NEW DELHI: The RBI’s Monetary Policy statement keeping policy repo rate unchanged at 6.50 per cent and remaining focused on ensuring that inflation progressively aligns to the target of achieving the target of consumer price index (CPI) inflation of 4 per cent while supporting growth, revised upward in FY25 to 7.2 per cent, has been welcomed by economists and industry.

The real GDP growth for 2024-25 is projected at 7.2 per cent with Q1 at 7.3 per cent; Q2 at 7.2 per cent; Q3 at 7.3 per cent; and Q4 at 7.2 per cent.

The first message is that while headline inflation has seen sequential moderation since February 2024, albeit in a narrow range from 5.1 per cent in February to 4.8 per cent in April 2024, there is no room for complacency. Food inflation remains elevated due to persistence of inflation pressures in vegetables, pulses, cereals, and spices. However, looking ahead, overlapping shocks engendered by rising incidence of adverse climate events impart considerable uncertainty to the food inflation trajectory. Inflation is expected to temporarily fall below the target during Q2:2024-25 due to favourable base effect, before reversing subsequently.

The RBI has called for close monitoring of market arrivals of key rabi crops, particularly pulses and vegetables. Normal monsoon, however, could lead to softening of food inflation pressures over the course of the year. At the same time, volatility in crude oil prices and financial markets along with firming up of non-energy commodity prices pose upside risks to inflation. Taking into account these factors, CPI inflation for 2024-25 is projected at 4.5 per cent with Q1 at 4.9 per cent; Q2 at 3.8 per cent; Q3 at 4.6 per cent; and Q4 at 4.5 per cent. The risks are evenly balanced.

Second, the RBI decision shows signs of a more divided monetary policy committee, with one additional member voting for a softening in stance as well as policy direction. The majority retained their cautious stance to guide inflation towards the 4 per cent target on a durable basis, despite recent signs of disinflation. Concurrently, the FY25 growth forecast was revised up by 20 basis points to 7.2 per cent , underscoring the official optimistic view on recovery prospects.

“The MPC also signalled that they will not react to the upcoming base-effect-driven correction in inflation in 2QFY25, lowering the probability of a shift in 2H24. In all, the mix of strong growth and above-target inflation does not make a case for a shift to a less restrictive policy setting yet, validating our view that rate easing is not on the cards this year. Political developments are not expected to sway the monetary policy direction or outlook,” according to Radhika Rao, Executive Director and Senior Economist, DBS Bank.

While the RBI stance is in sync with broad expectations. India Ratings and Research (Ind-Ra) feels the RBI governor did not give any guidance with respect to change either in policy rate or policy stance, indicating that RBI is not in a hurry and would wait for a more opportune time to take action on this account. The comforting factor for the RBI is that despite elevated policy rate and volatile geopolitical situation GDP growth is robust and likely to remain so even in FY25.

“This sweet spot is providing RBI the leg room to remain firm on its fight against inflation till it believes that inflation has moved closure to its target 4 per cent on a durable basis. RBI’s guidance shows that retail inflation after dropping to 3.8 per cent in 2QFY25 will again rise to 4.6 per cent in 3QFY25 and 4.5 per cent in 4QFY25,” says Sunil Kumar Sinha, Senior Director & Principal Economist, IndRa. This simply means, says Sinha that RBI’s fight on the inflation front is still not over.

Moreover, the climate change related supply shocks impacting food inflation coupled with pressure from rising input costs have enough potential to derail RBI’s inflation guidance. Therefore, despite IMD’s forecast of above normal monsoon, Ind-Ra believes the policy rate cut is unlikely to happen before the 2HFY25 and would continue to be data dependent. With growth still strong and uncertainties high both on global and local front, others also see no immediate need for policy easing. However, as inflation settles closer to the target and real rates rise further, some room for easing to open up is expected.

According to EEPC India Chairman Arun Kumar Garodia, the RBI’s decision to keep the repo rate unchanged at 6.50 per cent is on expected lines and provides policy stability. “This should help maintain the ongoing growth momentum in the economy,” says Garodia but hopes that given that retail inflation is on declining trajectory, RBI will cut the repo rate at appropriate time in order to make credit more affordable. “ As India aspires to be the global production hub, it is imperative that cost of capital substantially come down for the manufacturers to stay competitive,” says Garodia.

Sonal Varma, Managing Director and Chief Economist (India and Asia ex-Japan), Nomura also feels the RBI policy decision is largely on expected lines, but with a surprise on the vote split. Two external MPC members voted for a cut versus one MPC member earlier, which suggests that the divergence within the MPC is growing further. Varma points out that the RBI view of the macroeconomic outlook as one of goldilocks, with higher growth and stable inflation is in line with Nomura’s concurrence. “The transition from El Nino to La Nina after June should bode well for food price inflation. With lower wage growth and inflation expectations in check, we expect headline inflation to converge with core inflation and average 4.4 per cent in FY25.

