NEW DELHI

In what may be seen as a forceful endorsement of the Government’s faith in the nation’s demographic dividend, in the idea of a new India taking wings and in its own readiness to stake claim for a rightful position in world being reshaped by myriad economic challenges, a State Bank of India Research report, quite opportunely, reveals the phenomenal growth in the average income of middle-class Indians over the past decade who have positioned themselves as the tax filer base, helped by ongoing reforms, confidence building measures coupled with a galvanizing economy firing on all cylinders. This aspirational set promises to bring to the net 482 million IT filers in FY47 (70 million in FY23), increasing its share in taxable workforce eligible to pay taxes to 85.3 per cent from current 22.4 per cent, and thus propel the country into a middle income economy.

TAX BASE SHIFT:

The ‘Deciphering Emerging Trends in ITR Filing’ report comes just past the country’s 77th Independence Day and amidst the bugle cry of the 2024 general elections which puts to a litmus test, the Government’s claims to have improved the economic status of Indians. As per the report, the lower middle class has transitioned to higher income levels over the past 10 years. In 2010-11 (FY11), of the 16 million people who filed tax returns, 84 per cent belonged to the income group of up to Rs 5 lakh. In the financial year 2012-13 (FY13), the average income was Rs 4.4 lakh, which has risen to Rs 13 lakh in FY22. By FY22, only 64 per cent of the 68.5 million income tax return filers belonged to this income bracket. This indicates that over the years, 13.6 per cent of the population transitioned from the lower-income group to higher levels by FY22.

The report also highlights the significant decline in the number of zero-tax liability returns. That is, tax returns where the individual’s taxable income falls below the basic exemption limit

and he/she is not liable to pay any tax. The share of such ITRs has gone down from 84.10 per cent in FY11 to 64 per cent by FY22. The formalization drive of nearly 70 million MSMEs promises to broad base the cohort suitably and 25 per cent of ITR filers are expected to leave the lowest income strata by 2046-47 (FY47) as against 13.6 per cent leaving the lowest income strata between FY12-FY23.

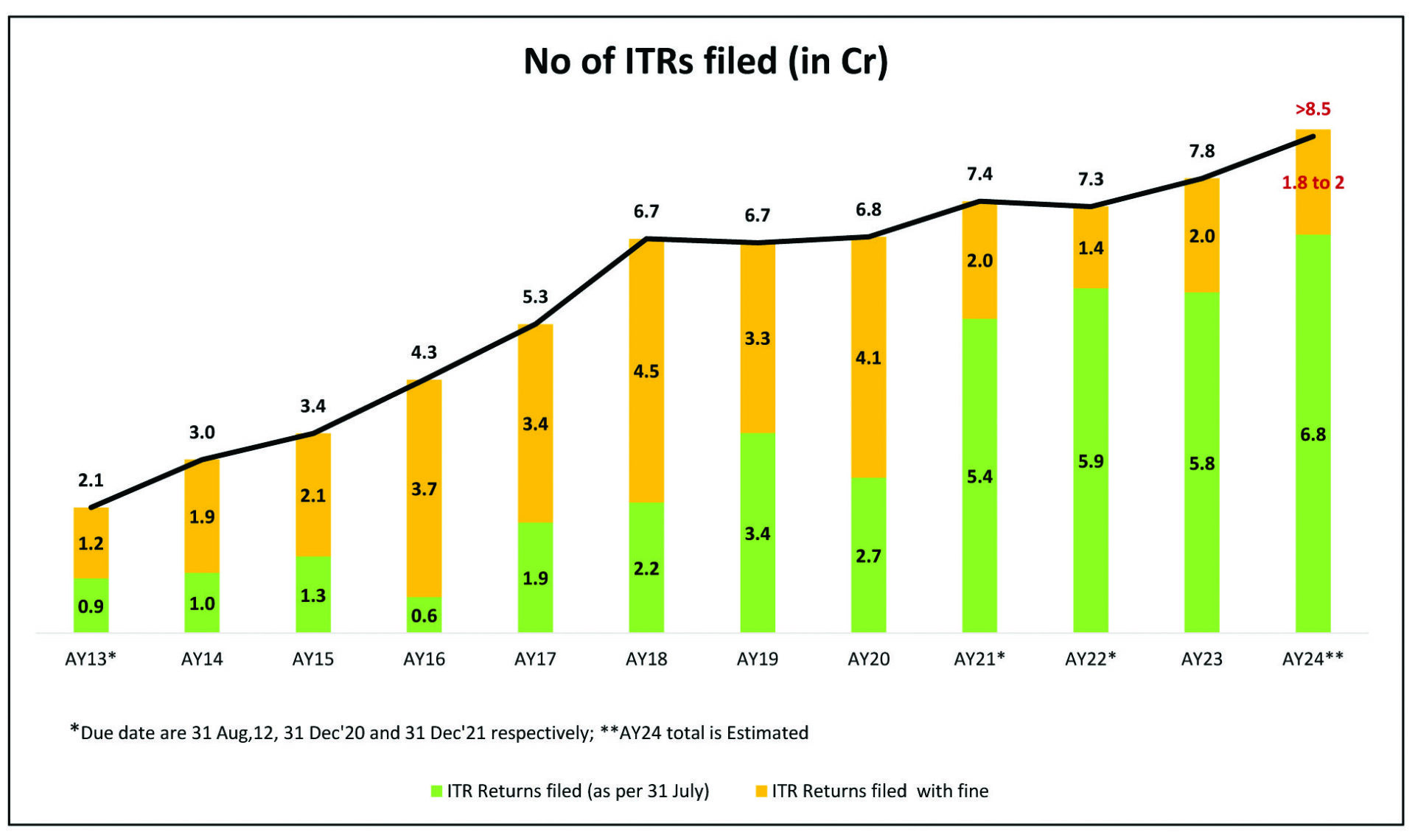

TAX FILING: Besides adding heft to the tax base, Indians have brought about an improvement in their orientation and punctuality towards paying their dues in recent years. Of the 78 million returns filed in FY22, 75 per cent were filed on or before the due date. That is, only 25 per cent returns were filed late. This is sharply down from the 60 per cent late tax returns in FY19. Total income tax returns filed during Assessment Year (AY) 23 increased to 78 million from 73 million in AY22. Of these, total 58 million or 75 per cent of the returns were filed on or before the due date.

