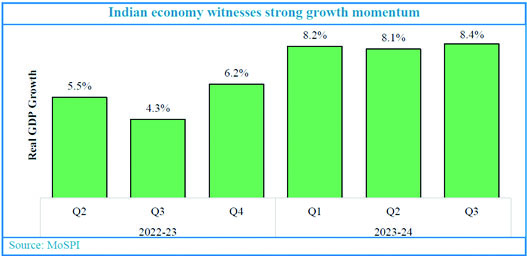

India looks set to close an eventful financial year 2023-34 (FY2024) with the economy growing above 8 per cent for three consecutive quarters, reaffirming her position as a standout performer amidst persistent geopolitical headwinds, and to continue on an ambitious trajectory with the estimated GDP growth revised upwards from 7.3 per cent to 7.6 per cent for FY24 as underlined by the monthly economic review of the Finance Ministry (MER) for February, also the last review before the fiscal ends on 31 March. Stable inflation and external account, steady number of new project announcements keeping India among the top 5 destinations for global greenfield projects, progressive employment outlook help the Indian economy close the current financial year on a positive note, the Finance Ministry notes, even as a welcome decline in global commodity prices from their post-Ukraine conflict, rising FPI inflows, declining current account deficit (CAD), rise in foreign exchange reserves at USD 636 billion as on 8 March 2024, allow India, on the whole, to look forward to a bright outlook for FY25, the report projects.

Importantly, the Finance Ministry is not isolated in its own revised view of the Indian economy as it joins a slew of updates on India’s prospects by global observers. The Ministry refers to SBI Research and Moody’s which expect GDP growth for FY24 to be 8 per cent, Fitch and Barclays which raised their growth forecast for FY24 to 7.8 per cent. Many non-governmental expert agencies have also upped their growth projections, the MER points out. Rating agency CRISIL has forecast India’s GDP growth at 6.8 per cent in the next fiscal (FY2024-25) and yet India will retain its position as the fastest-growing large economy. The Finance Ministry also argues that the inclination towards 8 per cent growth for FY24 stems from the fact that the 7.6 per cent GDP growth for FY24, as estimated by the CSO, means an implied growth of 5.9 per cent growth for Q4 FY24, which is likely to be an understatement given the continuing momentum of the economy.

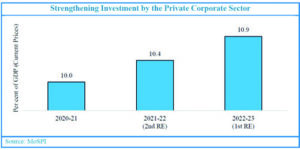

Indeed, there is double engine at work for the optimistic buzz around Indian economy, besides the international endorsement. First, enablers in place and second catalysts which will spearhead progress. Take the first dynamics, for instance, the Government’s thrust on capex which has continued to crowd in investment of the private corporate sector. There has been a broad-based pick-up in investment, reflected in the growth in Gross Fixed Capital Formation (GFCF) of 10.2 per cent in FY24 and 10.6 per cent in Q3 of FY24 and rising share of GFCF from 29.6 per cent in FY22 to 31.3 per cent of GDP in FY24.

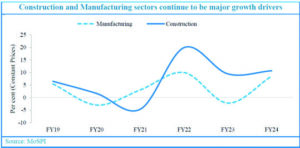

The strong thrust to infrastructure investment through initiatives like GatiShakti and National Infrastructure pipeline have also raised the demand for construction. With a robust increase in cement and steel production aided by government interventions and increased demand for residential properties in tier-2 and tier-3 cities, the construction sector is capturing new markets.