Loans under PMMY are provided to meet both term loan and working capital components of financing for income generating activities in manufacturing, trading and service sectors.

New Delhi: Clay artisan Suman, who had to toil hard to support her family’s daily needs by moulding clay along with her husband, turned her expertise in clay pots into a business to boost her means of livelihood with money borrowed from her neighbours. As the business picked up, she got help from Cashpor Micro Credit through a micro loan of Rs 15,000.00. Suman bought a small piece of land, which provided clay, the raw material and expanded her venture which now allows her a good margin and earnings. Similarly, Lovili Zhimomi from a poor tribal family in the Northeast was earning from a small provision shop she had bought in 2007 in Khermal area of Dimapur, with money borrowed from friends and relatives. Lovili learnt about the Pradhan Mantri Mudra Yojana (PMMY) loan and approached IDBI Bank and availed a loan of Rs 50,000 for procuring additional stocks. The business has now grown and giving sound returns to Lovili.

Suman and Lovili are just a microcosm of the expanding community of women who have benefited from the PMMY launched by Prime Minister Narendra Modi on 8 April 2015, for enabling flow of institutional credit to micro, small and medium enterprises in a hassle free/seamless manner. The scheme provides loans up to Rs 10 lakh to the non-corporate, non-farm small/micro enterprises in an effort to create an environment particularly for small businesses and generate large-scale employment opportunities at the grassroots level which 70% of Indian women are using, as per government data.

The loans under PMMY are provided to meet both term loan and working capital components of financing for income generating activities in manufacturing, trading and service sectors, including activities allied to agriculture such as poultry, dairy, beekeeping, etc. The rate of interest is decided by lending institutions in terms of RBI guidelines. In case of working capital facility, interest is charged only on money held overnight by borrower.

As per some government reports, though India has a robust Self Help Group-bank linkage programme and schemes like Mudra remain essential sources of access to credit, especially for low-income women and women-led micro and small enterprises, a closer look at these programmes reveals that though India has 9.72 million exclusive women SHGs, only 7.67 million, that is, 79% of accounts are operative. Further, SHGs cover only about 20% of 300 million low-income women in India and the loans remain cash-driven and small ticket-size which are inadequate for growth-oriented women-led enterprises. Similarly, women form 98% of the clientele for micro finance institutions in India. However, MFIs can only extend small ticket-size loans of up to Rs 1.25 lakh to female borrowers. Majority of women (95%) work in the informal and micro sectors. They lack collateral, credit histories, bank statements, or income tax returns (ITRs) to access higher-sized loans to invest and grow their enterprises.

