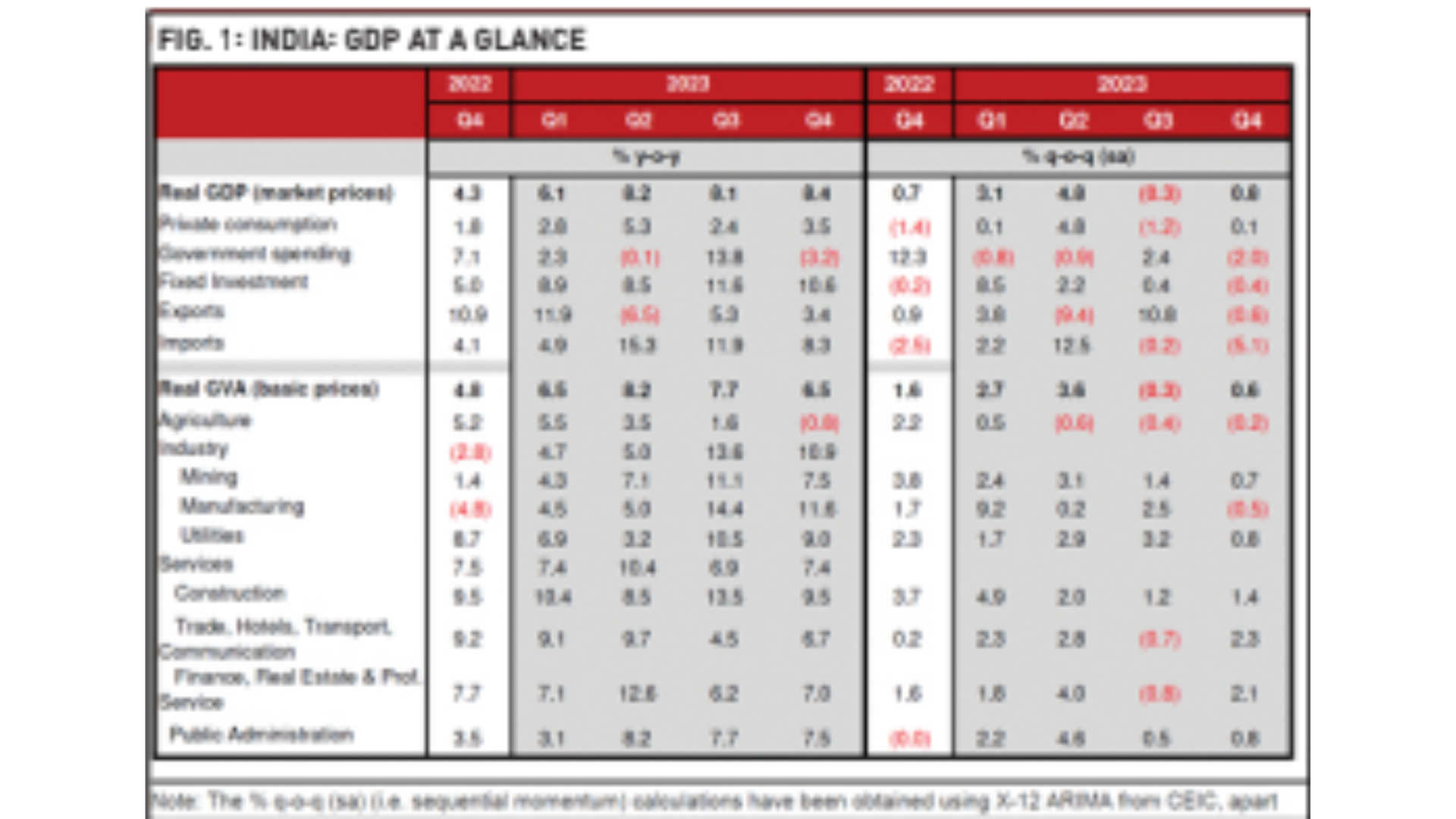

The Indian economy is on a bull run, with its gross domestic product (GDP) roaring ahead in the October-December period or the third quarter of financial year 2023-24 (Q3FY24) to post a real growth of a high 8.4 per cent year-on-year, showing no signs of a slowdown amid geopolitical conflicts, rather exceeding expectations yet again.

