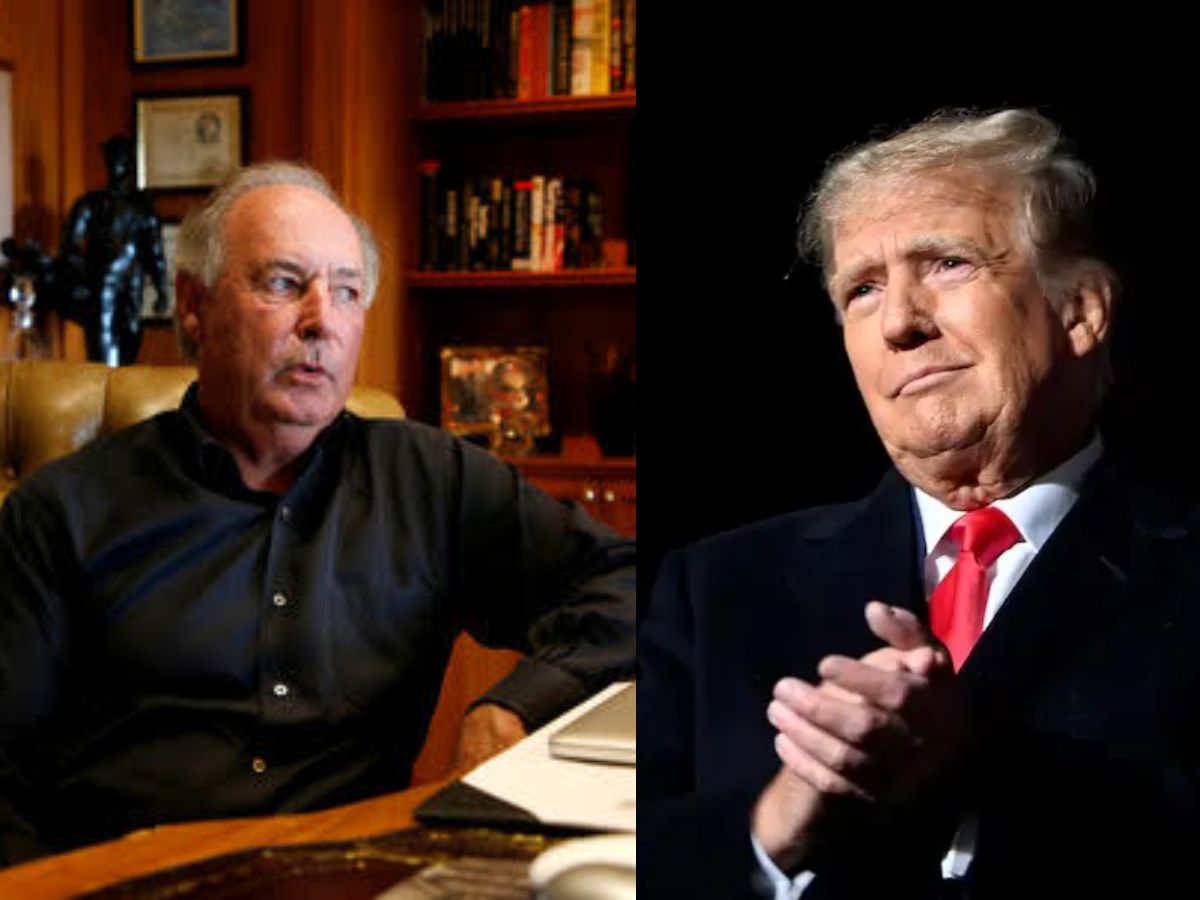

The Back-Channel History of Trump Donor Harry Sargeant in Venezuela (Image: File)

WASHINGTON, United States, January 9 —In the chaotic week following Nicolás Maduro’s arrest, the Trump administration’s most influential guide on Venezuela isn’t a career diplomat. It’s a Florida billionaire whose companies have both profited from and been penalized by the very regime Washington just toppled. Harry Sargeant III, a Republican donor with deep, complicated ties to Venezuela’s oil state, is now quietly helping shape America’s most sensitive energy pivot as per reports.

Harry Sargeant is a paradox. He’s a major GOP donor whose wife gave nearly $300,000 to Trump’s campaign. He’s an oil dealer who built a business on Venezuelan asphalt for decades. Last spring, the Trump administration revoked his company’s license to export that asphalt as part of its pressure campaign against Maduro. Now, according to four sources, that same administration relies on his expertise to unwind the mess it helped create.

The unusual nickname traces back to November 2017, when Sargeant first met Maduro to secure heavy crude for his asphalt business. The moniker, based on Sargeant's appearance, signaled a personal rapport that translated into commercial access. Over the years, his firms signed multiple deals with state-run PDVSA. In early 2024, he secured the first direct U.S. asphalt export deal from Venezuela in years, cementing his status as a rare American bridge to Caracas.

The answer lies in a stark reality. “There are very few people inside the U.S. government who have the industry expertise to be able to run this thing,” a source told Reuters. Sargeant’s value isn’t just technical knowledge of heavy crude; it’s his Rolodex. He helped broker a 2025 meeting between U.S. envoy Richard Grenell and Maduro. His teams are in touch with current Vice President Delcy Rodríguez. In a landscape of unknowns, he represents a rare line of communication.

Sargeant's path is marked by contradiction. In March 2025, the U.S. Treasury revoked his company Global Oil Terminals' license and ordered it out of Venezuela as part of Trump’s "maximum pressure" campaign. Yet, following Maduro’s arrest, those same restrictions are being reassessed as Sargeant now meets with White House and National Security Council officials. His value is his irreplaceable on-the-ground knowledge and relationships, turning a former sanctions target into a strategic asset.

Sargeant and his team are actively involved in planning the reconstruction of Venezuela’s crippled oil infrastructure. He has advocated for dealing with current Vice President Delcy Rodríguez over opposition leader María Corina Machado, arguing Rodríguez can better guarantee stability and contract security for returning U.S. firms. Since Maduro’s capture, Sargeant’s team has maintained contact with Rodríguez, discussing both future oil terms and a potential democratic transition.

Publicly, Secretary of State Marco Rubio speaks of selling seized oil for the Venezuelan people’s benefit. Privately, the plan is more granular. Sargeant and other executives are mapping how American companies—fearing legal risks—can return. This requires favorable contracts and a stable partner. Their advice? Work with Delcy Rodríguez, not the opposition. “I think Delcy will, when the time is right, be willing to transition the country to democracy,” Sargeant said. It’s a bet on continuity over revolution.

The contours are undeniable. A businessman whose wealth is tied to Venezuelan infrastructure is advising a government now controlling that country’s oil future. Sargeant’s company sought deals with PDVSA in 2017 and struck another in 2024. He has a financial stake in the sector’s revival. The White House offered no comment on his role. Sargeant insists he’s never discussed Venezuelan oil with Trump directly, positioning himself as a behind-the-scenes operator.

This isn’t just about one advisor. It reveals the Trump administration’s core approach: pragmatic deal-making over ideological purity. The goal isn’t to install a idealistic opposition but to find the most capable manager for the oil fields. It’s a strategy built on access, not allegiance, and it’s being drafted by those who already know the players and the price of doing business.