A tweak in the personal slabs for taxation and a higher deduction for savings were required considering the pandemic and inflation.

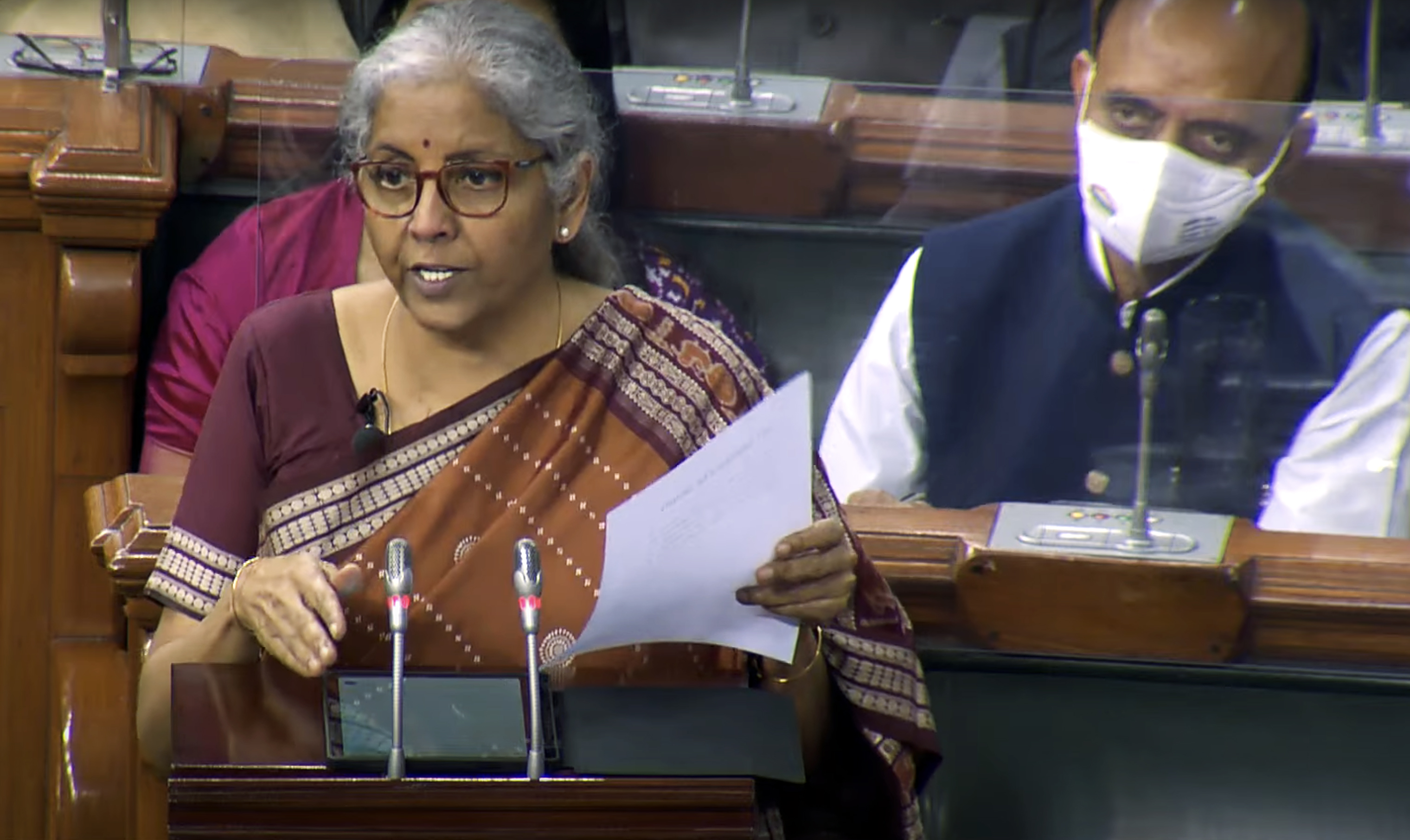

In the midst of the Covid Omicron wave, Union Budget 2022 was presented by the Hon’ble Finance Minister with an aim to achieve government vision of macro level economic growth, technology enabled development and promoting a digital economy. The 2022 budget focuses on a massive thrust on capex in a hope to stimulate private investment which in turn will fuel economic growth. The direct tax proposals in the budget are mainly aimed at bringing more administrative reforms, establishing a trustworthy tax regime, promoting voluntary compliances and reduce litigation. There are hardly any complex changes except to the trust taxation regime that would have an adverse impact on the taxpayers. The tax rates have been kept same and there are no benefits proposed in terms of incremental deductions or exemptions which were expected considering the impact of the pandemic on the general public.

