NEW DELHI: Even as coalition dharma plays out in the making of the NDA coalition government with the necessary juxtaposition of stance of its partners and amidst speculation on which way the government agenda will swing, there is broad consensus among economists, experts and stakeholders The Sunday Guardian spoke to, that in the context of the Indian economy holding out strong prospects of growth and resilience, this augurs well for an economic agenda that supports sustained momentum in manufacturing and services activity, revival in private consumption, keeping investment activity on track, thrust on infrastructure spending, optimism in business sentiments.

While global rating heads like Jeremy Zook, Director and Primary Sovereign Analyst for India, Fitch Ratings, led a large set of opinion to observe that though “BJP fell short of a single-party majority in the 543-seat lower house of Parliament for the first time since its latest period in government began in 2014”, there is an overall expectation that the government will secure enough support from allied parties in the NDA to stay on the trajectory of growth. “We do not think that the government’s losses at the ballot box will lead to substantial policy adjustment,” says Zook. “India’s medium-term growth performance to remain around trend estimate of 6.2% through FY28, despite the government’s slimmer majority,” says Zook.

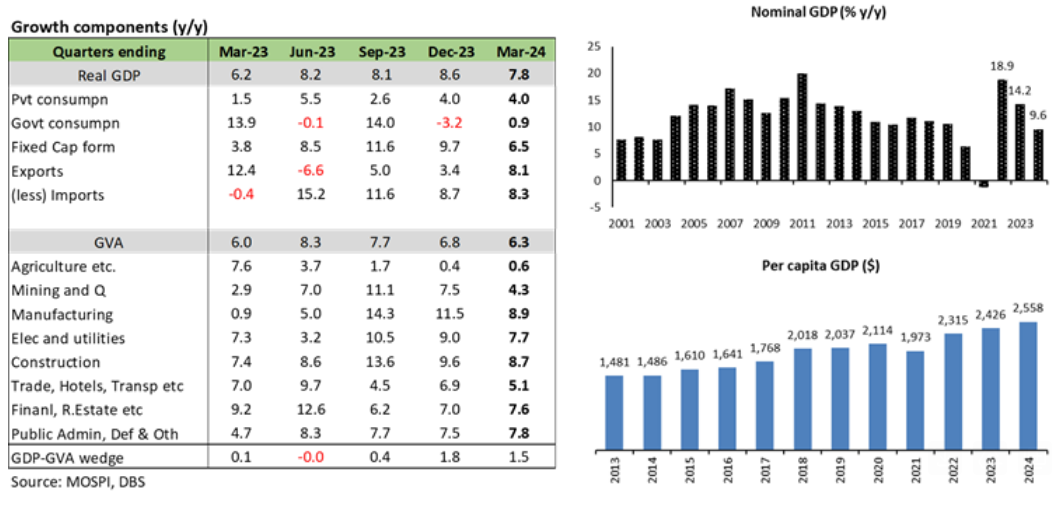

That optimism, according to Nagesh Kumar, economist and Director, Institute for Studies in Industrial Development (ISID), is being driven by the sense that the economy is in good shape with robust macro fundamentals. “India is doing exceptionally well in the global perspective if you see around the world with 8.2% growth in FY24 and projections of around 7%, if not more, for the current year, USD 650 bn of foreign exchange and sharp rise of the Sensex from levels of 60,000 to 75,000 points in the last few months,” Kumar told The Sunday Guardian. He agrees there has been some volatility in the stock market, which was expected, but what is important, adds Kumar is that this ascent signals market confidence that the Indian economy is expected to do well amidst a challenging global environment,” points out Kumar.

The government will naturally look to maintain this faith. “Albeit a narrower majority for the NDA alliance”, as Zook indicates, “the outcome should support broad policy continuity, with the government continuing to prioritise infrastructure capex”. “The Modi government increased public infrastructure investment significantly, helping to put India among the fastest-growing major economies in recent years,” says Zook. However, as Radhika Rao, executive director and senior economist, DBS Bank points out, public investments and government spending likely slowed ahead and during the various election phases. Going ahead, investment activity is likely to remain on track, with government’s continued thrust on spending to address infrastructure gaps, thus facilitating a strong outlook for private investment. In fact, Kumar sees a strong possibility of capex boost in the economic agenda.

“Considering that the Interim Budget has raised the infrastructure spending by 11%, the government has received a Rs 2 trillion bonus from the RBI and the GST collection is also increasing, there is fiscal space to enhance capex spending,” Kumar said. “I would not be surprised if the capex is enhanced, maybe from 11% to 20% jump,” adds Kumar.

On the agenda specifically is maintaining thrust and strong outlay towards railways, roads, and water—drinking as well as sewage. “There could be some re-prioritisation between various infra sub-segments to accommodate all the stakeholders,” suggests Ashish Modani, Senior Vice President with ICRA, indicating an adjustment due to coalition demands. “However, the capital outlay towards infrastructure is expected to sustain the healthy growth momentum, given the overall GDP multiplier effect of infrastructure spending and consequent job creations in the unskilled and semi-skilled segment,” assures Modani.