The RBI also dispelled the view that in matters of monetary policy, it is guided by the principle of ‘follow the Fed’. Das stated that while RBI does keep watch on whether clouds are building up or clearing out in the distant horizon, the Bank plays the game according to the local weather and pitch conditions. “In other words, while we do consider the impact of monetary policy in advanced economies on Indian markets, our actions are primarily determined by domestic growth-inflation conditions and the outlook,” says Das. Varma agrees that the RBI does not have to follow the Fed.” India has a large cushion of FX reserves, which gives it the space to follow an independent monetary policy by focussing on domestic considerations,” says Varma.

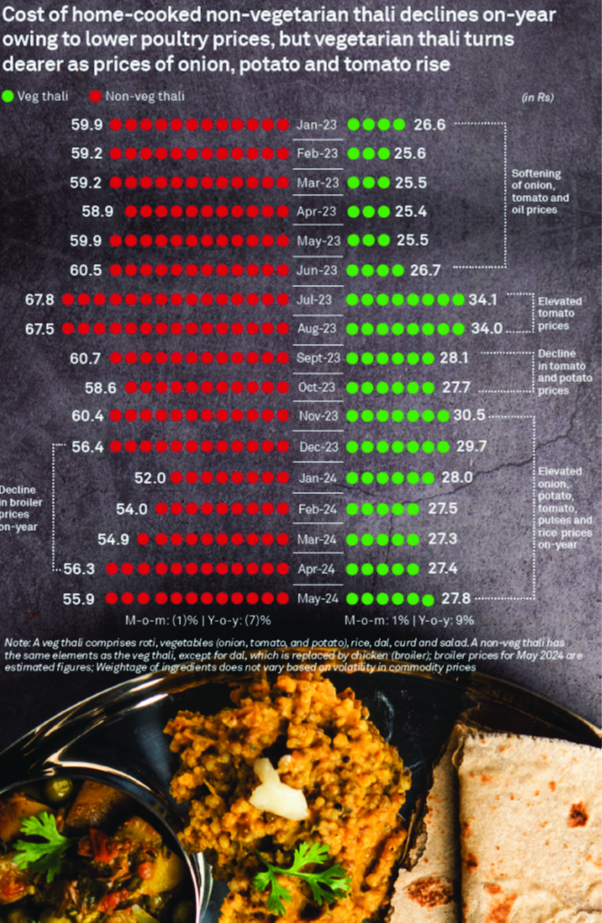

On-year, the cost of a representative home-cooked veg thali rose 9 per cent in May, while that of the non-veg thali declined 7 per cent as per CRISIL MI&A Research estimates. The cost of the veg thali increased owing to a surge of 39 perf cent, 41 per cent and 43 per cent on-year in the prices of tomato, potato and onion, respectively, largely because of the low base of last fiscal. Lower onion arrivals on account of a significant drop in rabi acreage coupled with a decline in potato arrivals on account of the adverse impact of late blight and crop damage in West Bengal contributed towards the increase in prices

A dip in acreage, resulting in subdued arrivals, led to a 13 per cent on-year increase in the price of rice (accounting for 13 per cent of the veg thali cost), while lower reservoir levels impacted production of pulses (accounting for 9 per cent of the veg thali cost) leading to a 21 per cent increase in prices on-year. On the contrary, prices of cumin, chilli and vegetable oil fell 37 per cent, 25 per cent and 8 per cent , respectively, preventing a further increase in the cost of the veg thali.

The decline in the cost of the non-veg thali can be attributed to an estimated ~16% drop in broiler prices on-year on a high base of last fiscal. The cost of the veg thali rose marginally on-month, largely owing to a 9 per cent increase in potato prices, while the cost of other major components broadly remained flat. The cost of the non-veg thali decreased as prices of broilers, which account for 50 per cent of the cost, declined an estimated 2 per cent on a high base.

According to RBI, the exceptionally hot summer season and low reservoir levels may put stress on the summer crop of vegetables and fruits. The rabi arrivals of pulses and vegetables need to be carefully monitored. Global food prices have started inching up. Prices of industrial metals have registered double digit growth in the current calendar year so far. These trends, if sustained, could accentuate the recent uptick in input cost conditions for firms. On the other hand, the forecast of above normal monsoon bodes well for the kharif season. Wheat procurement has surpassed last year’s level. The buffer stocks of wheat and rice are well above the norms. These developments could bring respite to food inflation pressures, particularly in cereals and pulses.