Interestingly, the share of returns filed after due date (i.e., with fine) has also declined from a high of 60 per cent in AY20 to merely 25 per cent in AY23. For AY24, 68 million ITRs have been filed by the due date and another 18-20 million returns are expected to be filed in the remaining financial year till March 2024, thereby taking the total number close to/over 85 million or 37 per cent of the formalized labour force.

For AY24, the SBI report estimates that the share of IT returns filed after due date may drop to around 20 per cent. This reveals the discipline among tax-payers along with the simplification of IT forms and processes driven by constant efforts of CBDT to build an efficient, digital-heavy filing, verification and return system. In FY21, 54 percent of the 59 million returns filed by the due date were processed by that date. In FY23, of the 68 million returns filed by July 2023, 64 percent were processed by the due date.

STATE TRENDS: Delving into state-wise ITR filing, the report shows that the top five states of Maharashtra, Uttar Pradesh, Gujarat, Rajasthan, and West Bengal accounted for 48 per cent of the ITRs filed for FY22. Overall, there have been 64 lakh more ITRs filed in AY23 over AY22, with the maximum increase registered in Maharashtra followed by Uttar Pradesh, Punjab, Gujarat, Rajasthan. Back in FY14 and FY22, Maharashtra, Uttar Pradesh, Gujarat, Rajasthan, and Tamil Nadu together contributed to the bulk of the rise in the number of ITRs (46 per cent of the 481 lakh additional returns). In terms of growth, among the smaller states, Manipur, Mizoram, and Nagaland clocked a more than 20 per cent jump in ITRs filed over the last nine years.

However, SBI cautions against viewing this state-wise data in terms of migration from states. In the case of the ITR data for FY21-22, of the top six states where most ITRs were filed, three states ― UP, Rajasthan, and West Bengal ― actually exhibited net negative migration. Simply put, one would expect states experiencing outward migration (people moving to other states for jobs) to have fewer ITR filings. But given that a person’s ITR is linked with your PAN address (likely in the state you belong to), this can be different from your workplace address (in a different state).

MSMEs: The report also mapped the role of Micro, Small and Medium Enterprises (MSMEs) in the ITR rally. Following the adoption of the revised definition of on 26 June, 2020, which is based on investment in plant and machinery or equipment; and turnover, the Udyam Registration Portal was launched on 1 July 2020. Since then, around 22 million MSMEs have registered on the Udyam portal (including Udyam Assist Platform). Based on the mapping of these state-wise Udyam registration with ITR filed in respective states, the report finds that these 21.8 million MSMEs have also helped in increasing tax filing base in India, which has increased by 10 million to 78 million in last 4 years. The top 5 states that accounted for 60 per cent of total incremental increase in ITR filling, also accounted for 45 per cent total Udyam registration, supporting our contention. This indicates formalization of MSME units on a larger scale driven by innovative measures and contribution by all stakeholders.

The report suggests an optimistic scenario ahead. The Indian workforce is projected to surge from 530 million in FY23 to 725 million by FY47. Consequently, there will be a notable rise in the number of tax filers, expected to increase from 70 million in FY23 to 482 million by FY47. Per capita income is expected to increase from Rs 2 lakh in FY23 to Rs 14.9 lakh in FY47 (in USD terms, the corresponding increase comes to USD 12,400 in FY47 from USD 2500 in FY23).

dditionally, SBI research points out that Indian population is expected to increase to 1610 million in FY47 from 1400 million in FY23. Correspondingly, workforce is expected to increase to 725 million in FY47 from 530 million in FY23, increasing the workforce share in population from 37.9 per cent to 45 per cent in FY47. Consequently, workforce with taxable base is expected to increase to 565 million in FY47 from 313 million in FY23, increasing its share from 59.1 per cent in FY23 to 78 per cent in FY47. The report estimates that around 25 per cent of ITR filers will move out of the lowest income strata (annual income up to Rs 5 lakh) by FY47.

Around 17.5 per cent filers expected to shift to income group of Rs 5 lakh-Rs 10 lakh, 5 per cent are expected to shift to income group of Rs 10 lakh–Rs 20 lakh, 3 per cent are expected to shift to income group of Rs 20 lakh-Rs 50 lakh. According to the report, 0.5 per cent of filers are expected to shift to income group of Rs 50 lakh–Rs 1 crore, and 0.075 per cent to income group of above Rs 1 crore by FY47, per capita income is expected to increase from Rs 2 lakh in FY23 to Rs 14.9 lakh in FY47.

Given that the local diaspora, high on innovations and technology, educational qualifications, skill sets and laced with a can-do attitude is showing new patterns of migration in pursuit of better opportunities, SBI suggests this can be better captured through harmonsing the PAN-Aadhar data further. Further, the migratory characteristics of a huge population block warrant dynamic capture of place through various attributes (place of domicile/place of permanent residence/place of work) which could throw interesting and useful insights into the growing tax fliers base, the socio-economic implications and integration of various welfare schemes.