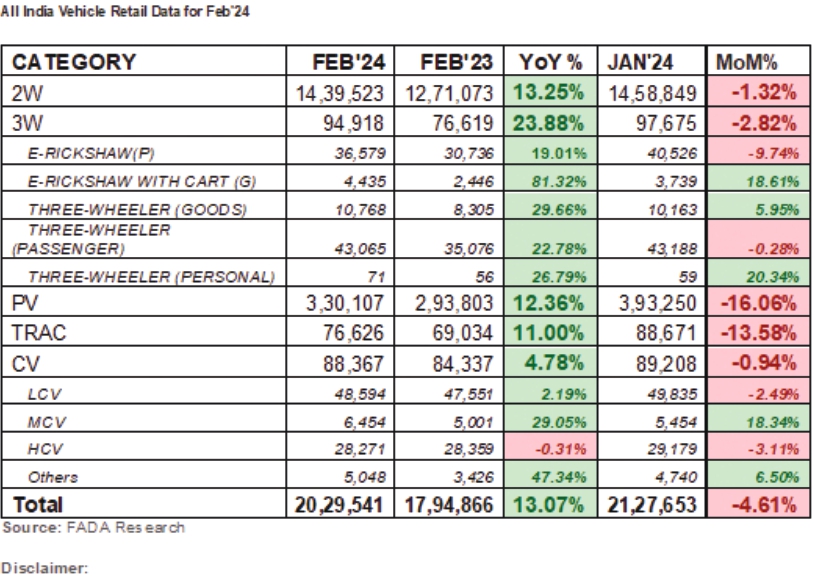

Indian auto retail posted robust overall growth in February 2024, with 13 per cent year-on-year growth across all vehicle categories, led by 13 per cent growth in two wheelers, 24 per cent in 3W, 12 per cent in passenger vehicles,11 per cent in tractors and 5 per cent in commercial vehicles, according to vehicle retail data released by the Federation of Automobile Dealers Associations (FADA) for the last month.

The 2W market growth was notably driven by the rural sector, demand for premium models and strong performance of entry-level segments with broader product availability and compelling offers enhancing product acceptance, notes FADA President Manish Raj Singhania. “Factors like favourable marriage dates and improved economic conditions also contributed to this positive growth,” says Singhania.

The 3W market surged by 24 per cent YoY, with EVs making up 53 per cent of this growth, fuelled by first-time users and a shift towards electric rickshaws, alongside better market sentiment and consumer engagement. The PV segment growth marked the highest February sales figures ever, driven by new product introductions and enhanced vehicle availability. While the sector benefits from favourable customer sentiment and the successful introduction of models in high demand, the persistently elevated inventory levels, remaining at 50-55 days, present a significant concern. necessitating OEMs to adjust production to reduce dealer carrying costs.

“It is imperative for PV OEMs to undertake adjustments in production to mitigate these high inventory levels, thereby reducing the financial burden of carrying costs on dealers as it is vital for maintaining the financial health of dealers. Adopting this forward-looking stance is essential for ensuring the sustained growth and vitality of this segment,” suggests Singhania.

The CV sector achieved 5 per cent yoy growth, overcoming challenges such as cash flow shortages and election-related purchase deferrals through fleet purchases and school buses, strong sectoral demand and improved financing, despite obstacles like cash flow shortages and election-related purchase deferrals, highlighting the sector’s resilience and gradual recovery.

The near term outlook for March 2024 suggests cautious optimism, with potential growth driven by robust signals from the rural market and financial year-end buying activities. The auto retail sector is influenced by a blend of positive trends and challenges. The rural sector’s robust signals, along with an increased demand for premium and entry-level segments, are set to bolster the 2W market.

Similarly, both the 3W and CV sectors anticipate a boost in sales, driven by the financial year-end rush and an infusion of funds into the market, which is expected to stimulate purchases. In the PV sector, the confluence of financial year-end buying incentives, improved availability of vehicles and seasonal factors such as marriages is likely to propel demand.

Overall, the near-term outlook for March 2024 in the auto retail sector is one of cautious optimism. Financial year-end activities traditionally spur purchasing across segments, yet the feedback from dealers highlights the nuanced challenges of inventory management, extremely aggressive target settings and evolving consumer preferences. The ability of OEMs to address these challenges through strategic product introductions, supportive dealer policies and adaptive sales strategies will be paramount in maintaining the sector’s growth momentum and achieving success in the near term.