NEW DELHI: India’s merchandise exports seem to have weathered the headwinds quite well so far amid heightened geopolitical tensions that have rendered the global environment highly uncertain but while support continues from some of its traditional large export partners such as Europe and the Gulf Cooperation Council (GCC) – as per destination-wise trade data of the Government and industry — shipments to the US — India’s largest exporting destination – declined marginally in fiscal 2024 which is prompting New Delhi to scout for new partners across untapped geographies.

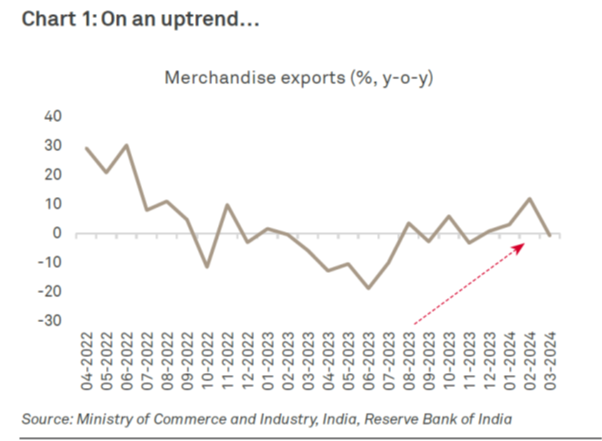

On-year export growth entered the positive zone in August 2023 for the first time in many months and has since displayed healthy momentum. After an average 13.1 per cent on-year contraction during April-July 2023, exports logged 2.2 per cent growth over August 2023-March 2024. Indeed, export growth in the last quarter of fiscal 2024 was faster at 4.5 per cent. The performance was largely in sync with global trade, according to CRISIL Market Intelligence and Analytics. According to latest data from the United Nations Conference on Trade and Development, global merchandise exports declined 4.6 per cent in 2023, similar to India’s 4.7 per cent decline during the period, thereby keeping India’s share in world exports stable at 1.8 per cent. India’s export performance was, in fact, better than developing Asia as a whole, which saw merchandise exports decline a higher 6.8 per cent in 2023.

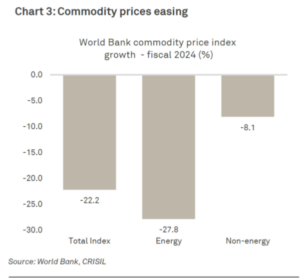

Lower international commodity prices played a dominant role in pulling down India’s dollar export bill, finds CRISIL Analytics. Most international commodity prices have been on a downward trend since shooting up due to geopolitical uncertainties in February 2022. The World Bank commodity price index shows this holds for both energy as well as non-energy (including metals and minerals) commodities. The sharp decline in energy prices, especially crude oil prices, was one of the biggest contributors to the fall in India’s overall merchandise export bill. With over 20 per cent 1 share, oil is India’s top export item, and hence, its movement has a large bearing on India’s total export earnings. For instance, India’s petroleum export bill reduced to USD 84.1 billion in fiscal 2024, from USD 97.5 billion in fiscal 2023, as crude oil prices fell. In volume terms, India exported out more tonnes of petroleum products in fiscal 2024.

Core exports managed to grow 1.4 per cent to USD 320.2 billion, from USD 315.6 billion. The rise in core exports despite the broad-based decline in international commodity prices suggests India was able to ship out a higher volume of most goods, indicating robust demand for Indian goods in international markets. Electronics goods recorded the highest growth as exports of telecom instruments or mobile handsets surged, due to a push from the government’s production linked incentive scheme. Other major core categories that displayed healthy export growth were drugs and pharmaceuticals, agricultural goods and engineering goods – one of India’s largest export categories.

Agriculture and allied exports posted positive growth, despite the ban on non-basmati rice, wheat and some other curbs from time to time and led by other categories such as meat and poultry products, spices, fruits and vegetables, oil meals, oil seeds and unmanufactured tobacco. The high growth in ores and minerals exports, was a result of the surge in iron ore exports which was up 118 per cent to USD 3.9 billion in fiscal 2024, from USD 1.8 billion on account of a low base. These exports were hit by high export duty imposed in fiscal 2023, which was subsequently removed and sequential improvement in Chinese demand this fiscal. High growth of mica also supported overall ore and mineral exports from India.

Among India’s top core exports, organic and inorganic chemicals remained a laggard, declining 3.2 per cent to USD 29.4 billion in fiscal 2024, from USD 30.3 billion in the previous fiscal. Labour-intensive exports remained in the red as in the case of textile products — mostly ready-made garments — though some categories such as cotton yarn, fabrics, made-ups and handloom products managed to increase their exports during the fiscal). The trend also reflected in leather and leather products and marine products.

India’s destination-wise trade data suggests continued support from some of its traditional large export partners such as Europe and the Gulf Cooperation Council (GCC). While demand from the US remained weak despite the economy posting healthy growth — largely due to the US being largely services sector led destination. That said, there has been some revival in India’s goods exports to the US in the past few months.

Improvement in exports to the EU, the region feared to be most impacted by the geopolitical uncertainties, suggests the exporters were possibly able to sustain the momentum by adopting newer trade routes, for instance, routing exports via Cape of Good Hope in South Africa, which increased the travel time but did not impact demand for goods, at least till last fiscal. Increased exports to EU was largely led by petroleum exports which grew 32.8 per cent on-year to USD 17.8 billion during April- February fiscal 2024, from USD13.4 billion in the year-ago period, even as India’s overall oil exports declined. Some other key items that India was able to push to the EU were machinery which grew 4.5 per cent on-year during April 2023-February 2024, iron and steel which increased 17.6 per cent, pharmaceutical products which grew 5.8 per cent, auto and auto parts up 6.2 per cent.

At the same time, India has been able to push its exports to some smaller partners such as East Africa and, thereby, support its overall merchandise exports. Even as exports to South Africa have shown some improvement recently, exports to East Africa rose sustainably through the fiscal and were supported by commodities such as oil and pharmaceutical products, and to some extent by machinery.

Rise in exports to GCC reflects further improvement in India’s exports to the United Arab Emirates which is the largest export destination of India’s goods in the GCC region and with which India’s Comprehensive Economic Partnership Agreement (CEPA), came into force in May 2022. This likely gave a push to India’s exports to the country.

India’s gems and jewellery exports to the UAE increased by a whopping 42.3 per cent on-year during April-February fiscal 2024, even as India’s overall gems and jewellery exports declined 14.5 per cent during this period.

While export growth to Oceania (led by Australia) was the highest among all the regions, it must be kept in mind that a low base was at play as exports to Oceania had dropped in the year-ago period. In the past few months, there has been some improvement in exports to Northeast Asia led by China and ASEAN.