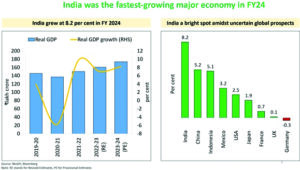

NEW DELHI: Even as curtains come down on the election campaign and the Modi Government exits FY24 with India positioned as the fastest-growing major economy in the last financial year, riding on a growth juggernaut of 8.2 per cent, growth prospects are already appearing bright, with high-frequency Indicators for April 2024 signalling a good start to Q1FY25. Broad-based growth, driven by robust demand and investment activity, forecast of a normal monsoon that bodes well for the agricultural sector, upbeat business and consumer sentiments, strong corporate and bank balance sheets, continued capex push and strategic trade agreements underlining India’s commitment to expanding its global trade footprint are setting the stage for India to sustain the growth momentum with Government projecting India to grow by 7 per cent in FY25.

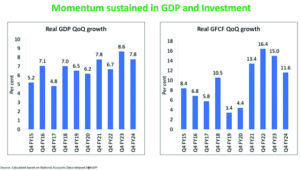

However, the GDP growth for Q4 FY24 at 7.8 per cent has come as a surprise for economists like Sunil Kumar Sinha, Senior Director and Paras Jasrai, Senior Analyst at India Ratings and Research. “It was much higher than Ind-Ra projection of 6.2 per cent,” say Sinha and Jasrai, pinning down the reason to net taxes received by the Government. The net taxes which grew at 7.9 per cent yoy and 12.7 per cent yoy in Q1FY24 and Q2 FY24, grew at 31.2 per cent yoy and 22.2 per cent yoy in Q3 FY24 and Q 4 FY24. “This is due to robust economic activity and higher corporate profitability. It appears that non-pass through of lower input cost has resulted in higher corporate profitability and in turn higher payment of taxes,” the economists said.

Rumki Majumdar, Economist, Deloitte India also agrees that GDP surprised to the upside, thanks to strong growth in manufacturing and robust buoyancy in the services sector. “India’s growth continues to surprise on the upside,” says Dharmakirti Joshi, Chief Economist, CRISIL who notes provisional estimates of GDP growth for fiscal 2024 at 8.2 per cent despite a poor showing by agriculture. “This beats the 7.6 per cent growth estimated by National Statistical Office in February. Although real GDP is still around 7.5 per cent, below where it would have been without the pandemic, domestic strengths and policy focus have put the economy on a healthy growth trajectory and is trimming the permanent loss of GDP from the pandemic,” notes Joshi.

For Anish Shah, President, FICCI, the strong India GDP numbers are in line with expectation and prediction in December 2023 of a 8 per cent GDP growth in FY24. “The GDP growth rate of 8.2 per cent for FY24 and 7.8 per cent for Q4 FY24 is the highest among the major economies of the world making India the fastest growing major economy globally, says Shah.

Aditi Nayar, Chief Economist, Head Research and Outreach, ICRA is in line with the view that while the growth in India’s GDP and GVA moderated to a four-quarter low of 7.8 per cent and 6.3 per cent, respectively, in Q4 FY2024 from the revised prints of 8.6 per cent and 6.8 per cent, it exceeds both ICRA and market expectations.

Gross final consumption expenditure grew by 0.9 per cent yoy in Q4 FY24 as the focus of government spending has now shifted away from revenue to capex. “Though somewhat subdued, GFCF grew 6.5 per cent yoy in Q 4 FY24 as compared to 9.7 per cent yoy growth in Q3 FY24 as government has front loaded the capex in FY24, perhaps in view of the parliamentary elections in April/May 2024. Nevertheless, it shows sustained government capex along with green shoots emerging in private capex in select sectors,” say Sinha and Jasrai.

Majumdar agrees that consumer spending remained modest, but according to her, high-frequency indicators for the fourth quarter suggest that improvement is much more broad-based. “Rural demand might be picking up as evident from high-frequency indicators such as two-wheeler sales, tractor sales, and improvement in the FMCG sector,” says Majumdar.

Ind-Ratings attributes the weakness in the consumption demand due to its skewed nature towards goods and services largely consumed by the households belonging to the upper income bracket. “Therefore, consumption demand continues to be narrowly based and its growth sustenance critically hinges on the recovery of goods and services consumed by the households belonging to the lower 50 per cent of the income bracket,” Sinha and Jasrai.

Industrial sector which grew at 10.5 per cent yoy in Q3 FY24, continued its good run even in Q4 and recorded a yoy growth of 8.4 per cent. The gross fixed capital formation came in at 33.2 per cent of GDP for Q4 2023-24, indicating steady capacity expansion for more employment opportunities in the coming times. Even manufacturing maintained the growth momentum it has displayed in the earlier quarters of FY24 to grow at 8.9 per cent yoy in Q4 largely due to benign input prices which has helped in maintaining margins. Amongst other segments of industrial sector, construction grew by 8.7 per cent yoy, followed by electricity/utility services at 7.7 per cent yoy in Q4.