One of the important proposals on the tax front which reposes trust in the taxpayer is the provision of filing an updated return. Presently, the tax authorities collect huge data from various sources which is sought to be matched with the tax return. It was observed that in the cases of such mismatch, a lot of time and effort go in the lengthy litigation process. Accordingly, to facilitate voluntary compliance, it is proposed that an updated return can be filed within two years from the end of the assessment year. As they say, no rose without a thorn…and this proposal also has a caveat that the updated return can only be filed after payment of additional tax i.e. 25% of the amount of tax and interest if the updated return is filed within 1 year and 50% of amount of tax and interest if it is filed beyond one year but before two years from the end of the assessment year. Besides this, a very welcome proposal is the capping of the surcharge rate on long term capital gains on transfer of any type of asset at 15% which hitherto, suffered a graded surcharge up to 37%.

With a phenomenal increase in transactions in crypto, a specific tax regime has also been proposed wherein a wide definition of Virtual Digital Asset (VDA) is proposed to be introduced which basically intends to tax the profits on transfer of cryptocurrency. A 30% tax rate is proposed on profits on transfer of such assets without allowing any deduction (other than cost of acquisition), allowance or set-off of losses. In order to widen the tax base, withholding tax provisions have also been introduced on payment for transfer of VDA above a threshold limit. The specific tax regime also covers taxing the gifting of the VDA by including the same in the definition of property under section 56 of the Act.

There are many proposed amendments which have negated the judicial decisions which were favourable to the taxpayer. A few noticeable amongst these proposals are explanations added in Section 14A and Section 40(a). The proposed amendment in Section 14A relates to disallowance of expenditure even if the exempt income is not accrued or arisen or has not been received during the previous year. Various High Courts and the Supreme Court had earlier decided this matter in favour of the taxpayer. Though this amendment is proposed to be applicable prospectively but the language of the explanation suggests a retrospective application, which may result in litigation. Besides this, allowability of education cess as an expenditure has been a matter of litigation for the past few years. Various High Courts rightly or wrongly had decided the issue in favour of some of the taxpayers and relying on those judgements, the other taxpayers had starting claiming the said expenditure. Negating the decisions of the courts, the budget proposes to introduce an explanation to section 40(a) clarifying that the term “tax” includes any surcharge and cess and thus is not an allowable expenditure. The said proposal would apply with a retrospective effect.

Widening the scope of tax deduction at source has become the most convenient way for revenue collection as can be seen from past few years. Each year, there are amendments to increase the scope of TDS. This year also, there are proposals to broaden the coverage of TDS compliances. Section 194R is proposed to be inserted to cast an obligation on person responsible for providing to a resident, any benefit or perquisite, whether convertible into money or not, arising from carrying out of a business or profession by such resident. It was observed by the authorities that the recipient was not offering benefits received in kind to tax and therefore an obligation has now been cast on the payer. The proposed TDS rate is 10% of the value of such benefit or perquisite if the same exceeds Rs. 20,000. Other noticeable proposal under the TDS regime is the amendment in Section 194IA obliging the buyer of immovable property to withhold tax on sale consideration or stamp duty whichever is higher. Presently, the obligation to deduct tax was on the sale consideration.

There is a lot of disparity in provisions related to exemption of income of trust or any university or hospital etc. referred to in Section 10(23C) and the charitable trusts registered under Section 12AA/12AB. A lot of amendments have been proposed to bring consistency in the provisions of these two regimes. However, to add to the complexity of trust taxability, a clarification is proposed to be inserted that application will be allowed in both the above regimes only when the sum sought to be claimed as an application is actually paid. This actually goes contrary to the trust reposed in the taxpayers by the Hon’ble FM in her speech.

Other important amendments include abolition of concessional rate of 15% on foreign dividends, extending the sunset clauses for start-ups and manufacturing units due to covid pandemic which has resulted in delay in setting up such units.

In its present avatar the GST law is akin to the old Excise law as the number of notifications that the taxpayers are saddled with makes it extremely difficult to keep a track of the changes. Classification disputes continue like it used to be in the old excise regime and the GST Council has not taken any steps to reduce litigation on this account till now. If the manufacturing sector is one of the engines of growth, then the Government should in all earnest look at reforming the GST law. Further, amendments which are proposed for restricting the input tax credit based on the outward statement filed by the supplier goes against the concept of seamless credit which is at the root of the GST law.

While the industry captains and the stock markets have given a thumbs up to the budget, there are noticeable misses in this budget. A tweak in the personal slabs for taxation and a higher deduction for savings was required considering the pandemic and inflation. If India has entered into Amrit Kaal then a lot more effort and commitment is required from the Government to streamline compliances in terms of ease of doing business, more so if we have to compete with neighbouring and other Asian countries. Finally lack of accountability in tax administration and adherence to the taxpayers’ charter by the department still remains a wish list.

Parul Jolly and Sachin Vasudeva are from SCV & Co. LLP.