In 2020, more and more governments began embracing cryptocurrencies and offering legal clarification and regulations.

London: It is somewhat ironic that cryptos such as Bitcoin and Ethereum were initially championed as a means to make payments globally, without the need to use third parties such as banks. Unfortunately, nefarious actors quickly sized the opportunity to move money digitally—quickly and cheaply—and potentially most importantly, anonymously, by-passing many of the existing KYC/AML checks that banks and regulators had established to reduce the economic impact of the shadow economy – terrorist funding, money laundering etc. The likes of the notorious Silk Road website, which offered illegal drugs, guns and pornography, quickly adopted the use of cryptos as a form of payment. The US FBI unearthed the Silk Road website and shut it down in October 2013, seizing its stash of Bitcoin and, for a while, making the US government the largest holder of Bitcoins. Operators such as Plus Token, which was alleged to be a Ponzi scheme and moved $100 billion of cryptocurrencies, used crypto currencies as their chosen ransom payment. Indeed other organisations that have resorted to blackmailing and carried out cyber-attacks (such as the DDoS demanding Bitcoin as a payment). Thus, it was easy to see why cryptocurrencies were held with a high degree of suspicion and distrust.

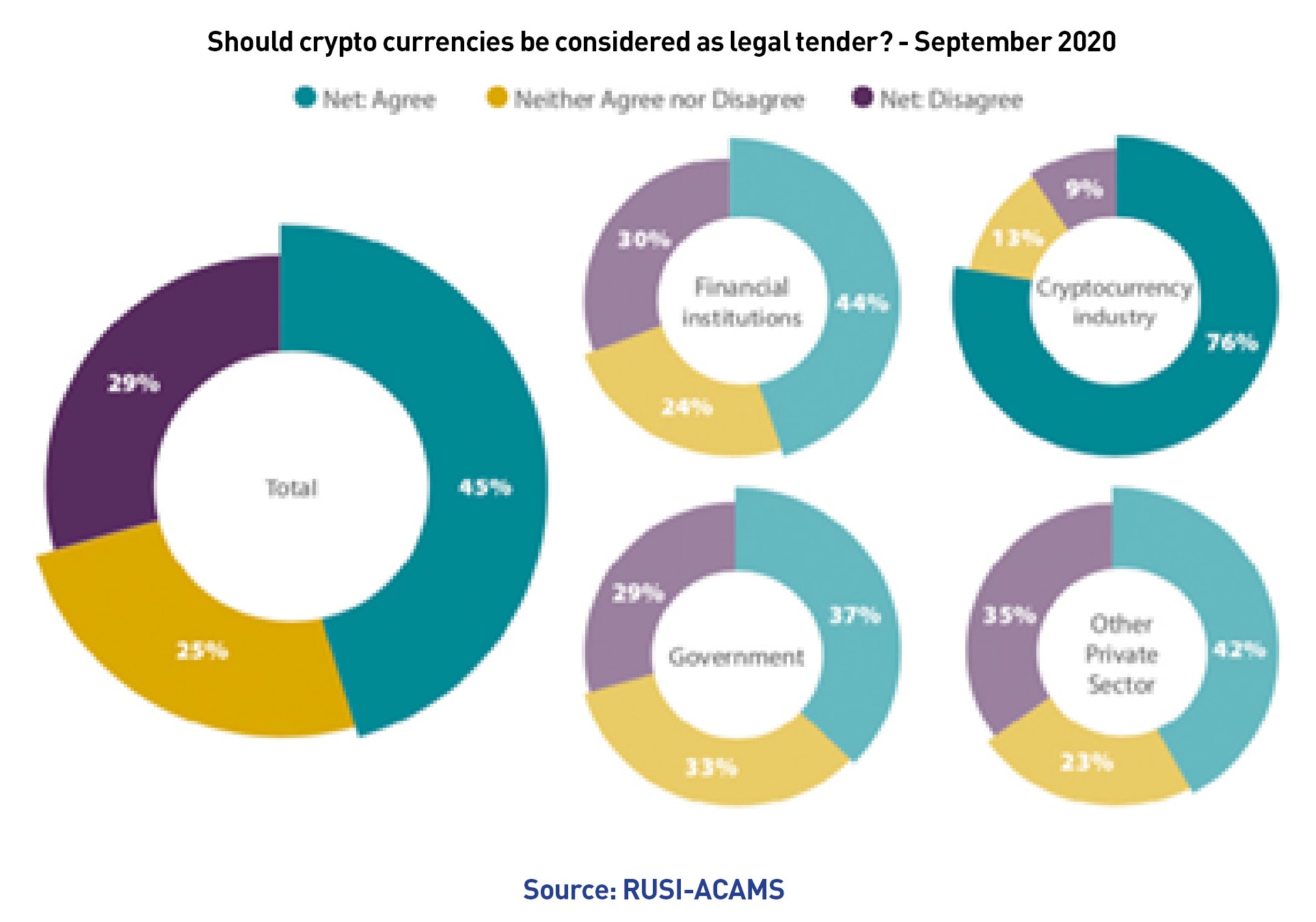

However, in 2020, we bore witness to more and more governments beginning to embrace cryptocurrencies and offering legal clarification and regulations. Somewhat ironically, we have seen regulation to be the driving force for crypto adoption with legal certainty and regulatory clarity in various jurisdictions encouraging individuals, asset managers and multinational corporations to buy cryptocurrencies. Countries such as Japan, Singapore, Switzerland and South Korea have all passed legislation, now procuring established and thriving crypto-trading communities. In the USA, the SEC has been cracking down on ICOs, such as Telegram, forcing it to hand back $1.24billion. Presently, the government agency has a court date to bring action against Ripple for its alleged $1.3billion breach of security regulations. However, the U.S. Commodity Futures Trading Commission has confirmed Bitcoin and Ether are both classified as commodities, leading the way for quoted companies such as MicroStrategy and life assurance firms, such as Massachusetts Life, to buy Bitcoin as part of their portfolio – with some asset managers doing the same.

In effect, regulations are being seen, once again, as a driving force behind the use of cryptos not to circumvent the law, but being bought since there is now legal clarity to do so. Conceivably, given the recent strong performance of Bitcoin in the last few months, there will be more interest in this asset class, and we will witness an increase in the acceptability of cryptos in various jurisdictions globally.

How and where are Bitcoins mined?

The recent surge in the price of Bitcoin will no doubt be spurring on those who have access to cheap sources of electricity since Bitcoin mining requires a huge amount of electricity. Every ten minutes 6.25 Bitcoins are created which, at $41,000, handsomely rewards the successful miner over $256,000. However, as to be expected, alongside these potential profits we are seeing much confusion globally and some unexpected consequences. There is a hidden story about Bitcoin mining. A ‘hash’ a term used to refer to an algorithm which converts an input of