NEW DELHI: The domestic air passenger traffic for May 2024 was estimated at 138.9 lakh, higher by 5.2 per cent in comparison to 132.0 lakh in April 2024. Further, it witnessed a YoY growth of 5.1 per cent in comparison to 132.1 lakh in May 2023 and higher by 14 per cent than pre-COVID levels of 121.9 lakh in May 2019. For 2 months of FY2025 (April-May 2024), domestic air passenger traffic was 270.9 lakh, reflecting a YoY growth of 3.8 per cent over 261.0 lakh in 2M FY2024, according to ICRA.

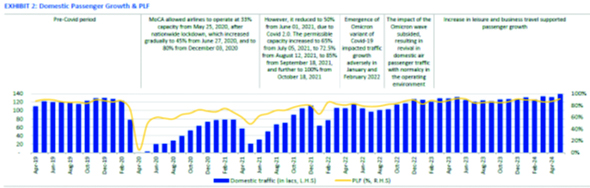

The airlines’ capacity deployment in May 2024 was higher by 6 per cent than that of May 2023 and higher by 2 per cent over April 2024. It is estimated that the domestic aviation industry operated at a passenger load factor (PLF) of 91 per cent in May 2024 against 92 per cent in May 2023 and 90 per cent in May 2019 (pre-Covid). Post a YoY decline of 14 per cent in average ATF prices in FY2024 over FY2023, the prices of ATF in April 2024 declined by 0.4 per cent sequentially, but rose by 0.7 per cent in May 2024. In June 2024, it declined by 6.5 per cent sequentially. Domestic air passenger traffic for May 2024 was estimated at 138.9 lakh, 5.2 per cent higher than 132.0 lakh in April 2024. Further, it grew by 5.1 per cent on a YoY basis and was significantly higher by 4.0 per cent compared to pre-Covid levels. The airlines’ capacity deployment in May 2024 was higher than May 2023 by 6 per cent and higher by 2 per cent over April 2024.

For FY2024 (April–March), domestic air passenger traffic was 154 million with YoY growth of 13 per cent. It thus surpassed the pre-Covid levels of 142 million in FY2020. Further, for FY2024, the international passenger traffic for Indian carriers stood at 296.8 lakh, a YoY growth of 24 per cent, and higher than the pre-Covid levels of 227.3 lakh by 30 per cent, surpassing the peak levels of 259.0 lakh in FY2019 (April–March 2019). For 2M FY2025 (April-May 2024), domestic air passenger traffic was 270.9 lakh, reflecting a YoY growth of 3.8 per cent over 2M FY2024.

The outlook on the Indian aviation industry is stable, as per ICRA, amid the continued recovery in domestic and international air passenger traffic, with a relatively stable cost environment and expectations of the trend continuing in FY2025. Moreover, the industry witnessed improved pricing power, reflected in the higher yields (over pre-Covid levels) and, thus, the revenue per available seat kilometre–cost per available seat kilometre (RASK–CASK) spread of the airlines. The momentum in air passenger traffic witnessed in FY2024 is expected to continue into FY2025, though further expansion in yields from the current levels may be limited.

Despite a healthy recovery in air passenger traffic and improvement in yields, the movement of the latter will remain monitorable amid elevated aviation turbine fuel (ATF) prices and depreciation of the INR vis-à-vis the USD over pre-Covid levels, both of which have a major bearing on the airlines’ cost structure. Average ATF prices stood at Rs 103,499/KL in FY2024, which was lower by 14 per cent than Rs 121,013/KL in FY2023, but significantly higher by 58 per cent than the pre-Covid levels of Rs 65,368/KL in FY2020. In Q1 FY2025, the average ATF price remained higher by 5.4 per cent on a YoY basis. In June 2024, it declined by 6.5 per cent sequentially. Fuel cost accounts for 30-40 per cent of the airlines’ expenses, while 45-60 per cent of the operating expenses — including aircraft lease payments, fuel expenses and a significant portion of aircraft and engine maintenance expenses — are denominated in dollar terms.

Further, some airlines have foreign currency debt. While domestic airlines have a partial natural hedge to the extent of their earnings from international operations, overall, their net payables are in foreign currency. The airlines’ efforts to ensure fare hikes, proportionate to their input cost increases, will be the key to expand their profitability margins. Gradual pace of recovery in earnings – The pace of recovery in industry earnings is likely to be gradual owing to the high fixed-cost nature of the business. The industry reported a net loss of

Rs 170-175 billion in FY2023 due to elevated ATF prices along with the depreciation of the INR against the USD. Going ahead, ICRA expects the Indian aviation industry to report a similar net loss of Rs 30-40 billion in FY2025 as seen in FY2024, which is significantly lower from levels of Rs. 170-175 billion in FY2023, as airlines continue to witness healthy passenger traffic growth and maintain pricing discipline.

The industry has been facing supply chain challenges and issues of engine failures for the Pratt and Whitney (P&W) engines supplied to various airlines. In FY2024, Go Airlines (India) Limited grounded half of its fleet due to faulty P&W engines, thus stalling its operations. InterGlobe Aviation Limited (IndiGo) has also grounded more than 70 aircraft due to the P&W engine issues, as on May 23, 2024, including the powder metal (used to manufacture certain engine parts) contamination factor with its P&W fleet.

It is estimated that 24-26% of the total fleet of Indian airlines in operations was grounded by March 31, 2024. Considering the bulk recall of the engines globally by P&W and other existing issues with the OEM’s engines, the testing by P&W is likely to take longer, around 250-300 days. This will result in increased operating expenses towards the cost of grounding, increased lease rentals due to additional aircraft being taken on lease to offset the grounded capacity, rising lease rates and lower fuel efficiency (due to replacement with older aircraft taken on spot lease), which will adversely impact an airline’s cost structure.

However, healthy yields, high passenger load factor (PLF) and partial compensation available from engine OEMs would help absorb the impact to an extent. In the current fiscal, the industry has also faced challenges related to availability of pilot and cabin crew, leading to several flight cancellations and delays. Such issues impact the capacity availability and add to customer grievances. With half of Go Airlines (India) Limited’s fleet grounded due to faulty P&W engines, it faced payment defaults with vendors, aircraft lessors and financial creditors. Consequently, GoFirst filed for insolvency with the National Company Law Tribunal (NCLT), which, in February 2024, extended the deadline for the completion of the resolution process by another 60 days, which ended on 4 April, 2024.

On 8 April, 2024, the NCLT granted a further extension of 60 days till 3 June, 2024, to complete the corporate insolvency resolution process (CIRP). On 1 May, 2024, the Directorate General of Civil Aviation (DGCA), on the directive of the Delhi High Court Order, deregistered all 54 aircraft of GoFirst. For May 2024, domestic air passenger traffic stood at 139 lakh against 132 lakh in May 2023, implying a YoY growth of 5.1 per cent. Further, on a sequential basis, domestic air passenger traffic in May 2024 was higher by 5.2 per cent, than April 2024.