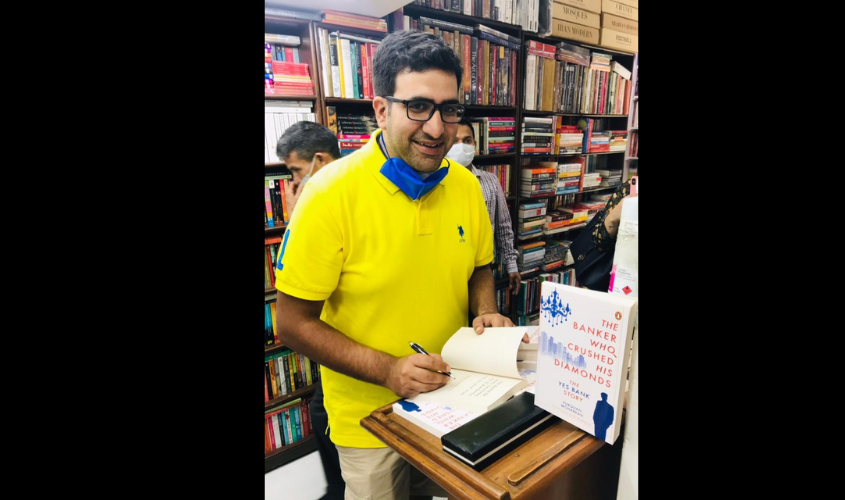

Furquan Moharkan, the journalist who first uncovered the Yes Bank crisis, says he got legal notices while writing his book.

New Delhi: It’s been a year since the collapse of Yes Bank, the fourth largest private bank in India. The collapse had put the lack of preparedness and flaws of the banking system of India under the spotlight. On 5 March 2020, the Reserve Bank of India (RBI) imposed a 30-day moratorium on Yes Bank, superseded the private-sector lender’s board, and appointed Prashant Kumar, who was serving as chief financial officer and deputy managing director at State Bank of India (SBI), as an administrator. Furquan Moharkan, the journalist, who was the first to uncover the Yes Bank crisis, has now compiled the gripping details of the rise and fall of Rana Kapoor and Yes Bank and launched his debut book “The Banker who crushed his Diamonds”.

Published by Penguin India, the book takes you right to the start of Rana Kapoor’s career as a banker, charting his meteoric rise, his mercurial personality, the lavish lifestyle, and the unravelling of it all. The Sunday Guardian spoke to the author Furquan Moharkan about his book. Excerpts:

Q: What inspired you to write this book?

A: I have been following Yes Bank for the past 2-3 years now. I was the one who broke the story that funds are not coming in September 2019. What I realized over the period of time is that it was just a facade put out due to which retail investors suffered. I realized that the system is rigged towards the retail investors. In the case of Yes Bank before what happened on 5 March, we saw 47% of its shares held by retail shareholders. There were 16 lakh retail shareholders. So many people suffered. All this while they were thinking that funds would come and Yes Bank would be saved, but that never happened. So, it was just a small step towards attaining financial literacy which is nearly zero now.

Q: What are the challenges that you faced while writing this book?

A: Well, the number of legal notices I have got is more than the right swipes on Tinder (laughs). You get pressure from different quarters not to do the story. But at the end of the day, we should realize that as a journalist and as a writer, our priority should be the public interest. So that is what we should be focusing on. If you take sides, you will get brownie points from individuals with vested interests. But in the long run, it will affect your credibility. I remember, the first time I broke the story on Yes Bank on getting funds, I was threatened with legal consequences. I knew my story was full-proof. There is a certain degree of anxiety that comes to you.

Q: In your book you have traced the rise and fall of Rana Kapoor. According to you what is that one thing which is common in all the financial chaos and economic offenses India has witnessed so far?

A: There are 2-3 things that are common among economic offenses and financial collapses. There is an over-centralization of power. The power resides with one guy and that one guy is over-ambitious. There are legal loopholes that are exploited. See, laws are there, but the only problem is the implementation of those laws. You look at Vijay Mallya. It was a one-man show at Kingfisher. Even after his exit, Kingfisher is still associated with him. A similar thing was happening at Yes Bank. At one point in time, it was called Rana’s Yes Bank in Dalal street. We also cannot ignore the governance issue.

Q: You have said multiple times that Rana Kapoor’s over-ambitiousness has led to this crisis. Why do you think so?

A: See, having ambition is not a wrong thing. But when it comes at the expense of other people, or something not ethically correct, then it becomes a problem. Rana Kapoor, somewhere I feel as per his interaction with people, his family members, and associates, comes out as a man who had an attitude of “Come what may”.

Q: Do you think this crisis was foreseeable and preventable?

A: Absolutely. There were red flags in 2015 that Yes Bank is having a lot of stress in the books in a report. I came to know that Yes Bank is not getting any funds. By September 2019, when I rolled out the story, the run on the bank didn’t happen. It happened in October 2019. If I knew by then, the RBI as a regulator would have known it. It is still beyond my imagination why did the RBI give such a long rope.

Q: The crisis at Yes Bank has somewhat unveiled the flaws of the banking system. What are the reasons that the system was unable to tackle the crisis?

A: We have seen our policymakers as being more reactive in nature than being proactive. Image management is a priority for them. They give a long rope to everyone and it’s a very bureaucratic process. There is no objective assessment of the situation.

Q: What were the red flags that if noticed could have stopped this collapse?

A: As per a report on Indian banking in July 2015, Yes Bank had lent around 125% of its net worth to stressed companies. It was a damning report. Despite that report, Rana Kapoor was given a freehand at Yes Bank for three more years. This is a specific incident where RBI could have acted.

Q: How far, in your opinion, was the RBI responsible for this financial crisis?

A: Being a regulator, the RBI has to be proactive. What we saw on the Harshad Mehta scam was RBI’s mistake. They did not act till the mess got real. I am pretty much sure they knew everything. So basically, they haven’t learned anything in the last 30 years.

Q: Keeping in mind the financial crisis that has happened over the years, do you think the system has learned its lesson?

A: It’s not the first case and it will not be the last case. There still a lot of people with vested interests and they will always be there. What we need to watch out for is, how to be proactive in these situations. The retail investors can be a bit aware. Financial literacy is something that needs to begin at the grassroots level. RBI is also trying its best and contributing towards enhancing financial literacy. People need to take more interest in the financial matters of this country.

Q: It is said that Harshad Mehta was just “using” the existing loopholes. How do you fill in these loopholes and stop people from exploiting them?

A: The only way to avoid these loopholes is to put in place strict implementation of laws and keep an eye on the system. This was rightly done by Urjit Patel during his tenure. He cracked down on any discrepancies. Loopholes will always be there and people will find different ways to exploit them in their favour. But the important thing is how quickly we catch it as a regulator, that is what makes the difference.