NEW DELHI: Where will the Indian economy be, at the end of this financial year, 2020-21? And more specifically, what will be the growth rate of GDP in the first quarter [1st Qtr] of 2021-22 [April 1, 2021-June 30, 2021], compared to the first quarter [1st Qtr] of 2020-21 [April 1, 2020-June 30, 2020]? Note that every financial year has four quarters.

Quarterly data obtained by the Central Statistical Office [CSO] in the Ministry of Planning are partial. For example, the database of the just released figures for industrial sector output does not include the output of MSME [which is more than 60% of the national industrial output].

Thus when Ministry of Finance flaunts the data of “industrial output”, it is an overestimate since MSME output, which has sunk to a new low, is excluded in the calculation.

For FY21 [i.e., the whole year 2020-21] compared to FY 20 [2019-20], according to my estimate, assuming the petering out of the coronavirus pandemic and resumption of normal economic activity as was in 2019-20, the decline in GDP would be about minus 10%-15%.

The former chief statistician of the government, Dr Pronab Sen said on 13 December 2020 [to Press Trust of India] that macro situation was not rosy but uncertain, and that FY21 growth rate would contract by about minus 10% contrary to government’s claim of a much lower decline at minus 7.5%. The government claim that Qtr 3rd will have a positive growth rate is the usual spin, which prediction the media will forget by the time official data is released.

The unemployment level of both totally unemployed and under employed on starvation wages at the end of FY21 should be 44% of the total available labour force. According to CMIE, the unemployment rate has already climbed to a 23-week high in the week ending 13 December 2020. Both urban and rural unemployment has worsened in these weeks. Government of India has no data since it relies on annual sampled data collected by its National Sample Survey. This trend indicates that by the end of FY21, India would be at the worst in unemployment since the British Imperialist period.

The CEA, Dr Subramanian in the Ministry of Finance, described the Qtr 2 economic situation as “under heating”. We have known “over heating” in American English, which essentially means demand is in far excess of supply. Does he therefore mean to say “under heating” is when demand has fallen far short of supply? The normal term for that is recession, bordering on depression. Most observers think that India has entered a grave recessionary period.

If so, then who must take the censure or better still, be sacked? The implication is that the much touted three stimulus packages of the government have in reality been inadequate, as I had been predicting in these columns of The Sunday Guardian, and which “stimulus” had therefore failed to revive demand adequately. In fact, the RTI reply given to a Pune businessman, Prafull Sarda reveals that Government of India has barely spent 14% of the announced in all three Rs 21 lakh crore stimulus packages. That is, just Rs 3 lakh crore.

Yet, paradoxically, in the background of poor demand, all the three indices of prices—retail, wholesale, and consumer, have been rising, implying thus inflation, and hence it is “over heating” not “under heating”. This paradox of inflation and demand deflation can be unravelled by recognising that the Indian economy is in such a sick state that supply is declining much faster [as inventory is getting exhausted] than demand is declining [as incomes, due to rising unemployment, are declining]. These act as a pincer on our economy.

The nation was informed that our rising foreign exchange reserves as proof of the now hilarious “green shoots” and “V shaped recovery”. This rise in reserves was actually due to falling exports accompanied by an even faster fall in imports, and along with illegal foreign exchange deposits of crooks in foreign banks entering India under the guise of Participatory Notes [PNs] to buy stocks in the BSE and NSE. Cayman Islands, that notorious place for money laundering, has increased its foreign investment in Indian financial markets by more than 300% in the last quarter. In fact, Union Commerce Minister Piyush Goyal is quoted [by Financial Express dated 13 December 2020] as saying that foreign firms are buying Indian start-ups for at very low valuations. There goes the call for “make in India” and Atmanirbhar Bharat.

This cannot go on for long because PNs will be redeemed in dollars later to repatriate the same to a numbered account abroad via Mauritius. Expect then that soon thereafter the rupee will fall hugely—2 US dollar will exchange for Rs 100. Thereafter, the illegal khajana of Indians in foreign banks in dollars will boost up by the devaluation of the rupee without fresh deposits when the second round of PNs come into India for buying shares in the stock market. No wonder that the share market is booming and then crashing as these transaction are going on round and round.

The current account in the Balance of Payments is in surplus as exports are exceeding imports, even though both are declining. In fact imports are declining faster than exports are, when compared to earlier. All this can have a terrible impact on the economy.

