NEW DELHI: US trade representative emphasized that these measures are necessary to counter flooding of global markets with low-cost Chinese products.

Even as the US-China trade irritant evolving from the American administration’s proposed high tariff increases on Chinese imports of electric vehicles, batteries, medical supplies and many other products, threatens to escalate into a tariff war, the contentious situation is being seeing by India as an opportunity to seize the space left by an inevitable supply gap.

The view is finding resonance in industry, among exporters and importantly in Government with stakeholders hopeful of extracting advantage using vigilance and mechanism at their disposal to deal with possible dumping from China.

For a perspective, in 2023, the US imported goods worth USD 427 billion from China and exported USD 148 billion, highlighting a significant trade imbalance and prompting the proposed increases as part of the US’s broader strategy under Section 301 of the Trade Act of 1974, to combat what it claims as unfair trade practices by China. This includes issues related to technology transfer, cyber intrusions and cyber theft. The US Trade Representative, Katherine Tai, emphasized that these measures are necessary to counter the flooding of global markets with low-cost Chinese products.

The trade irritant comes – opportunely, as per some views — at a time when China has become the largest trading partner in merchandise trade with India with bilateral trade of USD 118.4 billion in 2023-24 surpassing, albeit marginally, India’s trade with US at USD118.3 bn in 2023-24. This, though, is only scratching the surface. “These are provisional. numbers which will get revised,” suggests Ashwani Kumar, President, FIEO.

“India-US trade has been much impacted by the Red Sea crisis and many export/import consignments expected in February/March 2024 would slip into April/May 2024, as is getting reflected in the current financial year numbers,” adds Kumar. “India’s merchandise imports from the US dropped by over 20 per cent while exports exhibited a marginal decline of 1.32 per cent,” points out Kumar.

The counter argument is that the US continues to be India’s overall largest trading partner (goods and services together) with trade of over USD 200 bn in calendar year 2023.

Moreover, as Kumar points out, only USD18 billion, out of USD 420 bn exports of China to US is affected, which is little over 4 per cent and thus marginal. The FIEO view is that this will further increase in times to come and therefore it provides opportunity to India and other competitors to chip in the supply gap.

The opportunity — in the event of China’s retaliation on US exports — has a catch. India can benefit, provided we have market access in products targeted by China., points out Kumar. Of the products affected by additional duties on China, India has opportunities in facemasks, PPE, syringes and needles, medical gloves, aluminium and iron and steel. This shift does open up scope for India to ramp up production and export of these in-demand products and thus enhance its trade footprint in the U.S. market. This window is limited.

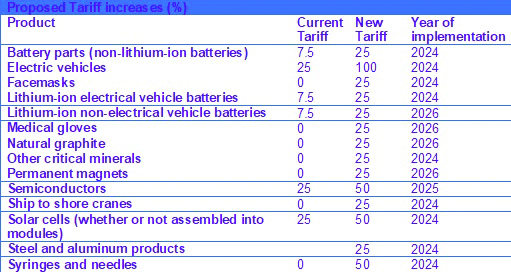

A study by the Global Trade Research Institute finds that specifics of the tariff increases are substantial. In 2024, tariffs on non-lithium-ion battery parts will increase from 7.5 per cent to 25 per cent with solar cells, steel and aluminum products also seeing significant hikes.

Tariffs on EVs will see a notable jump from 25 per cent to 100 per cent. New tariffs of 25 per cent will be applied to previously untaxed products like face masks, critical minerals, and ship-to-shore cranes. By 2025, semiconductors will face a tariff increase from 25 per cent to 50 per cent, with further increases planned for other products in 2026.

There is thus growing unease over the strong possibility of a China – currently sitting on overcapacity in many sectors – resorting to dumping. “That in any case, is not ruled out and more so when an important market is closed for their exports,” says Kumar. While FIEO is confident that Government will be keeping close watch on imports and any incidence of a surge or dumping will be met by appropriate action to safeguard industry, the scenario is complicated by the fact that both the USA and the EU are cutting import of EVs from China.

Nomura Ratings suggests that China may face similar measures from other regions, as it has been criticised by some of its major trade partners for running at “overcapacity”, dumping cheap products and deepening its trade relations with Russia. As the EU and UK account for about 40 per cent China’s EV export volumes, the EV sector may face bigger pressures if Europe follows the US and imposes high punitive tariffs on Chinese EVs.

The raising of tariff on EVs, batteries and many other new technology items by the US may push China to dump these products in other markets including India. “India may not get any export advantage on remaining products like the EVs, semiconductor as India is the net importer of these products,” observes Ajay Srivastava, founder GTRI.

With the US and EU taking active measures to cut reliance on China, India with stagnant exports and rising imports from the eastern neighbour, would need a China strategy, suggest many trade observers and experts. Especially as the routine tariff increases that go beyond the WTO commitments and large subsidy programmes to ramp up local production have put developed countries on a full protectionist mode.

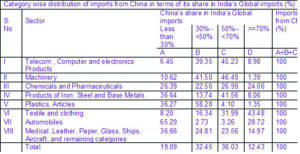

Over the years, contrary to general perception, India’s imports from China have expanded beyond the electronics sector, China is India’s top supplier in all eight industrial sectors including electronics and over the last 15 years, China’s share in India’s imports of industrial goods increased from 21 per cent to 30 per cent. This is a role reversal from India’s trade surplus with China in the 2000 decade. India exported goods of value USD 10 billion to China in 2005 and Chinese trade records reveal that India had a trade surplus with China during the 2003-2005 period.

However, post 2005, China raced ahead, and India’s trade deficit steadily widened with import of US$ 101 billion in FY2024 from China, the GTRI study reveals. Imports from China grew 2.3 times faster than India’s total imports. Growing trade deficit with China is a cause of concern. From 2019 to 2024, India’s exports to China have stagnated around USD 16 billion annually while imports from China have surged from USD 70.3 billion in FY2019 to over USD 101 billion in FY2024, resulting in a cumulative trade deficit exceeding USD 387 billion over five years.

Policymakers and sources in Government assure that India will remain vigilant and has the mechanism to deal with possible dumping of electric vehicles and batteries following steep hike in tariffs by the US on imports originating from China. The Directorate General of Trade Remedies (DGTR) system functioning, India’s anti-dumping system is functioning and there is an institutional mechanism in place to look into it. The view is that the US is following policies through which it wants to reduce its dependence on China in energy transition. Post Covid, it has ben proved that it is not a good idea to put all eggs in one basket. Same is the policy in India which is building capacities in manufacturing.

Indian is also betting on the progress in technology driven sectors of exports such as machinery, electrical and electronic, auto mobile, pharma, biotechnology etc. This will get further push once the PLI related sectors start producing in the country, as a significant portion of production will find its way to the global market. “In the past 4 years, our exports growth in all the above sectors, outpaced global import growth and thus, our share, though modest, has improved,” says the FIEO president who also points out the machinery sector which experienced a compound annual growth rate of 4 per cent during 2019-2022, whereas India showcased a more robust growth of 7 per cent in this sector. Similarly, in the realm of electrical and electronics, the global growth reached a CAGR of 7 per cent, contributing to a market size of approximately USD 3.5 trillion.

Remarkably, India’s exports in these sectors recorded a CAGR of about 20 per cent, propelled by the mobile phone exports.