Cryptocurrencies may offer a home for some, given how they historically have not corelated with other assets but this market is still relatively small.

The dark days of 2008, when equity markets tumbled, seem a long time ago. It looked like we were going to see the collapse of a number of banks across Europe and the United States, forcing governments to step in to bail out heavily debt-laden so-called safe institutions. Against this backdrop we saw the emergence of something called “Bitcoin”, a cryptocurrency.

Bitcoin’s price rose from 1 cent in 2008 to over $20,000 in December 2017 and led to the creation of over 3,400 other cryptocurrencies and the emergence of a new assets class.

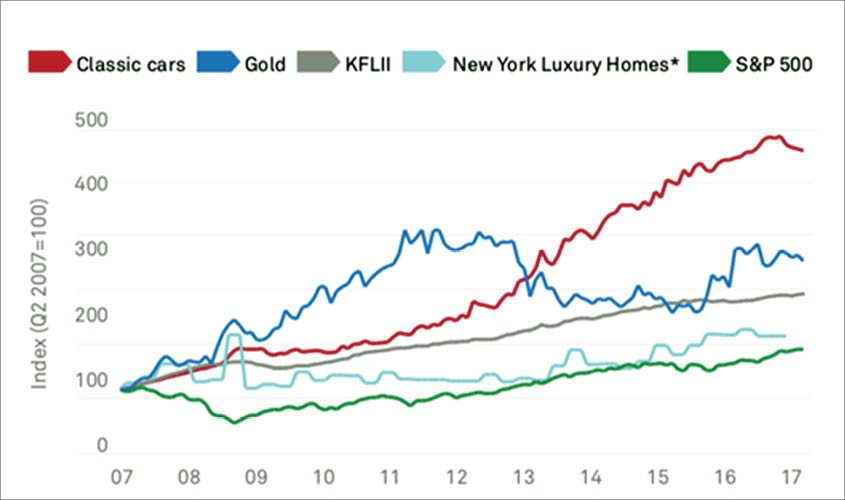

As the graph (figure 1) shows, bonds, equities, properties and even classic cars all have had a good run. But what goes up must come down.

IS THE END NEAR?

So what could bring this long run bull market to an end?

POLITICAL UNREST: Will Germany continue to bail out Portugal, Italy, Greece and Spain, not to mention the continued troubles in the Middle East, which have been leading to higher oil prices recently?

Governments cannot afford the social support net of ever increasing healthcare and pension payments. They do not have any cash. So it looks like they may have to raise taxes, and thus reduce demand as people have less cash.

SOCIAL INEQUALITY: In so called sophisticated societies, how can it be correct or sustainable that 82% of the wealth generated in 2017 goes to 1% of the global population, as is the case, according to Oxfam? It is often quoted that when the US catches a cough the world gets the flu.

According to Diane Swonk, chief economist at Grant Thornton, “The US economy has a bit of a cushion, and we can weather the storm for a bit. But the storm is still brewing and the undercurrents are clearly forming.”

INTERNATIONAL TRADE WARS:

This, as Donald Trump tries to make “America great again”.

RISING INTEREST RATES: The average period between interest rates being ratcheted up and the markets taking fright in the last 50 years is 34 months (source: https://www.sovereignman.com). The Fed started raising interest rates in December 2015, so 34 months from then is October 2018.

Many public company directors have their remuneration linked to the company’s earnings per share (EPS). In order to improve a firm’s EPS, if the number of shares stays the same you need to increase the company’s earnings, i.e., increase profits. Alternatively, you borrow and buy back shares. With fewer shares, your EPS rises, giving the directors a bonus.

In 2017, S&P 500 companies bought back over $530 billion of equity, but in 2018 they are expected to buy back over $800 billion of their shares. There are only 10 companies in the S&P 500 that are cash positive, that is those without any debts.

With corporate debt as a percentage of GDP in US at a historic high at over 72% rising interest rates will not be welcome.

CORPORATE DISAPPOINTMENT:

Facebook has recently announced that they had increased revenue only by 42%, thus missing investors’ expectations and paying the price by losing over $120 billion in two hours This reminds us how fickle investors can be and how fast stocks can fall.

Just talk to your local estate agent, who will tell you how sluggish property prices are where you live. The issue is that prices are not just sluggish, they are falling.

Yet, complacency seems to be the order of the day, as investors seem to ignore the gathering storm clouds. What will be interesting is when the penny drops and markets suffer dramatic falls, will we see cryptocurrencies come of age? Will they prove to be a safe haven and continue to be uncorrelated to other asset classes, as the table given (figure 2) indicates they have been in the past? This could well happen since what other asset class represents good value for investors currently?

So before the markets fall, take a long hard look at where your pension is invested. May be now is time to say thank you to one of the longest bull markets in property, bonds and equites and raise the amount of cash you have. By holding cash in your pension fund or portfolio, the risk is an opportunity cost, i.e., markets may still go higher.

But how stressed will you be if markets fall by 25%+ (as we saw Facebook do in just two hours)? There are enough uncertainties to trigger stock, property or bond market to fall. Cryptocurrencies may offer a home for some, given how they historically have not corelated with other assets but this market is still relatively small. We could see cryptocurrencies become more popular, as apart from holding cash, what alternatives are there?