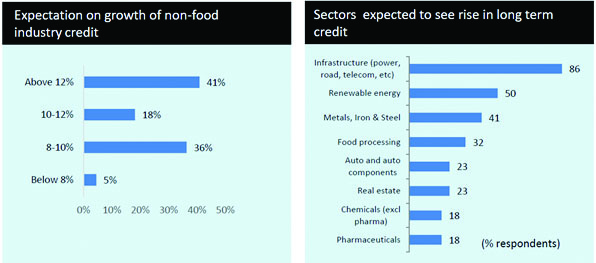

The relatively better performance of the Indian economy with 7.6 per cent projected growth in FY24 — compared to other major economies — driven by strong investment growth and a rebound in industrial activity has led to sustained growth in long term credit demand for sectors such as infrastructure, metals, iron and steel, food processing. While infrastructure is witnessing an increase in credit flow with 82 per cent of the respondents indicating an increase in long-term loans as against 67 per cent in the previous round, the outlook for non-food industry credit over next 6 months is optimistic with 41 per cent of the participating banks expecting non-food industry credit growth to be above 12 per cent.

Of this segment, 18 per cent feel that non-food industry credit growth would be in the range of 10-12 per cent and 36 per cent of the respondents are of the view that non-food industry credit growth would be in the range of 8–10 per cent, according to the FICCI-IBA survey of 23 banks representing about 77 per cent of the banking industry. Credit growth also continued to rise, supported by factors such as economic expansion and a continued push for retail credit which has been supported by improving digitalisation. The banking sector’s clean balance sheets support further loan growth going forward.

According to the survey, 65 per cent of respondent banks reported credit standards for large enterprises to have remained unchanged as against 54 per cent in the last round. Respondents reporting easing of credit standards has decreased to 17 per cent in the current round as against 29 per cent in the previous round while those reporting tightening in credit standards were