The Finance Ministry must not be playing the violin while the Indian economy is potentially in a situation of being gutted by a fire as Rome was then. I am glad Nitin Gadkari recently criticised the mechanistic way prices of steel and electricity is being raised.

Prime Ministers are not elected by the ruling majority in Parliament because he or she is a scholar of economics. Nehru, Shastri, Indira, Morarji, Rajiv, V.P. Singh, Chandrashekar, PVNR, Vajpayee knew nothing of economics. Nehru and Indira did not know economics but consulted Leftist economists who were intellectual slaves of the Soviet Union and hence their advice ruined India till 1990. Soviet Union itself balkanised into 16 separate countries in August 1991. Prime Minister Manmohan Singh is a brilliant economist, but he could not stand up to the person who was the de facto super Prime Minister. Dr Singh had a Finance Minister for most of his tenure who knew how to make money for himself and for his patrons in the Congress Party, but not for the nation—which was a sad loser.

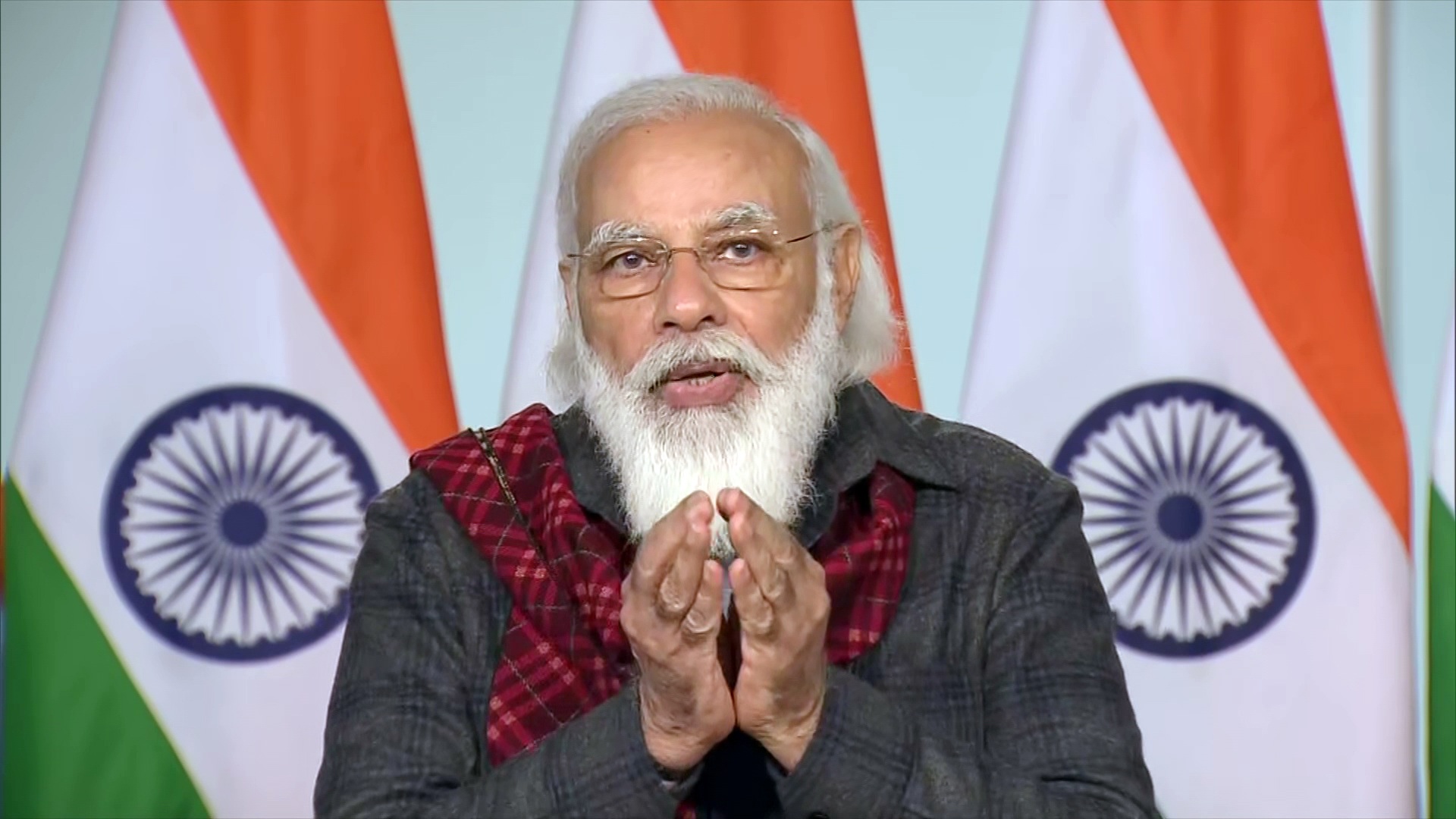

Prime Minister Narendra Modi had said in May 2019 after his re-election, that his government would double in five years India’s GDP to $5 trillion. Any genuine economist would have told him that doubling in five years would mean a GDP growth rate of 14.4% per year, which in the circumstances of May 2019, was not possible. There was also no such plan drawn up and given to him to be convinced about the feasibility of achieving this target in the scenario in 2019. The economists he has hired in the PM’s Economic Advisory Council, Finance Ministry, and those in the Niti Aayog must have known about it but kept silent. That is the most charitable thing I can say about them.

This “under heating”, if a joke, is not funny. It is in the same vein as the remark of a NITI Aayog official that Indian people have too much democracy. Officials should not pontificate with the people. An economic adviser weaned on jargon learnt in a business school i.e., learnt how to spin yarns as a substitute for the real performance of the multi-dimensional Indian macro-economy—who are then to be blamed, especially since it is also the duty of MPs, journalists, and specialists outside the government to bluntly state the reality with facts and figures?

Where, for example have the trillions of rupees in so-called stimulus gone if today there is “under heating”? It is a fit subject to examine this evaporation of national resources, and recommend appropriate cure and punishment. I am sure that such a probe would in detail reveal, as did the RTI to Mr Sarada, that only about Rs 3 lakh crore of the Rs 21 lakh crore of the stimulus package announced has been utilised so far for boosting demand, so in future the PM can act to ensure corrective action.