FATE OF REFORMS

A key worry is the fate of reforms in the Modi 3.0 given the BJP-led NDA’s weakened majority that could pose challenges for the more ambitious elements of the government’s reform agenda. Historical precedents of coalition governments since 1991—both with and without a single-party majority—indicate that structural policy changes can be implemented under both scenarios. Sujan Hajra, Chief Economist, Anand Rathi, dismisses such concerns, arguing that the single largest party now holds around 240 seats, suggesting less dependence on coalition partners compared to 1991-2014. “The maturity of the Indian political system is underscored by the fact that no major policy reforms since 1991, initiated by the previous governments, have been reversed, despite ideological differences of successive governments and the personalities of different Prime Ministers. This augurs well for continuity of economic reforms,” emphasises Hajra.

Implementation of economic reforms during the first two NDA terms was mixed, but some positive measures were passed including the Goods and Services Tax and Bankruptcy Code in 2016. In the new government, sectors like infrastructure, defence and capital goods are expected to benefit from policy continuity and government focus on development projects, though experts are betting on post-election Budget in July to provide greater clarity on its economic reform priorities and fiscal plans over the coming five years.

The lingering worry is whether contentious reforms in the economic agenda could prove more difficult, particularly around land and labour, which have recently been flagged as priorities by the BJP to boost India’s manufacturing competitiveness. Fitch Ratings believes that major reforms to land and labour laws will remain on the new government’s agenda as it seeks to enhance India’s manufacturing sector but as these have long been contentious, the NDA’s weaker mandate will complicate their passage further. On the upside, Zook believes that such reforms will continue to advance at the state level in some parts of the country. Hajra also points out that the election results are likely to bolster federalism in India, given the resurgence of regional parties. “Future policymaking is expected to be more consultative and inclusive. Controversial social issues may take a backseat on the government’s agenda,” says Hajra.

FIRST 100 DAYS

The economic agenda of the government may take shape in the first 100 days which represent a critical window to set the tone for governance and policy direction. With improving world trade prospects that could support external demand amidst headwinds from geopolitical tensions, volatility in international commodity prices and geoeconomic fragmentation posing risks to the outlook, export promotion could be a priority in the 100-day agenda. Ajay Srivastava, Founder, Global Trade and Research Institute (GTRI) suggests diversifying service exports beyond IT/ITES and target markets beyond the US and Europe. “Currently, around 70% of India’s service exports are in IT/ITES and business services, primarily to the US and Europe. To reach the targeted USD 1 trillion goal for the services sector, India should expand into sectors like transport, tourism, healthcare, finance, and education. Reviving the champions services sector scheme and supporting the growth of over 1,500 global capability centres that export services could help achieve this diversification,” Srivastava told The Sunday Guardian.

Another potential area for the economic agenda is simplification of e-commerce export rules. India has more than 20 lakh firms that produce good quality products and services but less than a lakh of these export. Simplifying RBI, banking, customs, GST and DGFT rules related to e-com export will help them to start exporting handicrafts, jewellery, ethnic wear, decorative paintings, Ayurveda and many more products.

The government’s economic agenda is also expected to further the significant strides that have been made in poverty alleviation through welfare schemes and new livelihood opportunities. According to the Anand Rathi economist, non-agricultural job creation is expected to be an important objective of the new government. For this purpose, economic priorities would be establishing India as a global manufacturing hub, improving infrastructure, enhancing the business environment, and making agriculture more remunerative.

Weaker fiscal metrics relative to peers are a significant constraint for India’s sovereign rating, which was affirmed by Fitch Ratings at “BBB-“ with a stable outlook in January 2024. An important action area in the economic agenda is to address high fiscal deficits and reduce debt, and this ability, suggests Zook, will be important considerations for the rating in the next few years. Sustained deficit reduction, particularly if underpinned by durable revenue-raising reforms, would be positive for India’s sovereign rating fundamentals over the medium term. In that context, the government has improved its record on achieving deficit targets and has advanced fiscal consolidation gradually over the past few years.

Fitch Ratings sees this focus on gradual consolidation to broadly be sustained. The FY24 budget deficit came in at 5.6% of GDP, below the revised budget estimate of 5.8% which matched Fitch’s estimate. The Modi government is expected to attain the 5.1% deficit target for FY25 and address the goal of reducing the deficit to 4.5% of GDP in FY26 which appears increasingly achievable, although the election marginally increases risks of higher spending or slippage in capex to accommodate greater social spending,” indicated the Fitch Ratings Director.

Overall, the sentiments surrounding the government’s economic priorities are firm on India’s strong medium-term growth outlook remaining intact, underpinned by the government’s capex drive and improved corporate and bank balance sheets. However, upsides to medium-term growth prospects are likely to be more modest if reforms prove more challenging to advance, is the underlying message.