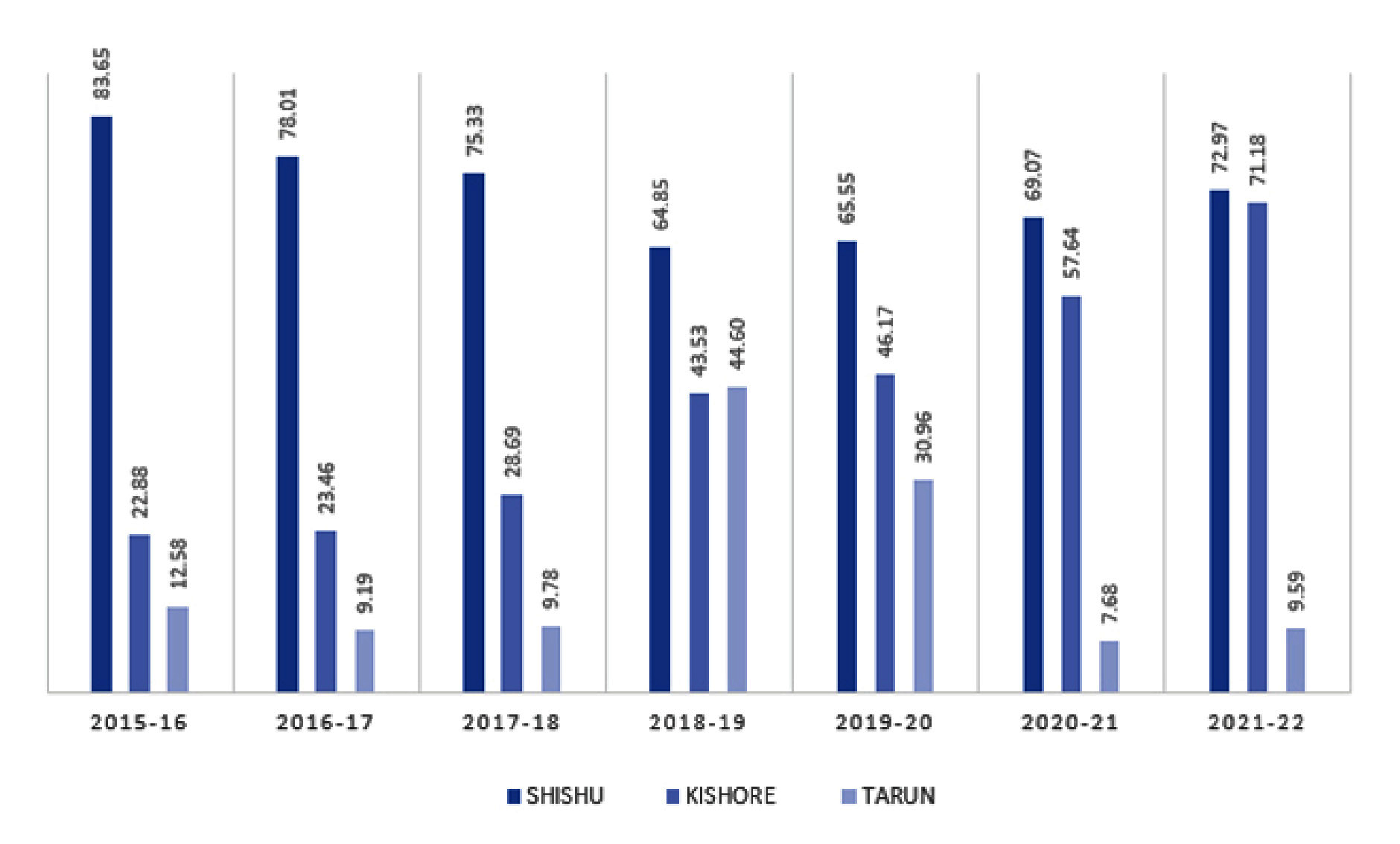

Envisaged as a solution for this credit gender gap in the missing middle category of borrowers—borrowers who need credit between Rs 1 lakh to Rs 5 lakh—the ambitious financial inclusion agenda has not looked back since inception, with more than 34.42 crore loan accounts amounting to Rs.18.60 lakh crore opened as on 8 April 2022. More than 68% of the loan accounts were sanctioned to women and 22% of the loans given to new entrepreneurs. Under PMMY, the loans are provided by banks, non-banking financial companies, micro financial institutions and other financial intermediaries in three categories namely, “Shishu”, “Kishore” and “Tarun” which signifies the stage of growth or development and funding needs of the borrowers. Government data on record shows that in fiscal year 2021-22, under the category of “Shishu” covering loans up to Rs 50,000, the total number of PMMY accounts were 4.17 crore, of which women entrepreneur-held loan accounts were 3.04 crore. The total sanctioned amount was Rs 124,747.37 crore, of which Rs 89,621.66 crore was for women entrepreneurs and total disbursed amount was Rs 123,969.05 crore of which women received Rs 89,233.92 crore. The PMMY also allows small borrowers with no credit history easier access to credit in a flexible manner. The “Shishu” category, for example, requires a brief, one-page application format, while both “Kishor” and “Tarun” categories have a three-page indicative application format.

In the Kishore category covering loans above Rs 50,000 and up to Rs 5 lakh, in FY22, the total no of PMMY accounts were 11,088,206, of which women entrepreneur accounts were 7,892,778. The sanctioned amount was Rs 137,644.38 crore of which women received Rs 70,027 crore and the disbursed amount was Rs 133,389.24 crore of which women beneficiaries received Rs 68,661.23 crore loans. In the same fiscal of 2021-22, in the “Tarun” category covering loans above Rs 5 lakh and up to Rs 10 lakh, the total number of accounts were 4,172,115, of which women held 3,044,192. The total sanctioned amount was Rs 124,747.37 crore with women’s share at Rs 89,621.66 crore and disbursed amount was Rs 123,969.05 crore, of which women received Rs 89,233.92 crore.

More recent performance of the PMMY scheme shows that during FY 2022-23 (till 26 August 2022) there were 1.61 PMMY accounts with loan of Rs 114,405 crore, of which women-held accounts were 1.19 crore with a loan amount of Rs 50,208 crore. The total number of accounts since inception (till this date) stood at 36.54 crore with Rs 2,006,117 crore of loans. Women held 25.01 crore accounts and accounted for Rs 891,877 crore loans.

Although MUDRA’s delivery channel is conceived through the route of refinance primarily to banks/NBFCs/MFIs, to improve last-mile delivery of credit, “Last Mile Financiers” have been roped in, such as companies, trusts, societies, associations, and other networks that provide informal finance to small businesses, as per a report by Observer Research Foundation. The credit guarantee scheme for assurance to financial institutions to mitigate the issue of collateral under the “Credit Guarantee Fund for Micro Units” has increased the appetite of financial institutions to disburse loans to first-time entrepreneurs. For a more integrated approach to financial inclusion and to expand digital payments, the MUDRA Card has been introduced as a credit product. Since the MUDRA Card is a RuPay debit card, it can also be used for drawing cash from an ATM or to make purchases and repay loan amounts.