Strangely, the investigating agencies have so far ignored the flourishing NPA creation industry.

At the heart of the ICICI-Dhoot-Deepak Kochhar imbroglio is the issue of brokerage and the way it works between clients and banks in South Asia.

Even as investigations continued over the alleged role of Chanda Kochhar, MD-CEO of India’s largest private sector ICICI Bank, in disbursing loans to companies with links to her husband, Deepak, experts in Delhi decoded the way such brokerage works, although it must be added that so far no such link has been claimed by the investigating authorities in the ICICI case.

Within the hugely profitable “writing off of NPAs industry” that has proliferated in India, 5% brokerage for loans between banks and clients is considered standard business practice. But, claimed experts, if another 5% is paid by the client to the broker and if the broker is related to a top bank official, then more cash may change hands.

For every lakh extended, brokerage of Rs 5,000 could be paid by a broker to the bank. For every lakh crore, this figure could go as high as Rs 5,000 crore. “India has Rs 2,000,000 crore of NPAs. The brokerage payable would be huge,” said Gopal Aggarwal, who heads BJP’s Economic Cell. Aggarwal said he estimates that brokerage on declaring loans as NPAs may have gone as high as Rs 40,000 crore. Strangely, the investigating agencies have so far ignored the flourishing NPA creation industry, which is at the root of the crisis in Indian banking. This points to the patronage the hidden industry is getting from influential officials and politicians since two decades.

The crisis is big, and growing bigger by the hour.

Turning now to the ICICI investigation, Chanda Kochhar could put in her papers if pressures mount. Else, she could excuse herself from her day-to-day operations of India’s largest private bank till the time her name is cleared from such charges levelled by the Central Bureau of Investigation (CBI).

There are high chances that RBI could ask Chanda to step aside and institute an independent inquiry commission and look into the matter of this scam. There are high chances that the Securities and Exchange Board of India (SEBI) will get involved to look into the loan of crores of rupees given to a shell company.

“This is a serious issue. ICICI has close to 50% foreign ownership and is answerable to the whole world. It is traded on the New York Stock Exchange under the symbol IBN,” said a senior government official in Delhi.

Highly informed sources said the Ministry of Finance (MoF) has nominated Lok Ranjan, a joint secretary in the Department of Financial Services of the MoF on the board of ICICI Bank as the government nominee to stem the rot and control the crisis, especially issues that could trigger some volatile movements in the market.

Repeated attempts to seek reactions from ICICI, Videocon and Kochhar proved futile.

The sources further said the MoF was contemplating looking into the role of its own Department of Financial Services (DFS), ostensibly because private banks like Axis and ICICI have substantial government holding. Moreover, the DFS appoints all PSB officers at ED and above levels, while Board level posts are cleared by the all powerful Appointments Committee of the Cabinet (ACC).

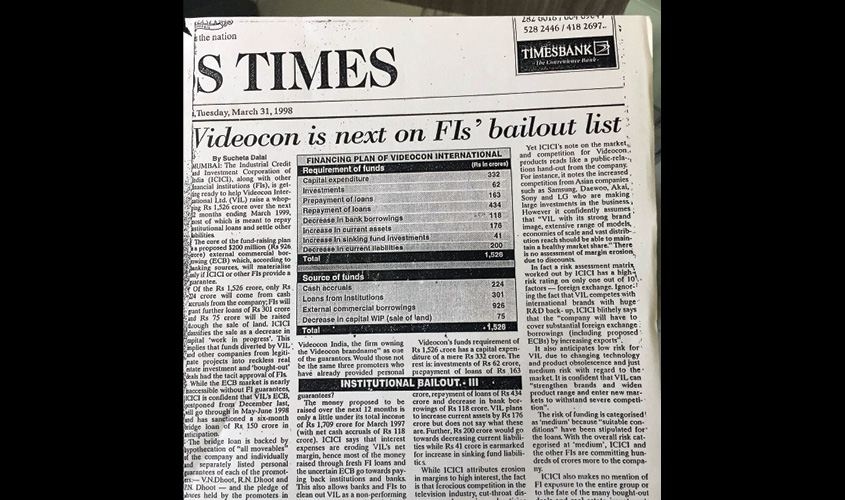

Interestingly, this is not the first time ICICI was trying to salvage the situation for Videocon. Way back in 1998, the bank helped Videocon raise what was then a whopping Rs 1,526 crore to repay institutional loans and other liabilities. The news was scooped by seasoned journalist Sucheta Dalal, who then was the business editor of the Times of India (TOI) [see image].

The decision to send in the joint secretary, DFS, has the support of the Reserve Bank of India (RBI). The decision was taken by the government after the CBI issued lookout notices against Kochhar’s husband Deepak and Venugopal Dhoot, the chairman of the Aurangabad-based Videocon group.

The government, it is reliably learnt, is keen to get to the bottom of the case, even if ICICI is India’s largest private bank. The Supreme Court has already ruled that for Prevention of Corruption Act, chairpersons of private banks shall be considered public servants. This was the ruling on 23 February 2016, by a bench consisting of Ranjan Gogoi and Prafulla C. Pant. This ruling came down in the case of Global Trust Bank, where the chairman and managing director abused their position to siphon off cash.