Indian industry is optimistic about manufacturing sector growth at 8.9 per cent in Q4 2023-24 on the back of strategic reforms and prudent policy measures by the government and efforts of industry. High growth in the electricity, gas, water supply and other utility services at 7.7 per cent in Q4 is expected to boost the manufacturing activities in the economy. “The consistent growth in the construction sector is indicating the creation of new employment as the construction sector absorbs skilled, semi-skilled and unskilled chunks of workforce,” says Sanjeev Agrawal, president PHDCCI.

Exports despite global headwinds recorded a yoy growth of 8.1 per cent driven by both goods and services exports. Merchandise and services exports (in rupee terms) witnessed modest growth of 5.9 per cent and 5.2 per cent yoy respectively in Q4 FY24. Majumdar believes that with exports considerably outpacing imports, net exports substantially boosted overall growth numbers. “Notably, the fourth quarter of FY 2024 saw a prominent increase in exports of engineering goods, electronics items, drugs and pharmaceuticals, and organic and inorganic chemicals—the highest-ever exports recorded in history. That is good news as India is gradually moving up the global value chain,” says Majumdar.

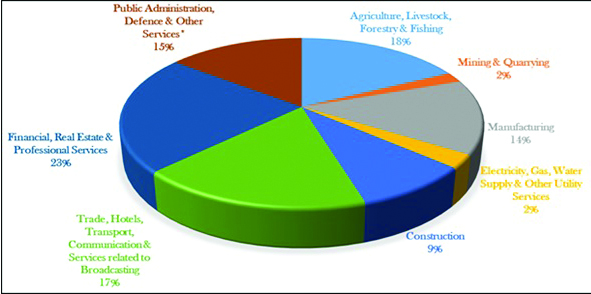

Services, the largest component of GDP, sustained its pace and grew by 6.7 per cent yoy in Q4 as compared to 7.1 per cent in Q3. All its segments have shown resilience. Its largest component trade, hotels, transport and communication grew at 5.1 per cent yoy in Q4. The other two components namely – financial, real estate and professional services and public administration clocked a growth of 7.6 per cent yoy and 7.8 per cent yoy respectively in Q4.

On the supply side agriculture, grew 0.6 per cent yoy in Q4 FY24. “Slower agriculture output, however, could dampen rural income and push up food inflation,” cautions Majumdar. Agriculture grew at 1.4 per cent in fiscal 2024, much below its pre-pandemic decadal average of 4.4 per cent. Joshi expects agriculture to improve its performance in the current fiscal on the back of normal monsoons and a favourable base effect.

At the fiscal level, economists are unanimous in the view that the Government’s fiscal deficit was contained below the revised estimate (RE) for FY2024, benefiting from higher than anticipated receipts and lower than estimated revenue spending, with only a marginal miss in the capital expenditure.

The Chief Economist of ICRA finds it interesting that with the gross tax revenues exceeding the RE, the central tax devolution to the states also surpassed the figure included in the FY2024 RE, which may have dampened the states’ borrowings in Q1 FY2025 so far. “While the fiscal deficit for April 2024 has spiked on account of an unexpected surge in revenue spending, in spite of healthy tax revenues, the higher than budgeted dividend from the RBI is likely to dampen the fiscal deficit in the rest of this quarter,” says Nayar.

There are however, external factors that pose a downside risk, suggest Government sources. Geopolitical tensions pose substantial downside risks, divergence of monetary easing paths of major central banks adds to policy uncertainty and frequent and overlapping adverse climate shocks pose key upside risks to the outlook on international and domestic food prices. There is also worry that the impact on sentiment and household finances due to rising retail exposure to stocks through direct stock investments and derivatives positions could keep household savings rate from recovering.

Joshi points out that signs of a mild slowdown were seen in the fourth quarter, when GDP grew 7.8 per cent and gross value added (GVA) 6.3 per cent. The growth moderation was seen across industry and services. From the demand-side, investment growth moderated this quarter. “We expect growth to moderate to 6.8 per cent in current fiscal, with high interest rates and lower fiscal impulse (as the deficit is trimmed to 5.1 per cent in fiscal 2025) tempering demand in non-agricultural sectors,” says Joshi.

Overall, the fiscal dynamics appear favourable for FY2025, amid continued resilience in GST collections and an unexpectedly large dividend payout by the RBI. The windfall arising from the latter is likely to provide additional leeway of Rs 1.0 trillion to the Government for enhanced expenditures or a sharper fiscal consolidation than what was pencilled in the Interim Budget for FY2025. Deepak Sood, Assocham Secretary General looks to agriculture joining the growth momentum as well in the current fiscal with expectations of an above average monsoon which has already hit the Kerala coast.

“The markets created a great gung-ho and market cap elevated to USD 5 trillion recently. The market momentum indicators such as high growth of GDP, forecast for the positive monsoon behaviour, softening inflation and fiscal direction are moving in tandem and supporting India’s lucrativeness to the global investors,” says Agrawal. Industry optimism for sustaining a growth momentum is also stemming from a good beginning by the core sector industries like steel, electricity etc which have shown a combined expansion of 6.2 per cent in April, 2024 over the previous fiscal. ‘’ We remain quite bullish about the Indian economy which is witnessing improved corporate earnings and new investments across different sectors like telecom, automobile, construction and strategic technologies, says Sood. Agrawal pegs real GDP in 2024-25 to hover around 8.1 per cent on the back of continued reforms by the government.