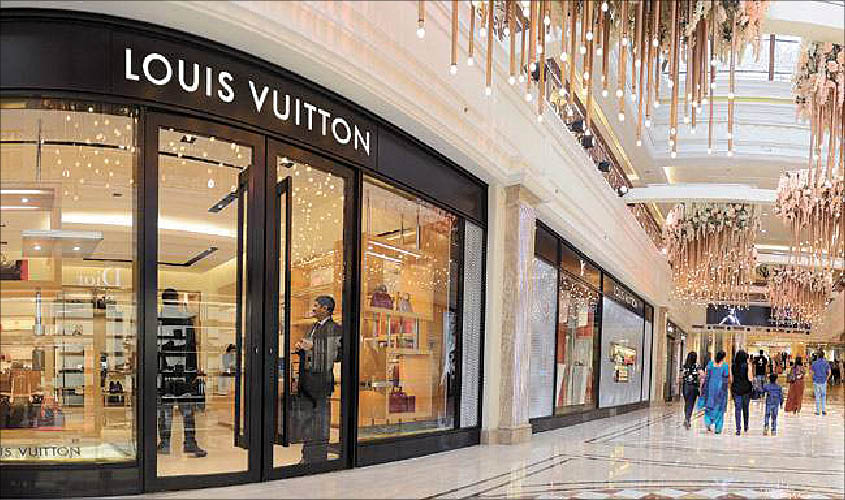

The 2009 Disney film Confessions of a Shopaholic is not just a quirky tale of modern consumption trends in the West. It echoes the sentiments of consumers all around the world. Just witness the growing global presence of international luxury brands, such as Gucci, Louis Vuitton and Breitling among many others. In the last decade or so, the Indian market has also opened up to these ultra high-end players, who now have dedicated showrooms in cities like Delhi and Mumbai. Every year, thanks to a consistently rising demand for such goods, India’s luxury segment has expanded, offering more options to buyers, and more profits to sellers.

“Increasing retail presence of luxury players and higher number of luxury brands entering the country has resulted in strong performance of luxury goods,” wrote country’s apex trade association, ASSOCHAM, in a report published earlier this year. The chamber also noted that brand consciousness among Indian youth, and an improved purchasing power of the upper-middle class in tier-II and tier-III cities have also contributed to this boom in the premium retail market.

A growing base of Internet users and a parallel rise in disposable incomes even in small towns, according to the ASSOCHAM report, has added to this upswing in the consumption of luxury goods across the country. The report also predicted that the market would grow to five times its present size in the next three years, and that the number of millionaires in India would increase by three-fold in another five years.

The luxury retail segment in India generated a revenue of $23.8 billion

The number of luxury outlets across Delhi-NCR is evidence enough of this growth. At shopping venues like DLF Emporio in Delhi’s Vasant Kunj, and Ambience Mall in Gurgaon, big brands are doing their utmost to generate attention and expand their customer base. They are trying to mainstream themselves like never before.

Speaking about the luxury market space in India, Prem Dewan, retail head, OSL Luxury Collections (a company that manages Corneliani, a luxury Italian menswear brand in India), pointed out that Indians prefer shopping at retail stores over online shopping, especially when it comes to investing in luxury brands. He said, “India has overtaken most countries and is now second to the United States when it comes to luxury retail segment. The luxury market in India is flourishing and is growing at a fast pace. The spending capacity of people in India has grown at a tremendous rate.”

When it comes to making an entry in the Indian market, a franchise or a joint-venture model is the usual route taken by overseas luxury brands, informed Dewan. “GST has provided a competitive advantage to India’s luxury retail sector. Since the customers these days are younger, better informed and are exposed to global brands, therefore sale is not the final destination; it’s a start of a long-term relationship with customers,” he added.

Several factors have contributed towards making India a favourable destination for high-end brands. Stable growth figures, steadily rising salaries in the urban centres, and business-friendly policies have all played their part in this success story.

A report compiled by CBRE, an international property consultancy company, analysed more than 300 prominent and renowned global retailers in India. It found that most international retailers opt for opening their stores in major metropolitan cities, such as New Delhi (79%) or Mumbai (68%), before gradually expanding to other tier-I locations, like Bangalore, Chennai, Kolkata, Hyderabad and Pune. So it is possible that the next chapter of India’s luxury-goods scene will be written in smaller towns and cities beyond the metros.

Sunil Mehra, a reputed menswear designer in India, also acknowledges the potential of this booming sector, but adds that wrong marketing techniques can impede its progress. He said, “The factor which can hinder growth is the placement of the product. It is important to note that market penetration has to be directed at the right segment, for a particular product or market. Mapping the pyramid of the retail sector is a must-do homework. Once it’s done, nobody can obstruct the dynamic growth.”