NEW DELHI: The uptrend in India’s domestic commercial vehicle industry is staring at a reversal with 4-7 per cent decline in wholesale volumes in FY2025 and a likely contraction of the aggregate operating profit margin (OPM) of CV original equipment manufacturers (OEMs) by 150-200 bps in FY2025, primarily due to lower volumes. This follows a muted year on year growth of 1 per cent and 3 per cent for wholesale and retail sales, respectively, in FY2024. The healthy growth witnessed in first half (H1) FY2024 tapered due to a slower Q4 FY2024, which saw a decline of 4 per cent in wholesale volumes due to factors such as implementation of the Model Code of Conduct and perceived slowdown in infrastructure activities ahead of general elections, finds an ICRA Ratings report.

According to Kinjal Shah, Senior Vice President & Co-Group Head, FY2022 and FY2023 had witnessed a very sharp growth in volume as well as tonnage terms, enlarging the base. The domestic CV volume growth momentum slowed down in FY2024 and is expected to dip in FY2025 amid the transient moderation in economic activity in some sectors in the backdrop of the general elections. The replacement demand would nevertheless remain healthy (primarily due to the ageing fleet) and is expected to support CV volumes in the near to medium term. “The long-term growth drivers for the domestic CV industry remain intact, like the sustained push in infrastructure development (evidenced by an increase in the interim budgetary allocation), a steady increase in mining activities, and the improvement in roads/highway connectivity,” assures Shah.

According to a Nomura Global Markets Research dated 27 May, 2024, the management commentary of CV major Ashok Leyland is positive on CV demand for FY25 given the market indications and its highest fleet age. Defense, power solutions, and spares have also grown strongly and AL will launch six light CVs in FY25, which will cover 80 per cent of the market (from 50 per cent). On the EV side, AL has orderbook for 1,500 buses.

However, the monthly retail data of the Federation of Automobile Dealers Associations (FADA) for April 2024 mirrors the decline, with data that shows CV segment grew modestly by 2 per cent yoy and reported 0.6 per cent month-on month decline, indicating varied market conditions. President of FADA Manish Raj Singhania points out that positive momentum was found in bulk and corporate deals and school bus demand, though elections dampened sentiment, with customers delaying expansion plans. “Limited finance options and regional challenges such as water scarcity further impacted performance,” says Singhania.

However, ICRA expects the operating profit margins (OPM) of the domestic CV OEMs to contract marginally in FY2025 to 8.5 per cent – 9.5 per cent on the back of lower volumes and higher competitive pricing pressures. These margins are estimated to have improved by 250-300 bps in FY2024, as the industry volumes were at a five-year high. In addition, lower discounting by the OEMs and benign commodity prices aided in the margin expansion in FY2024. Going forward, capex and investments for the industry are likely to increase to Rs 59 billion in FY2025 against Rs 37 billion in FY2024. These will be mainly towards product development, technology upgradation and maintenance-related capex.

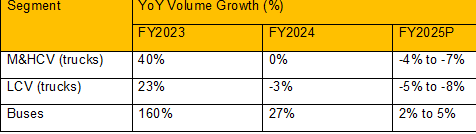

Among the various sub-segments within the CV industry, the medium and heavy commercial vehicles (M&HCV) (trucks) volumes in FY2025 are expected to contract by 4-7 per cent yoy, given the high base effect and the impact of the elections on infrastructure activities in the first few months. The segment closed FY2024 at 4 per cent growth, supported by the improved macroeconomic environment and the consequent higher freight availability in the early months of the fiscal, which compensated for the muted demand seen in the latter months.

Within this segment, while the haulage sub-segment reported a 6 per cent yoy volume contraction in FY2024, volumes for tipper sub-segment remained flattish for the year on a YoY basis. The tractor-trailers sub-segment, on the other hand, had a robust 19 per cent yoy volume growth in FY2024. In the other category of domestic LCV (trucks), CRISIL expects wholesale volumes are likely to decline by 5-8 per cent in FY2025 due to factors such as a high base effect, sustained slowdown in e-commerce, and cannibalisation from e3Ws. The segment witnessed a mild decline of 3 per cent on a YoY basis in FY2024, owing to the above factors in addition to a deficit rainfall impacting the rural economy.

The scrappage of older Government vehicles is expected to drive replacement demand for the bus segment from state road transport undertakings (SRTUs) in FY2025, supporting a growth of 2-5 per cent on an overall basis. The segment volumes gained considerable traction in FY2024 and exceeded the pre-Covid levels. In terms of powertrain mix, conventional fuels (primarily diesel) continued to dominate the domestic CV industry with a penetration of over 90 per cent, with alternate fuels (CNG, LNG and electric) contributing 9 per cent in FY2024.