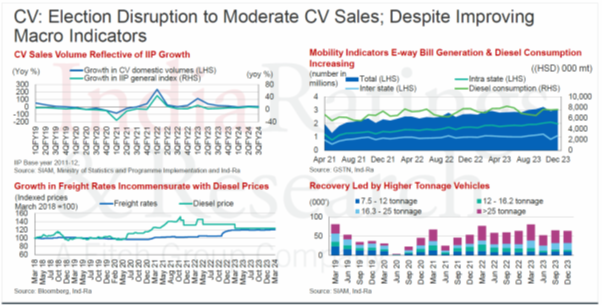

NEW DELHI: India’s general elections are slowing down the commercial vehicles (CV) industry with volumes for the domestic CV industry remaining muted as the base effect catches up and amidst a perceived pause in the infrastructural activities as the model code of conduct kicked in ahead of the polls. According to ICRA estimates, the domestic CV industry volumes are seen to have registered 2-5 per cent yoy growth in FY2024 and the industry’s sharp upcycle is expected to plateau in FY2025, with a marginal decline of 4-7 per cent in volume.

The rating agency expects medium and heavy CV volumes to decline by 4-7 per cent in FY2025, given the high base effect and the impact on the momentum in the Government’s capex in the first few months of the fiscal with the onset of the general elections. According to India Ratings’ FY25 outlook on auto and auto ancillaries, senior analyst Shefali Joshi and Director Shruti Saboo the CV segment is likely to buck the trend of a “continuity in the domestic upcycle in FY25 albeit at a moderate level. Even as domestic demand in FY25 will continue to grow by around 6 per cent to 9 per cent, “except CV, other industry segments volumes are likely to touch pre-COVID levels peaks”, project Joshi and Saboo.

Vice President Corporate Ratings, ICRA, Kinjal Shah notes that CVs registered a surprisingly healthy yoy growth of 13.9 per cent in wholesale volumes in the month of April 2024. However, and in line with expectations, says Shah, “CVs registered a sizeable sequential decline of 26.6 per cent as the implementation of the model code of conduct for the general elections 2024 led to a slowdown in infrastructure and construction activities.”

The domestic CV retail volumes, at 90,707 units in April 2024, reported a moderate 6.0 per cent growth on a YoY basis while registering a nominal 0.6 per cent sequential de-growth.

“We expect the domestic CV industry’s upcycle to plateau in FY2025, with an expected decline of 4-7 per cent in volumes,” says Shah. Arun Agarwal, VP& Analyst, Kotak Securities finds that for the month of April 2024, tractor segment’s sales momentum remained weak. Agarwal, however, sees a reverse trend happening with projections of an above-normal monsoon likely to bode positive for the industry.

The Federation of Automobile Dealers’ Association also points out in its most recent report last week that the CV segment showed modest 2 per cent yoy growth in retail sales and a 0.6 per cent month-on-month decline, indicating varied market conditions. “Positive momentum was found in bulk and corporate deals and school bus demand, though elections dampened sentiment, with customers delaying expansion plans,” agrees FADA president Manish Raj Singhania. “Limited finance options and regional challenges such as water scarcity further impacted performance,” says Singhania. Surprisingly, says the FADA president, electric CVs witnessed an astounding 175.5 per cent growth YoY, with 8,571 units sold, achieving a 0.85 per cent market share.

The Society of Indian Automobile Manufacturers (SIAM) president Vinod Aggarwal attributes the domestic CV industry’s marginal growth in FY 2023-24 at 9.7 million units — and within that, some drop in light CVs and small CVs — to degrowth in the CNG segment. “The growth in CV was also impacted due to migration to higher tonnage trucks which created higher payload capacity, that is not reflected in the number of units. Overall exports remained under stress during the last financial year with sizeable drop in CV,” said Aggarwal. As for the Q4 performance of 2023-24, CVs registered degrowth of 4 per cent by posting sales of more than 2.68 lakh units, according to Rajesh Menon, Director General, SIAM.

The ICRA study forecasts that amidst a decline of 1-4 per cent in FY2024 for the LCV segment, the slump in FY2025 is expected to be sharper at 5-8 per cent due to a relatively high base effect continuing for FY2025. On the positive, the mandatory scrappage of older Government vehicles is expected to drive replacement demand from state road transport undertakings, with EVs gaining traction over the near term.