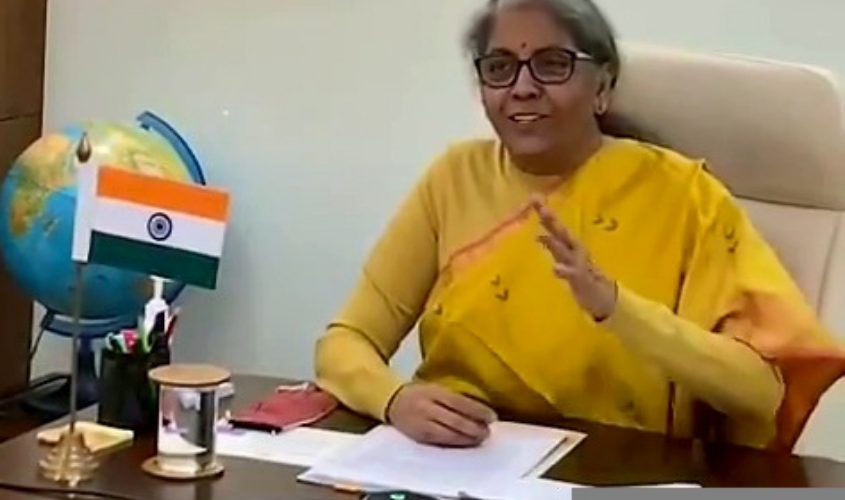

New Delhi: Ahead of the Budget Session of Parliament, Prime Minister Narendra Modi said that the Union Budget 2021-22 would be in continuation of the four-five mini budgets presented by Union Finance Minister Nirmala Sitharaman last year. In this first Budget Session of this decade, the budget will be presented on 1 February, Monday. On Friday, Finance Minister Nirmala Sitharaman tabled the Economic Survey 2020-21 in the Lok Sabha. The Economic Survey estimates real GDP growth of Financial Year 2021-2022 at 11%. While presenting the survey, Chief Economic Advisor K.V. Subramanian said: “India’s policy response to Covid-19 was guided by the realization that GDP growth will come back, but not lost human lives. Early intense lockdown saved lives, helped faster recovery.”

And now different sectors are hoping that this budget will give them some much-needed relief. Real estate and infrastructure sector experts say that some of the long-pending policy expectations include a grant of industry status; easing of GST regulations; increasing tax incentives to buyers; easy finance for the sector and single window clearance.

Pradeep Misra, CMD-REPL, Rudrabhishek Enterprises Ltd, told The Sunday Guardian: “The real estate sector is heavily driven by government policy and availability of investible surplus income in the hands of common people. Direct measures to address liquidity crisis may include FDI in rental housing, and ECB permissions in all real estate projects. Additionally, it may also make provisions for direct infusion of funds in the sector through existing channels like SWAMIH funds. Also, another fund as SWAMIH funds-II should be launched which should be state-centric and wherein state institutions can contribute 50% of capital. This should have the regional offices in respective states to fund only projects in Tier 2 and 3 cities which are untouched to date, under the current fund. The infrastructure sector is looking for more spending from the government side, as India is going to host the G20 summit in 2023.”

Meanwhile, start-ups and MSMEs are looking for some measures to improve the credit facilities and accessibility of funds that can mobilize the growth and further support the sector to revive from Covid.

Vishal Gupta, Co-Founder Brands2Life, told The Sunday Guardian: “The Production Linked Incentive (PLI) scheme needs a stronger framework that will further strengthen the Aatmanirbhar Bharat initiative. As technology-led developments are taking place at a faster pace, the MSMEs sector needs more encouragement from the government for its adoption. More entrepreneurship and incubation programs should be considered in the priority list of the budget that may create Silicon Valleys in India.”

Kazim Rizvi, Founding Director, The Dialogue, told The Sunday Guardian: “It is important that this year additional tax impositions should be kept at bay to show India as an investment destination in the global market. Compared to last year where tax measures were brought in the e-commerce sector in the form of TDS and equalization levy, it is expected that any such tax burdens are not introduced in the upcoming budget session. Importantly, with USTR deciding levy as a discriminatory measure, it is important to avoid any such measure until a multilateral consensus on the issue of digital taxation is achieved.”

Anuradha Prasad, Founder & CEO, India Leaders for Social Sector, told The Sunday Guardian: “Given all the unprecedented challenges and blows, the social sector has still impacted the lives of millions over the last year, continuing their projects under great duress. We hope the government will ensure that non-profits and social projects at large are more supported looking ahead.”

Vaibhav Lall, Founder, Khojdeal, told The Sunday Guardian: “To empower start-ups and MSMEs, the government needs to facilitate the establishment of a future-proof distribution system. This can be done by helping start-ups leverage digital and new-age technologies (AI, augmented reality/virtual reality, etc.) and making possible the adoption of agile approaches like drop-shipping and fulfilment centres.”

It is noteworthy that the coronavirus pandemic has shown a real need for implementing technology in education. Several industry experts point out that formalizing online education should be the priority of Budget 2021-22.

Sumeet Verma, Co-founder CEO, KopyKitab, told The Sunday Guardian: “Higher education needs it more than ever as it is related to the career and future of the students; 40 million students, teachers, and all the stakeholders in the higher education ecosystem require quality access with affordability, which can be solved by leveraging technology. Bottoms up approach would be of great benefit for the students as they come close to finishing their formal education and look to up-skill themselves for becoming industry-ready. However, in this Budget, we would like the FM to extend some relief to the sector in terms of GST and subsidy on education loans given for both formal and skill-based learning.”

The impact of a pandemic on the healthcare sector of the country was massive and it has now made healthcare mainstream in the last few months.

Dr Vispi Jokhi, MS (Ortho) EPGDHA (TISS), Chief Executive Officer, Masina Hospital, Mumbai, told The Sunday Guardian: “A major push towards digital healthcare models is expected. An allocation for vaccination of the population seems most likely. In my opinion, looking at the battering hospitals in the private and the public charitable sphere have received, some financial incentive or some tax benefits should form part of the budget for healthcare in this budget. The spending on healthcare as a proportion of GDP must increase to at least 2.5%, not including the allocation for vaccination. Relief on medical equipment and reduced price of implants are likely to help reduce the cost of healthcare.”