It’s raining external bounties for India as the economy closes financial year 2023-24 on one of the best growth narratives this fiscal – resilient exports and downward trending current account deficit (CAD) or trade deficit, keeping, as the Finance Ministry observes, “India’s external account stable despite persistent geopolitical headwinds”.

In fact, the bigger news is that the CAD can be expected to cross into surplus territory this year, as barring any untoward surprises in the upcoming March trade data, the merchandise trade deficit in January to March period of 2024 has so far remained capped, largely unscathed by the unscathed by the Red Sea disruptions.

India’s CAD narrowed to 1.2 per cent of the GDP in October-December quarter of 2023 from 1.3 per cent of GDP in Q3, with the wider merchandise trade deficit countered by a pick-up in the services surplus and healthy remittances. The merchandise trade deficit had widened to USD 18.7 billion in February from USD 16.5 billion in January with a spike in gold imports to a four month high of USD 6 billion contributing to the widening in the merchandise trade deficit last month. However, during April-February FY2024, the positive impact of the drop in the value of imports outweighed the negative impact of a decline in exports, thereby leading to narrowing of merchandise trade deficit.

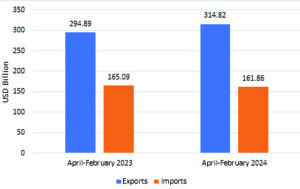

The Finance Ministry also points out that the narrowing merchandise trade deficit is fuelled by falling international commodity prices. “A welcome decline in global commodity prices from their post-Ukraine conflict highs offers some relief,” the Finance Ministry observes in its monthly review report. Also a close examination of the World Bank pink sheet database showcases a fall in prices of key international commodities, such as sunflower oil, palm oil, di-ammonium phosphate, crude oil, and natural gas, among others. Due to a fall in global commodity prices, the overall value of merchandise imports was 5.2 per cent lower from April-February FY24, compared to the first 11 months of FY23. Accordingly, India’s merchandise trade deficit narrowed from USD (-)245.9 billion during the first 11 months of FY23 to USD (-)225.3 billion in the corresponding period of FY24.

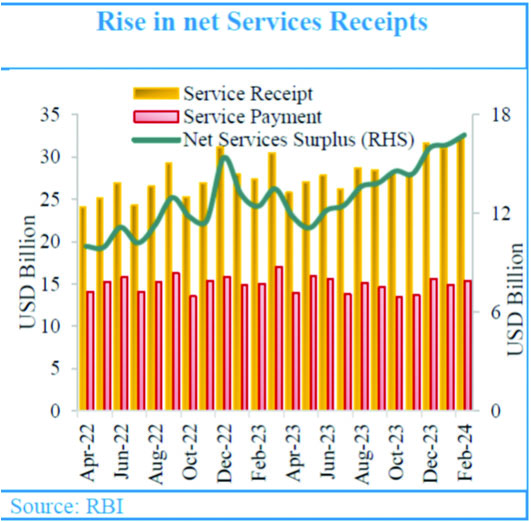

Going forward, policymakers and experts, are banking on services sector tipping the balance in India’s favour. This finds endorsement in the Finance Ministry’s latest monthly review of the economy which underlines that “merchandise trade deficit is narrowing and services exports remain strong, resulting in an increase in net services receipts”. Services exports stood at USD 314.8 billion in the first 11 months of FY24, recording a growth of 6.8 per cent over the corresponding period of FY23. Software and business services together constitute around 75 per cent of India’s total services exports and exhibited strong growth in FY24. Rising services exports, coupled with a fall in imports, have led to an increase in net services receipts, which rose from USD 129.8 billion in the first 11 months of FY23 to USD 153 billion in the corresponding period of FY24.

Notwithstanding a seasonal spike in the CAD in Q3 FY2024, Aditi Nayar, Chief Economist ICRA is of the view that the surge in services exports in the recent months is an indication that the CAD will compress appreciably in the ongoing quarter, to the extent of containing the full year figure to 1.0 per cent of GDP. Even Nomura analysts Sonal Varma and Aurodeep Nandi find that the services trade surplus has been exceptionally strong, reflecting strong IT exports, as well as increasingly robust ‘professional and management consulting’ flows. “Assuming healthy remittance flows, Nomura Ratings projects January-March period of 2024 to record a CA surplus of 0.5 per cent of GDP,” say Varma and Nandi.

All this augurs well for India, as it will ensure that the CAD for FY24 narrows to 0.7 per cent of GDP from 2.0 per cent of GDP in FY23. On a more optimistic note, Nomura reports its expectation of deficit to remain largely in check in FY25, averaging 1.1 per cent of GDP.

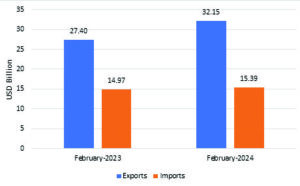

For the Government, the double bonanza comes from a surge in India’s merchandise exports which, at USD 41.4 billion in February 2024 was not only an 11 month high but showed a strong 11.9 per cent yoy for the third consecutive month in February as favourable momentum more than offset a negative base effect. Out of 30 major commodities, 22 commodities (accounting for 83.2 per cent of the export basket) registered expansion on a y-o-y basis. Engineering goods, electronic goods, organic and inorganic chemicals, drugs and pharmaceuticals and petroleum products supported export growth, while gems and jewellery, other cereals, mica, coal and other ores, oil meals and marine products dragged down overall exports in February.

The broader implications of the strong performance of both merchandise exports and imports is indicative of only a tangential impact from the Red Sea geopolitical disruptions so far. The New York Global Supply Chain Pressure Index also highlights that supply chain pressures have declined significantly, suggesting a diminished contribution to inflation pressures. Though, supply chain pressures turned positive in February 2024 for the first time in over a year, they have remained near normal. What also holds good for India is that rejuvenating demand scenarios in the advanced economies are expected to have a positive impact on its economy, though a sectoral impact on agricultural commodities, marine products, textiles and chemicals, capital goods, and petroleum products is possible.

As the financial year comes to a close on 31 March, these developments set the stage for continued resilience of merchandise exports which have weathered the Red Sea disruptions to post a positive growth of 14.20 per cent in India’s overall exports (merchandise and services combined) in February 2024 at USD 73.55 billion. India’s overall exports in April-February 2023-24 too have exhibited a positive growth of 0.83 per cent at USD 709.81 billion, over April-February 2022-23. Government data shows show engineering goods shipments have surged 15.9 per cent at USD 9.94 billion over USD 8.58 billion in February 2023 and electronic goods exports registered an increase of 54.81 per cent at USD 3.00 billion in February 2024 over USD 1.94 billion in February 2023.

The year has seen exports of organic and inorganic chemicals increase by 33.04 per cent from USD 2.22 billion in February 2023 to USD 2.95 billion in February 2024, exports of drugs and pharmaceutical products grow to USD 2.51 billion, an increase of 22.24 per cent over USD 2.06 billion in February 2023 and petroleum products exports in February 2024 register growth of 5.08 per cent at USD 8.24 billion from USD 7.84 billion in February 2023.