Like previous Budgets, this too will be tailored to PM Modi’s longer term, prosperity-oriented approach to governance, rather than a short term, populist approach.

One of the standard features of office buildings and residential complexes of a certain, not so distant, vintage in India’s major cities is the absence of any designated space for parking cars. Urban planning hasn’t been one of the country’s great strengths. In fact, most cities have grown unplanned. However, the lack of parking spaces for cars (there may be some for two-wheelers) was quite deliberate. Urban planners simply did not believe that India would become prosperous enough for masses to own cars in any reasonable time frame (infrastructure is built for at least 30 to 50 years). And to be fair it wasn’t just urban planners, but most of the nation. Our preferred “P” word, policymakers included, was poverty not prosperity. Prime Minister Narendra Modi has changed that in the last nine years. He has tapped into the aspirational side of a young nation.

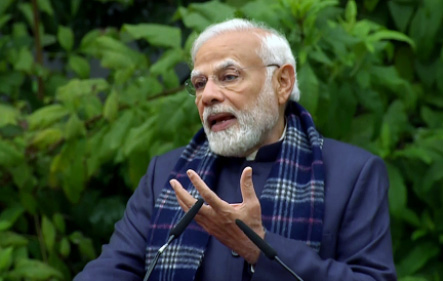

The Union Budgets of recent years have reflected this change. Instead of being instruments of tinkering tax rates or announcing a plethora of new schemes with eye-catching allocations, Budgets have become more on the lines of a presentation on the state of the economy and a vision of the future. On 1 February, Finance Minister Nirmala Sitharaman will present the last full year Budget of PM Modi’s second consecutive term in office. Like her previous Budgets, there is little doubt that this too will be tailored to Modi’s longer term, prosperity-oriented approach to governance, rather than a short term, populist approach.

For some, this has meant that Budgets are now a boring affair without the headline grabbing announcements that characterised Budgets in the past. This is actually a good thing. It is a sign of a mature economy. It is also evidence of a government that has already laid out a strategic pathway for growth. It does not need to tinker repeatedly. That suits the most important stakeholders in the economy, particularly investors (domestic and foreign), who also have long time horizons and have a strong preference for policy stability and continuity. For any country to grow rapidly, this alignment between the time horizon of policymakers and investors is critical. It isn’t always easy in noisy democracies where many stakeholders expect their share of “goodies” from each Budget.

In the past, Budgets attracted public interest for changes in tax rates. The introduction of the GST has meant that the debate on indirect taxes is largely in the GST Council (with states actively involved). The exceptions are tariffs where a large set of revisions has already been made and in petroleum products, in which the Government has also been consistent in its approach. On the direct taxes front, corporate taxes were rationalized in 2019 and are now competitive with East Asian countries. In corporate taxes, the Government has settled on what is a hallmark of a mature economy—limited or no exemptions and lower rates. The only thing that remains is to move the personal income tax structure in the same direction. It may happen in this Budget which will be a far-reaching reform. But, hopefully, there will be no tinkering in slabs, which is not fundamental reform.

The Government has also been consistent in its fiscal strategy. Overall, it has leaned towards a conservative approach, which was evident even during Covid. It will not bust the fisc by over-spending. And it will not kill economic growth by over taxing. Instead, it will try and create as much room for capital expenditure as is possible in the Budgetary constraints. Again, that is a forward-looking strategy, which creates the conditions for long-term growth led by the much larger and more efficient private sector. As for welfare spending, the government has tried to improve systems of delivery instead of enhancing allocations. It has ensured it gets far superior outcomes for what is spent, not just from the Government’s point of view but also the citizens’ point of view. The focus on outcomes instead of headline-making announcements of new schemes or big-ticket spending increases, may be staid but it is in sync with a longer-term view of the health of the economy. Effective delivery of goods and services to the poor also creates a perception of fairness in the system and creates room for the Government to carry out pro-market reforms.

It may seem counter-intuitive to reconcile a quest for prosperity with a sedate approach to Budgets. But it is only logical as Government spending accounts for around 15% of GDP only. Directly, it can only do a limited amount for growth. However, it must act as an enabler and for that to happen, efforts remain to be made on the administrative/legislative fronts.

At least PM Modi has succeeded in ridding us of the cynicism that India cannot become rich quickly. Now, the public and stakeholders must pressure the Government to continue on its path of structural reform without themselves succumbing to the temptation of demanding short-term handouts.

Those are only a palliative for a nation that is poor, not a recipe for prosperity for a nation whose time has come.

Dhiraj Nayyar is Chief Economist, Vedanta.