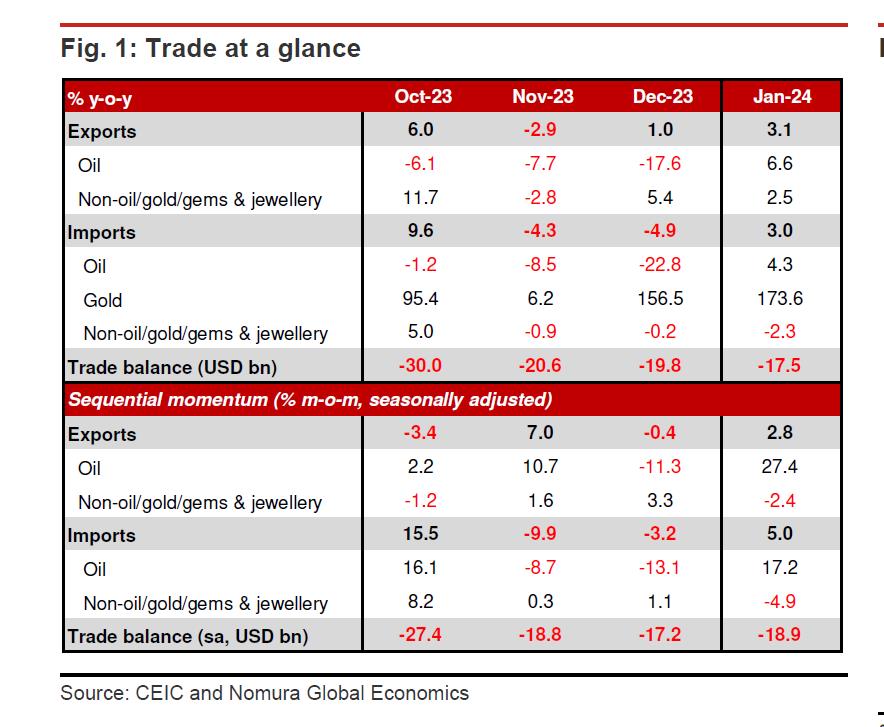

The Red Sea is a busy corridor for India’s sea trade to Europe and the US and any disruption can have significant consequences. January was widely expected to be the first month to reflect the impact of the disruptions in the Red Sea on merchandise trade. India’s merchandise trade, however, is braving the choppy Red Sea waters as shows the January data with exports rising 3.12 per cent y-o-y in January 2024 at USD 36.92 billion compared to USD 35.80 billion in January 2023 and growing from 1.0 per cent in December. Import growth is also picking up 3.0 per cent from 4.9 per cent. Merchandise imports in January 2024 were USD 54.41 Billion, as compared to USD 52.83 Billion in January 2023.

There is broad opinion that despite disruption in trade caused by strife around the Red Sea, exports have fared better than expected and that the surplus suggests muted external sector pressures. Nomura analyst Sonal Varma points to the Nomura India Normalisation Index (NINI), which excludes seasonal and base effects and captures performance relative to pre-pandemic levels. This index also sharply increased for both exports and imports in January suggesting that on a value basis, there doesn’t seem to be major disruptions to trade from the Red Sea escalations.

The healthy headline data despite supply-side disruptions has surprised many, including in the government quarters, official policymakers, industry and experts. Commerce secretary Sunil Barthwal attributes the positive show to collective efforts by the exporting community and the Ministry’s strong support to them “in the thick and thin of issues”, as Barthwal puts it. “I held atleast three meetings with exporters, shipping corporations, container corporations, the forwarding lines, the Department of Financial Services and the Shipping Ministry,” informs Barthwal. There was a focused strategy on how they should navigate the stormy waters and communicated to the banks to extend the maximum credit they can to the exporters.

Israr Ahmed, President (Officiate), FIEO emphasises that the increase in exports took place despite the Red Sea crisis posing challenge on the logistics front. “This goes to show not only the resilience of the sector but also of the exporting community, who have continuously been braving such odds since Russia-Ukraine war. The exporters have consistently been performing, driving the growth of exports, and also adding to the growth momentum of the economy,” observes Ahmed.

In another significant achievement, with exports doing better than imports on a sequential basis, merchandise trade deficit narrowed to USD 17.49 billion in January from USD19.8 billion in December. As per CRISIL Analytics data, cumulatively, in April-January this fiscal, merchandise imports contracted 6.7 pr cent on-year to USD 559.55 billion, helping narrow the merchandise trade deficit to USD 205.51 billion from USD 229.38 billion.