If the defying 8.4 per cent growth was the first surprise, revised growth of the past two quarters also underlined India’s resilience with India’s Q2 growth demonstrating an uptick of 8.1 per cent from 7.6 per cent and Q1 growth at 8.2 per cent from the earlier projection of 7.8 per cent. With this the fiscal 2024 growth of the country too is projected upwards.

The National Statistical Office (NSO) in its second advance estimates (SAE) pegs FY2023-24 GDP growth at 7.6 per cent compared with 7.3 per cent previous fiscal. However, Nomura Ratings flags headwinds, including the impact of the general election code of conduct on public capex support, patchy recovery in private capex, weak state of consumption, and ebbing terms of trade advantage for corporates as input costs rise.

A more or less wide expectation was emerging through Sunday Guardian’s interaction with economists and industry, of the GDP firing anywhere in the range of 6.3 per cent with a minimum and maximum growth estimate of 6.0 per cent and 6.6 per cent respectively, as per FICCI outlook while “India’s economy has become more robust and resilient and growth is strengthening quarter after quarter; the Q3 growth at 8.4 per cent indicates a strong growth trajectory to continue in the coming quarters too,” says SP Sharma, lead economist PHD Chamber of Commerce & Industry. The unexpectedness was in growth coming amid moderation in supply side measure of GVA (gross value added) output though matching with expectations – at 6.5 per cent, versus the revised 7.7 per cent in the quarter before.

