Demonstrating continued growth momentum and positive performance, India’s Goods and Services Tax (GST) revenue collection at Rs1,68,337 crore for February 2024, marks a robust 12.5 per cent increase compared to that in the same month in 2023. This growth was driven by a 13.9 per cent rise in GST from domestic transactions and 8.5 per cent increase in GST from import of goods.

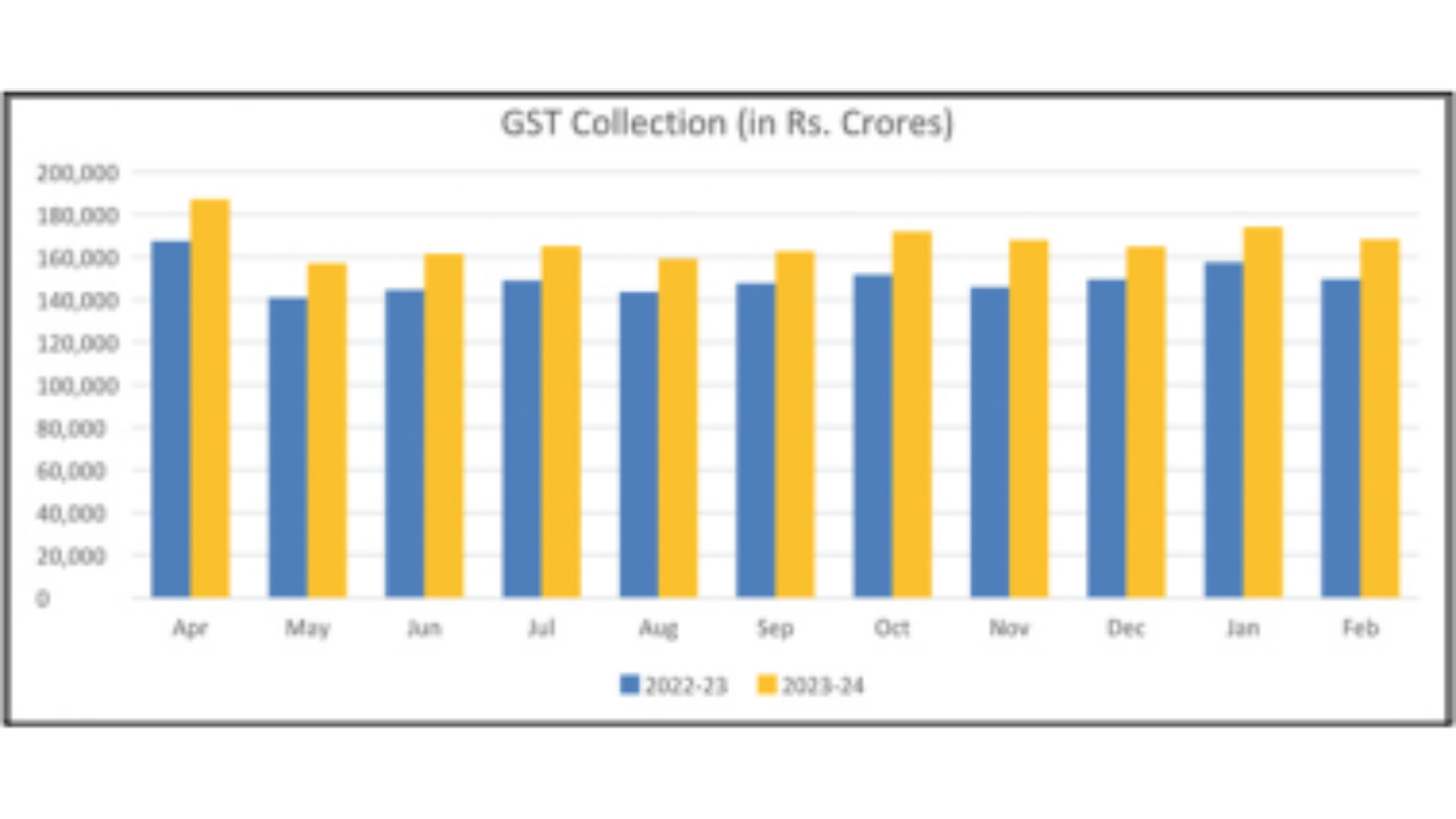

The GST revenue net of refunds for February 2024 stands at Rs1.51 lakh crore which is a growth of 13.6 per cent over that for the same period last year. Displaying strong consistent performance in FY 2023-24, the total gross GST collection for the current fiscal year as of February 2024, stands at Rs18.40 lakh crore, which is 11.7 per cent higher than the collection for the same period in FY 2022-23.

The average monthly gross collection for FY 2023-24 is Rs1.67 lakh crore, exceeding the Rs1.5 lakh crore collected in the previous year’s corresponding period. The GST revenue net of refunds as of February 2024 for the current fiscal year is Rs16.36 lakh crore which is a growth of 13.0 per cent over that for the same period last year. This February 2024 collection comprises Central Goods and Services Tax (CGST) of Rs31,785 crore and State Goods and Services Tax (SGST) of Rs39,615 crore.

The Centre on Friday authorised the release of two installments of tax devolution amounting to Rs 1.42 lakh crore to strengthen the hands of State Governments for financing various social welfare measures and infrastructure development schemes. This release is in addition to the tax devolution of an instalment of Rs 71,061 crore already made on 12 February 2024. With this release, states have received total of three installments of tax devolution in February 2024.

The GST collection for February also includes Integrated Goods and Services Tax (IGST) ofRs84,098 crore. This includes Rs38,593 crore collected on imported goods and cess of Rs12,839 crore, including Rs984 crore collected on imported goods. The Central Government settled Rs41,856 crore to CGST and Rs35,953 crore to SGST from the IGST collected. This translates to a total revenue of Rs73,641 crore for CGST and Rs75,569 crore for SGST after regular settlement.

The average tax-GDP ratio for FY15 to FY24 RE is about 10.9 per cent, higher than the 10-year average of 10.5 per cent during 2004-14, according to the Government’s White Paper. This is despite lower tax rates and widespread relief extended during the Covid-19 pandemic. Calculations show that GST has helped households save nearly Rs45,000 crore per month from December 2017 until March 2023. At the same time, monthly average revenue from GST has gone up from Rs90,000 crore in FY18 to Rs1.7 lakh crore in FY24.