letters and numbers into an encrypted output (hence crypto). These are, in effect, the building blocks of a number of cryptocurrencies including Bitcoin. According to the Cambridge Centre for Alternative Finance, research has revealed that 76% of ‘hashers’ use renewable energy. Miners also use renewable energy to power their activities, with hydropower being the number one source at 62%. However, the 76% (above) refers to the share of hashers who use renewable energy as part of the production of Bitcoins. Indeed, it estimates that only 39% of hashing’s total energy consumption comes from hydroelectricity, coal (38%) and natural gas (36%). The Chinese, with over 60% of Bitcoin capacity, have used renewable energy for much of their Bitcoin production. In China’s rainy season (June to October) ‘green’ powered provinces such as Sichuan and Xinjiang have hydropower plants capable of providing cheap electricity prices for Bitcoin mining operations. The location of Bitcoin mining is often driven by other factors. For example, in Russia, Gazprom is now selling surplus cheap gas to Bitcoin miners whilst the Venezuelans, as a way to get around international sanctions, are mining Bitcoin as a way to generate much-needed foreign reserves.

There would appear to be a close correlation between where Bitcoin is mined and cold weather, with places such as Canada, Russia, Kazakhstan and Iceland all appearing to have notable Bitcoin mining facilities. As reported by Forbes, Bitcoin mining is being seen potentially as a way to create jobs in the heartlands of America. An example of this is a US- based firm called Core Scientific which runs Bitcoin mining rigs for UK-listed Argo Blockchain PLC (whose share price has risen a massive 981% since BTC prices have doubled in the last month). In December, Argo mined 96 BTC which, at $20,000 at the beginning of December, were worth $1.9million—but at a price of $41,000, would be worth $3.9million! However, heed caution, as Argo PLC is a small cap stock thus may prove to be very illiquid stock to trade. According to the IAG Business School at Pontifical Catholic University of Rio de Janeiro, Bitcoin mining can also be used to reduce the risk of fluctuations in the price of electricity for those looking to build renewable energy facilities. Renewable energy can provide an alternative source of income when electricity prices are low by diverting electricity to produce Bitcoin, as opposed to selling it at wholesale prices on a country’s national electricity grid.

Ultimately, how and who produces Bitcoins is not straight forward. Undeniably, the amount of electricity Bitcoin uses due to its method of mining/production is considerable, since Proof of Works (PoW) does require significant computing power. This is one reason why other cryptocurrencies, such as Ethereum, are moving away from PoW to Proof of Stake (PoS) which uses a lot less energy. If interested, please see here for four key differences between PoS and PoW. If you think Bitcoin prices will keep rising, then you may indeed wish to start mining yourself. If so, check out this Bitcoin mining calculator.

(These articles have been written carefully to bring attention to developments in the Blockchain and Digital Asset sectors, but readers are recommended to take professional advice before taking any action based on any of the links and information above. TeamBlockchain Ltd does not take any responsibility for any action that may or may not be taken, loss or gain on receiving this edition of Digital Bytes.)

(Jonny Fry is CEO TeamBlockchain Ltd)