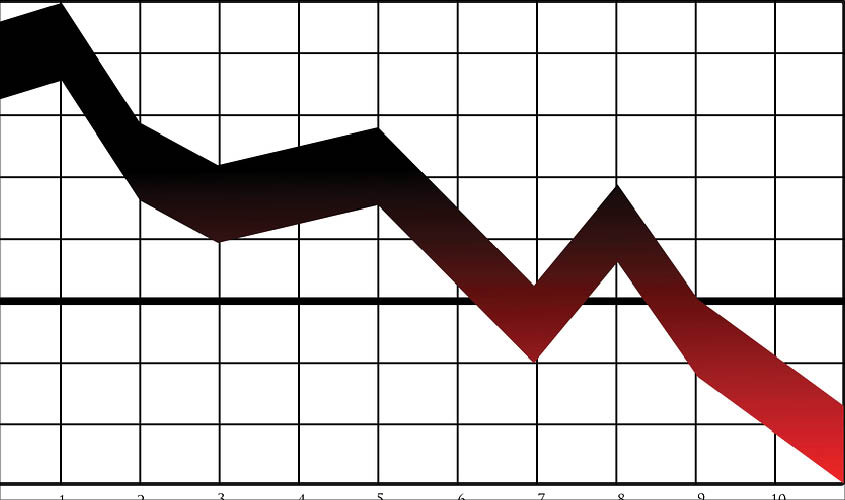

It was a manic Friday and a day which will go down as one of the most volatile days of 2018 for the Indian stock markets. The BSE Sensex crashed 1,500 points intraday, but recovered more than 900 points to close 279 points lower at 36,841. It was a bloodbath on Dalal Street for investors, as the market capitalisation of BSE listed companies plunged by more than Rs 1.90 lakh crore. The day started quite firm with the stock market surging more than 200 points until Yes Bank shares dropped like a bomb, falling more than 29% in the afternoon. This was on news that the RBI had denied a three-year term of appointment to promoter CEO, Rana Kapoor. The sharp sell-off in the afternoon was largely due to panic selling in non banking finance companies, especially after IL&FS defaulted on its interest payments to its bond holders on its commercial papers. The contagion effect was seen with housing finance companies’ stock prices falling like nine pins, creating panic. Sensex recovered partially after representatives of some of the non banking finance companies tried to allay investor fears on television that their balance sheets were quite strong and capable of repaying any loans or borrowing. They attributed market turbulence to an overreaction as their liquidity profile is intact and was no cause of any concern. Infra major IL&FS landed in an unprecedented financial crisis as it missed out several repayment obligations, resulting in a series of rating downgrades to as low as D (Default) on its financial instruments. The factors responsible for the current situation for IL&FS include delayed infra approvals for projects, rising interest rates scenario and dispute in relation to various contracts. Latest news suggests that IL&FS is considering selling its financial arm worth Rs 4,500 crore to tide over the current liquidity crunch. With so much mayhem in the stock market, it does not make sense to make a recommendation of any stock or mutual fund as the markets are bracing for a bumpy ride in the coming weeks. These are unnerving times and investors should hold on to their existing portfolios as markets are showing no clear direction. The India VIX, a measure of investor perception about the risk of sharp swings based on option prices, rose nearly 10% to 15.4%. These hint at more volatile times ahead.

Rajiv Kapoor is a share broker, certified mutual fund expert and MDRT insurance agent.