Rating agency S&P Global Ratings has said Vedanta Resources Ltd will likely have enough liquidity until December 2023.

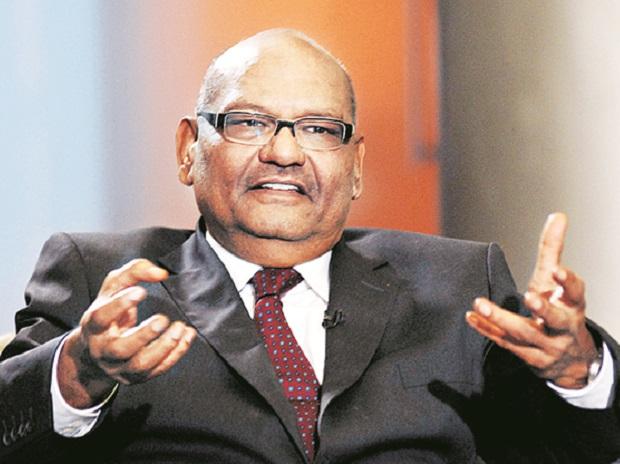

New Delhi: Billionaire Anil Agarwal’s debt is suddenly in the news, and many in the West have already started comparing the rags-to-riches industrialist to the recent predicament of Gautam Adani, another billionaire who remains in the headlines for reasons that have been very much in the news.

There is an unusual amount of scrutiny in the West—which itself reels under huge financial misadventures—of highly leveraged Indian conglomerates. And on top of it, the size of the challenge at Adani was pegged at $24 billion compared to the size of the challenge at Vedanta Resources, which stood at $3 billion.

So let’s ignore the Western hoopla for the time being. And let’s take a serious look all the news surrounding Agarwal. At the heart of it is Agarwal’s plan to build a $19 billion chip-making plant in India that some speculate has got delayed, ostensibly because Agarwal’s Vedanta Resources is yet to sign up a technology partner and is also awaiting some significant financial incentives the government has pledged for such projects. The market gossip has stayed because Vedanta’s chip partnership with iPhone assembler Hon Hai Precision Industry of Taiwan is yet to be cemented. But then, it is not easy to set up new semiconductor plants and create huge complexes that cost billions to construct and require very specialized expertise to run.

Critics have also said Vedanta and Hon Hai have no significant chipmaking experience, yet they point out that they’re attempting to take advantage of India’s ambition to build a semiconductor industry. The fact is that the duo are among the first to show such interest.

First, not having prior experience should not hold a company from entering a new business if it is backed by strategy and vision. In the past, Agarwal amply demonstrated both. Two, it would be wrong to presume that Agarwal, who has weathered many a storm, has thrown in the towel in the ring. He has already submitted a capital expenditure estimate of $10 billion to the Indian government, says the market buzz. And then, the industrialist is hoping that the government will pay up to a half of the project’s cost. Anyway, the banks are in the business of investment, right?Still, the gossip about his cash persists.

Why? Let’s take a closer look. The group’s total debt is around $13 billion and expected profit in the coming year is at $9 billion. And then, there is an expected revenue of $30 billion in the coming year. So what are his debt servicing obligations next year? It’s in the region of $3 billion. And then, his debt maturities include $500 million of loan repayments in the quarter ending December 31, 2023 and Bond due January 2024: $1 billion.

Rating agency S&P Global Ratings has said Vedanta Resources Ltd will likely have enough liquidity until December 2023. The natural resources group has debt servicing obligations of about $3 billion, including interest and inter-company loans. It will have at least another $1 billion obligation that would require funding until March 2024.

Corporate cognoscenti say a B-rating on Vedanta Resources with a stable outlook “reflects its expectation the company will secure additional funds to support liquidity beyond December 2023. This is not all. Vedanta Resources’ funding initiatives are supported by its capacity to borrow at its subsidiary, Twin Star Holdings Ltd. The latter directly owns a 46 per cent stake in the operating company, Vedanta Ltd.

There are other issues which need a closer look. For the records, Vedanta Resources has been more successful in the past in raising debt at the Twin Star-level, given the structural seniority of Twin Star debt to Vedanta Resources debt. And then, Vedanta Resources is claimed to be India’s biggest private miner and integral to India’s economic growth. Let’s remember one crucial fact: The group has suffered terribly because of the ongoing mining ban in Goa and the shutdown of its copper plant in Thoothukudi on the Coromandel Coast of the Bay of Bengal.

In case of copper in particular, the shutdown of the plant has meant that India has turned into a net importer from being a next exporter. Is this then the handiwork of vested interests and strong overseas lobbies behind the shutdown, as claimed just days back by a top functionary? Well, it may be the case.

And then, it’s important to analyse Vedanta and its financial strength in comparison with other Indian conglomerates. Historically, Tata Sons has also sold 1.48% stake in Tata Consultancy Services, its flagship IT services firm, to raise Rs 8,127 crore ($1.25 billion) to retire debt and invest in group firms across sectors such as auto and steel.

And this is a classic example of intergroup refinancing efforts by one of India’s largest conglomerates. Earlier, as part of the group’s move to bring down cross-holding among group companies Tata Power had sold its stake in Tata Communications and its holding firm Panatone Finvest to Tata Sons for around Rs 21.50 billion. And then, Tata Sons divested 2.72% stake in Tata Teleservices Maharashtra Limited (TTML) through offer for sale.

Tom Albanese, who served as chief executive of Vedanta Resources from 2014 to 2017, is confident Agarwal will overcome the crisis. “Anil has always been a survivor. He rose literally from the street; English isn’t his first language. He always felt he had something to prove.”

Albanese should know.

Agarwal once said his commodities businesses were “throwing off enough cash” and he expected $9bn of profit across the group for the coming year. “$1bn is peanuts for us.” And then he added: “Everybody wants to finance us. Becoming a zero-debt company is not a distant dream, but a medium-term, achievable goal. We make profits of over $10 billion annually, so we have enough cash to fund our investment on our own.”

It is evident that it’s the West that needs to exercise restraint and imbibe a sense of realism while evaluating Indian conglomerates.

Shantanu Guha Ray is the Asia Editor of Central European News, UK.