The Supreme Court recently empowered the RBI and its Governor Urjit Patel to take action. Since millions of depositors are following the case, RBI is expected to act quickly.

In a recent speech, Patel—his reference was to the Nirav Modi scam involving the Punjab National Bank (PNB)—expressed helplessness about not having adequate legal powers to supervise and manage PSU banks.

Chanda, considered among the most powerful figures in India’s banking and corporate circles, has admitted to her friends that the crisis is the “toughest” in her 34-year banking career. She has been troubled by a steady rise of non-performing assets (NPAs) and RBI’s penalties on ICICI Bank over the last one year, but those were nothing in comparison to the controversy alleging her of making personal gains, involving her husband Deepak and relating to loans given to Videocon Group.

The CBI says Chanda influenced the decision to give loans worth Rs 3,250 crore to Videocon as Venugopal had business dealings with the banker’s husband Deepak’s firm, NuPower Renewables. The news surfaced after Arvind Gupta, an ICICI Bank shareholder, wrote a letter to the Prime Minister, Finance Minister, RBI Governor and investigating agencies, seeking “appropriate investigation into illicit banking and commercial relationship between Venugopal and Chanda Kochhar’s family owned NuPower Renewable Group steered by her husband Deepak”.

The CBI notices were issued on 6 April 2017, a day after Deepak’s brother, Rajiv, the son-in-law of former Maharashtra Chief Secretary Sharad Upasani, was questioned at Mumbai airport and not allowed to travel to Singapore.

Rajiv, who is being questioned by the CBI as part of a probe into loans given by the bank to Videocon Group, runs financial services firm Avista Corporate Finance, the Indian arm of the Avista Advisory Group, a Singapore-based financial services firm owned by Rajiv Kochhar-promoted Hillingdon Holdings.

At the Mumbai airport, Rajiv was questioned for seven hours. Interestingly, Avista Advisory was “credit adviser” to the debt-laden Videocon group for the restructuring of an FCCB (Foreign Currency Convertible Bond).

At its offices in Mumbai’s Bandra Kurla Complex, the CBI had questioned a host of ICICI Bank officials in connection with the allegation that a quid pro quo was involved in the bank issuing a Rs 3,250 crore loan to the Videocon Group in 2012. The quid pro quo allegation is related to a deal that Deepak’s company, NuPower Renewables, allegedly engaged in with Venugopal.

Earlier, ICICI chairman M.K. Sharma had tried hard to defend the MD-CEO, first saying that the bank’s overall exposure in Videocon Group’s gross NPAs was less than 10% and then saying the regulators had looked at the matter in 2016. “ICICI Bank was not the lead bank for this consortium and the bank only sanctioned its share of facilities aggregating approximately Rs 3,250 crore which was less than 10% of the total consortium facility in April 2012,” Sharma told reporters in Delhi last week.

But Sharma did not answer on what basis the ICICI board gave Chanda a clean chit and whether a due process was followed in the review of the case. He did not even say why the review was not disclosed to the stock exchanges. Worse, Sharma did not share the board’s replies to the Securities and Exchange Board of India, the market regulator. No wonder the charges made by the CBI have stuck.

However, the BJP-led NDA government does not want to take any chances, ostensibly because there are fears the case could snowball into a political controversy after Venugopal played the Marathi card to give his financial woes a strange twist to nudge the controversy. Venugopal, it is reliably learnt, is meeting up with senior leaders of the Shiv Sena to explain his side of the story and why he feels the Marathi Manoos is unnecessarily targeted. “We belong from a Varkari community of Maharashtra, who are devotees of Lord Vitthal. We would never enter into illegal act or any financial irregularities,” Venugopal said, arguing he came in contact with Deepak through Deepak’s brother Rajiv.

Sources in Mumbai said Venugopal was pushing the Marathi Manoos agenda through his brother, Rajkumar, a three-time Rajya Sabha Shiv Sena MP. After the exposure of the alleged conflict of interest between Dhoot-Kochhars-ICICI Bank, the Shiv Sena is yet to make any statement on the controversy.

Venugopal has maintained all along that he severed his business alliance with Deepak and his firm NuPower Technologies—it is into renewable energy business—as soon Videocon got an oil and gas rigging contract. Venugopal further said he had nothing to do with Supreme Energy, and it is not a part of Videocon.

But a senior CBI official said Supreme Energy allegedly funded Rs 64 crore to NuPower and assumed majority and Venugopal had transferred his shares to his associate Mahesh Chandra Punglia, who, in turn, transferred his entire stake in Supreme Energy to Deepak’s Pinnacle Energy for only Rs 900,000, just six months after the Videocon Group got a loan of Rs 3,250 crore from ICICI Bank.

A preliminary enquiry or PE into the case, registered last month, is reported to have named Venugopal, Deepak and unidentified others. Chanda Kochhar, who has recently been cancelling all her high-profile public appointments, could also be questioned further, the CBI official said.

Unlike other deals of ICICI, this one remains wide, wide open.