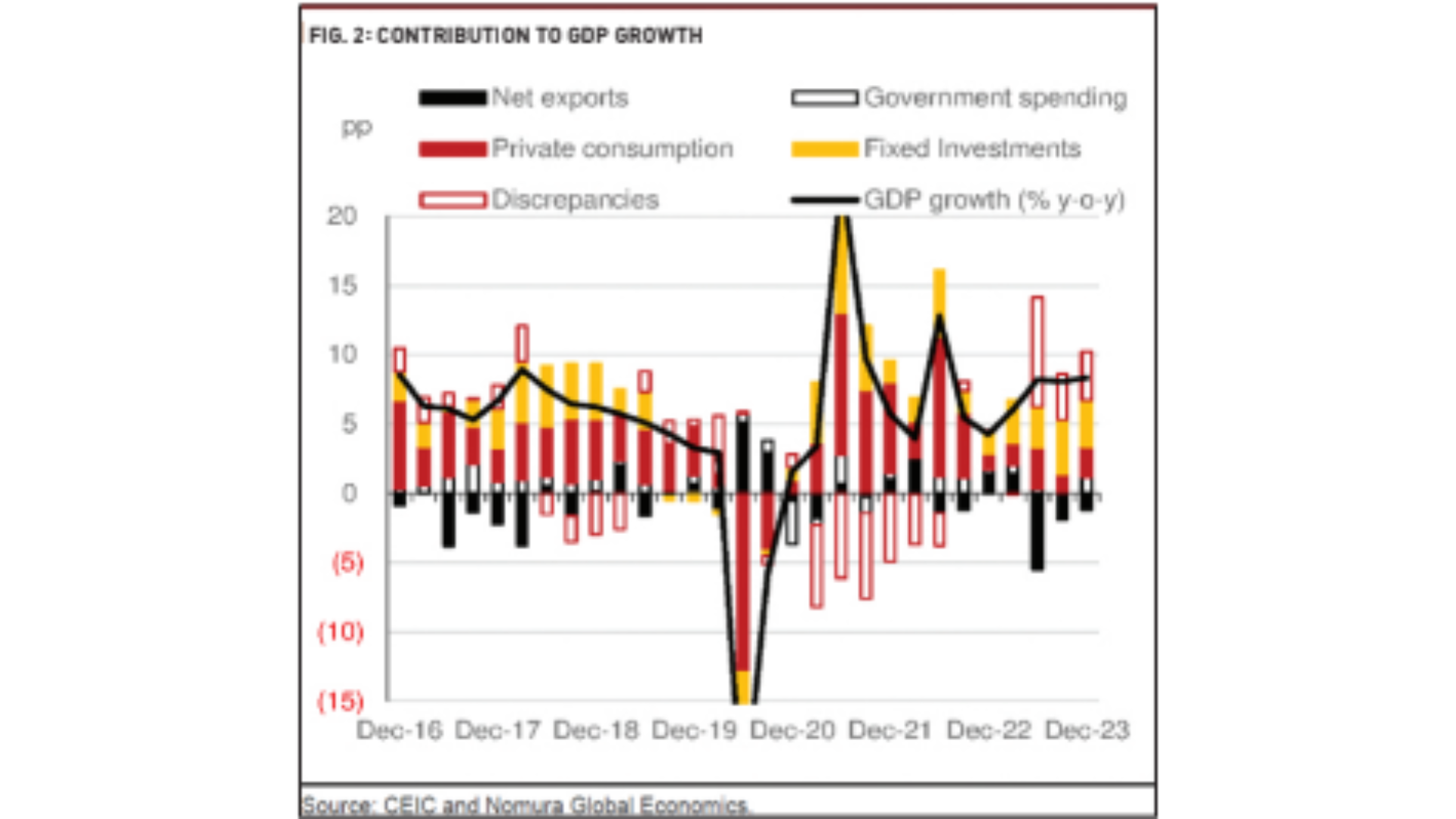

According to CRISIL experts, a sharp rise in net tax growth contributed to the divergence between GDP and GVA and was a key factor behind the upward revision of GDP growth. On the demand side, fixed investment with a 10.2 per cent growth, led by public capex continues to be the key driver of growth in the current fiscal year. Investment growth, reflected in the gross fixed capital formation segment), was up 10.6 per cent yoy in Q3FY24. The investment push was likely broad-based, led by the government’s push but also accompanied by households’ real estate demand and private sector participation, which benefited from backward linkages to the public capex cycle.

The strength of manufacturing, construction and electricity sectors which pushed the GDP acceleration in the third quarter, came as a surprise though they have emerged as major growth drivers in recent quarters. Manufacturing saw the highest growth at 11.6 per cent year-on-year in the third quarter, albeit some moderation from the 14.4 per cent in previous quarter. While falling input costs benefited, the pace of decline slowed to -1 per cent from -3 per cent on the back of strategic reforms and prudent policy measures by the government and efforts of industry.

High growth in the electricity, gas, water supply and other utility services at 9 per cent is inspiring as this will boost the manufacturing activities in the economy. Construction GVA grew at a healthy pace despite some moderation of 9.5 per cent vs 13.5 per cent and was supported by continued government capex in infrastructure. The gross fixed capital formation at 32.4 per cent of GDP for Q3 2023-24, higher than 31.8 per cent in 2022-23 for Q3, is indicating steady capacity expansion for more employment opportunities in the coming times, particularly in the labour-intensive ‘trade, hotels, transport & communications’ segment.

As Nomura analyst Sonal Varma points out, services GVA growth has also picked up to a healthy 7.4 per cent y-o-y compared to 6.9 per cent with a broad-based performance across construction, public administration, ‘trade, hotels, transport and communication’ and financial/real estate services.

The services sector growing at a steady pace of more than 7 per cent is inspiring, displaying that India’s growth momentum will continue. On the face of it, the economy seems to be firing on all cylinders. However, dichotomies prevail. Agriculture and allied GVA contracted 0.8 per cent in the third quarter compared with 1.6 per cent growth in second quarter. While partly the result of a highly unfavourable base, it is also due to a fall in kharif output as per the government’s second advance estimates.

Investment growth continued to surpass consumption, while private consumption was muted at 3.5 per cent yoy despite the festive push, troubled by weak farm output. This finds reflection in the recently released household expenditure survey which sheds light on to the changing trends of the Indian consumer.

One of key takeaways from the household consumption expenditure (HCES) survey -conducted after a 11-year gap between August 2022 and July 2023 – is that the share of food will likely be lower from 46 per cent to 41-42 per cent. The Nomura growth outlook in 2024 suggests, going by early high frequency indicators for Q1 2024, a mixed picture for consumption indicators, with stable passenger vehicle and twowheeler sales, even as tractor and MHCV sales have underwhelmed. Aviation passenger traffic is trending lower, while aviation cargo and real consumer goods import growth have picked up.

Looking ahead, there are several positives to India’s long term prospects, says Aditi Nayar, Chief Economist ICRA. One of them is fiscal management. The Government’s fiscal deficit stood at Rs 11.0 trillion or 64 per cent of the FY2024 RE in April-January FY2024, lower than the Rs 11.9 trillion recorded in April-January FY2023. While net tax revenues rose by 11 per cent, non-tax revenues expanded by 46 per cent, boosted by the RBI dividend, amidst a tepid 1.4 per cent growth in revenue expenditure, and a strong 26.5 per cent YoY expansion in capex.