The Power Minister says that in 2021-22, the Plant Load Factor [PLF] should touch 56.5% of its past peak. This should give a glimpse into the state of the demand in the economy. The question now is, how despite the “under heating” the retail inflation is hovering above 7%?

The only good news coming is from agriculture. But then this sector has little to do with the Finance Minister. The weather has been very good this Kharif season, and the hard toiling farmers and landless labourers are responsible for this performance. Tractor sales are looking up. But all this is due to the weather since the yield per hectare has barely changed over the last three years.

But now with trouble over the farm laws passed by Parliament—welcome laws that have been lost in perception—leaves no option for the Government but to comply with the Supreme Court suggestion that the laws be put on hold. Legally can it be possible? Yes, because the government has yet to frame the Rules for the Acts. Hence the three Acts can be put on hold because the Rules have yet to be finalised. My suggestion is: declare the Acts as Model Acts and leave the option with state governments to decide if they want to enforce these Acts.

The overall economy is also in bad shape, policy making is confused, and the claims of a revival are vastly exaggerated, without any accountability. People need jobs and incomes, particularly in this pandemic season, but the situation presents a dismal picture. Government does not need to invest heavily for this, but needs to entitle these labourers to be able to stand on their own feet and toil for the farmer.

The CMIRE numbers put the unemployment rate at 6.68%. Labour participation rate too is very low at 41%, while for women this is 25%. This is of the completely unemployed and does not include the underemployed who are below the poverty line.

The Finance Ministry is looking in a pitch dark room, for a black cat, which not there.

It took India 30 years [1950-90] to break out of what was known as the “Hindu rate of growth” of 3.5% per year. Today it is less than 7%. In those days, we did not need spin artists in the Treasury. The reality spoke out loudly.

The moment of truth has arrived for all us: We are in recession, growing unemployment and poverty. No one likes bad news. The bearer of such truthful bad news is portrayed as an enemy. It is no pleasure for patriots to be vindicated later by truth. But no one’s morale today can be boosted by spin. The reality is plainly visible and action is needed by the government to ensure adequate growth.

Dr Subramanian Swamy is an MP nominated by the President for his eminence as an economist. He is a former Union Cabinet Minister for Commerce and Law & Justice.