The Ministry also directed the EXIM Bank and ECGC to not hike insurance payment rates,” the commerce Secretary added. All this created a highly positive and facilitative atmosphere which has facilitated export growth. “If the midst of such difficult circumstances, if we have grown, that speaks volumes of the exporters,” adds Barthwal, assuring that the Government was committed to further these initiatives and work with exporters to ensure that the coming period also yields such positive growth in exports,

Going forward, as part of the concentrated effort by the Commerce Ministry on some products, a task force has been created to look at non-tariff barriers, sanitary and phytosanitary issues. This task force is also identifying bottlenecks, as per some issues taken up with some of the countries which were not listing India’s exporters, insisting that they already done so and that the list was already quite long. We have asked them to delist those who are not exporting and enlist those who have the potential to export now. The task force will also continue to work and this will help push shipments.

The Government is also looking at new categories and products which can be exported. There are a huge number of products which have been identified for thrust and are being exported for the first time from India. At the same time, the Ministry is also mapping new geographical territories where India can export. We are trying to create a much larger basket for ourselves to drive exports – in terms of territory, in terms of products, in terms of removing NTBs, in terms of increased interaction with cooperation forums like the US and resolving WTO issues which is also helping us to move ahead with our exports.

Analysts in CRISIL highlight the proactive support by the government in the form of easier access to credit etc. “To be sure, they are getting support from a depreciating rupee and stronger-than-expected growth in the US, a key trading partner. The real effective exchange rate2 (REER) based on export weights has declined 1.25 per cent on-year since April 2023 till December,” says a Crisil paper.

David Sinate, Chief General Manager – Research & Analysis Group, India Exim Bank attributes the rise in merchandise exports as been primarily driven by a robust growth in several categories of food products, a few high value-added manufactures like electronics, plastic products and pharmaceuticals. Commerce Ministry data shows main drivers of merchandise export growth in Jan 2024 as petroleum products, engineering goods, iron ore, electronic goods, drugs & pharmaceuticals, etc. Petroleum products exports in January 2024 registered growth of 6.57 per cent at USD 8.21 billion from USD 7.70 billion in Jan 2023.

Oil exports reversed course, increasing 6.6 per cent to USD 8.21 billion compared with a decline of 17.6 per cent in December. This is in line with the 2.95 per cent on-month increase in Brent crude oil prices to USD 80.2 bb/l from USD77.9 bb/l in December 2023. Also encouraging is export growth in labour-intensive sectors like carpets (9.4 per cent vs 3.8 per cent), cotton, yarn, fabrics, made-ups, handloom products and others (2.5 per cent) which remained positive compared with the previous month.

On the flip side, uncertainties cloud the global growth prospects and exporters are already facing the heat due to the Red Sea Crisis. Shortage of containers and high shipping costs have been impacting the profit margins of exporters. Nomura suggests that while the overall impact doesn’t seem to be too large for now, it manifested in pockets as slower export growth — such as drugs and pharmaceuticals (6.8 per cent

vs 9.3 per cent), engineering goods (4.2 per cent vs 10.2 per cent) and gems and jewellery (-1.3 per cent v 14.1 per cent) in January.

A CITI analysis for January 2024 shows that during January’24, Indian textiles exports registered a negative growth of 1.18 per cent over the previous year while apparel exports registered a degrowth of 3.46 per cent during the same time period. The cumulative exports of textiles and apparel during January have registered a degrowth of 2.29 per cent over January 23.

Engineering goods exports recorded an increase of 4.20 per cent at USD 8.77 billion over USD 8.41 billion in January 2023. Chairman EEPC Arun Kumar Garodia informs that despite tough global conditions, Indian engineering exports grew 4.20 per cent year-on-year to USD 8.76 billion in January 2024. “The engineering exports maintained the pace after a strong rebound in December last year. In the current fiscal year, we have seen ups and downs but we expect the second half to be better,” hopes Garodia.

Sequential momentum has also ebbed in January for core exports (non-oil) and imports (non oil, gold, gems & jewellery). Volume growth for both have moderated, suggesting that the Red Sea disruptions may have hit trade volumes, without affecting the value materially. Core exports grew 2.5 per cent on-year in January compared with a 5.4 per cent growth in December 2023, ceramic products and glassware exports fell 3.5 per cent and handmade carpets by 16.6 per cent. According to CRISIL, cumulatively, India’s merchandise exports have declined 4.8 per cent on-year in April-January this fiscal to USD 354.04 billion, compared with USD 372.1 billion a year ago.

While the numbers are encouraging, experts recommend caution with rising global tensions and unevenness in global growth indicating that maintaining export momentum will not be an easy task. President of FIEO Ahmed confirms that recent tensions in West Asia especially the threat for consignments routing through the Red Sea has further added to woes of the exporting community, as the freight rates have gone up unimaginably high, with further burden of various surcharge. This has pushed Indian exporters to hold back around 25 per cent of the outbound shipments transiting through the Red Sea. Ahmed also raises concern that much will depend on the new agreement to be signed with buyers during the new fiscal as the exporters have been absorbing the burden of increased freight cost as per the old agreement. The exporters have called for addressing the Red Sea crisis challenges by ensuring availability of marine insurance, regular supply of containers, and rationale increase in freight charges to drive FY 2023-24 exports past last year’s figures.