NEW DELHI: Fin min’s monthly economic report highlights three pillars of this buoyancy.

India is experiencing a business renaissance which is sparking growth and optimism from a slew of signals across multiple economic indicators in March 2024, suggesting surging and robust business activity. The month of March marked significant milestones, from record-breaking performances in the stock market to remarkable advancements in tax revenue collection even as overall, India continues to be the fastest-growing major economy with positive assessments of the growth outlook for the current financial year, for India by international organisations and the Reserve Bank of India. Accordingly, the IMF, in its April 2024 WEO has revised upwards its estimate of India’s real GDP growth for FY2023-24 to 7.8 per cent from 6.7 per cent in its January 2024 update and 6.3 per cent in its October 2023 WEO.

Drawing attention to the resilience of India’s business activity, the Finance Ministry’s monthly economic report (MER) highlights three pillars of this buoyancy. The Indian stock market witnessed another bullish run as both the Nifty 50 and BSE Sensex 30 indices soared to new heights. In March 2024, the Nifty 50 opened with a record high of 22,048.3, ultimately surging to an all-time peak of 22,526.6. Similarly, the BSE Sensex 30 commenced trading with a historic high of 72,606.3, reaching an unprecedented pinnacle of 74,245.2, the Finance Ministry notes.

Indeed, as CRISIL Ratings points out, net financial inflows rose to 1.3 per cent of GDP, from 1.2 per cent and there was a net accretion of USD 6 billion to foreign exchange reserves during the third quarter of FY24 ended 31 December, compared with USD 3 billion in the second quarter. Portfolio investments dominate capital inflows in the third quarter. Net inflow from foreign portfolio investors (FPIs) improved to USD 12.01 billion, compared with USD 4.95 billion. Much of this net inflow was from equity and investment fund shares (USD 6.7 billion) compared with debt securities (USD 5 billion).

Net foreign direct investment (FDI) inflow turned positive, at USD 4.18 billion, as against a net outflow of USD 0.63 billion in the second quarter, because of higher gross inflow (14 per cent) and lower outflow (-15 per cent ) on-quarter in the third quarter.

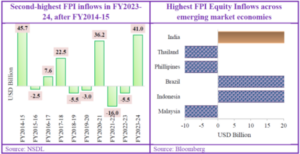

The Finance Ministry also points out that India’s FPI flows saw a significant turnaround in FY2023-24. Supported by rising economic growth, a favourable business environment, and strong macroeconomic fundamentals, India witnessed robust FPI inflows in FY2023-24. Net FPI inflows stood at USD 41 billion during FY2023-24, as against net outflows in the preceding two years. This is the second-highest level of FPI inflow after FY2014-15. India received the highest equity inflows among emerging market peers during FY2023-24. The imminent inclusion of India’s sovereign bonds in global bond indices is likely to spur demand for exposure to India further.

Owing to a rise in repatriation/disinvestment, net FDI moderated to USD 25.5 billion in the first ten months of FY2023-24 from USD 36.8 billion a year ago. Despite global FDI flows remaining weak in 2023 with only a modest increase of 3 per cent over 2022, India fared better than its Asian peers did7. India’s foreign exchange reserves reached an all-time high of USD 645.6 billion as of March 29, 2024, sufficient to cover 11 months of projected imports and more than 100 per cent of total external debt.

The buoyancy extended to the manufacturing and services sectors, as evidenced by the soaring HSBC India Manufacturing PMI and Services PMI. Amidst strong demand and positive market conditions, both sectors experienced substantial growth in output, new orders, and employment.

The MER notes that March 2024 witnessed a significant milestone in India’s tax revenue landscape, particularly in Goods and Services Tax (GST) collections. The Gross GST revenue for the month stood at an impressive ₹1.78 lakh crore. Notably, this figure reflects a substantial 11.5 per cent year-on-year growth, underscoring the robust health of the economy. The increase was primarily driven by domestic transactions that witnessed a huge surge. Collection from domestic transactions signifies a buoyant domestic economic landscape, instilling optimism and bolstering overall revenue accruals. Furthermore, the steady rise in average monthly collections by approximately ₹18,000 crore throughout the year underscores a compelling narrative of robust growth and economic recovery.

With March concluding the fiscal year 2024, the uptick in GST collections not only reflects robust compliance but also signifies an expansion in the ambit of GST, covering a broader spectrum of economic activities within its purview, the Finance Ministry says. The surge in GST collection from domestic transactions, registering a remarkable 17.6 per cent increase, played a pivotal role in driving this growth momentum. Moreover, the GST revenue net of refunds for March 2024 amounted to ₹1.65 lakh crore, indicating an 18.4 per cent expansion compared to the same period in the previous year.

In March 2024, the HSBC India Manufacturing PMI surged to an impressive 59.2, a notable increase from the final figure of 56.9 recorded in the previous month. This upswing was driven by robust demand, marking the fastest growth in factory activity since February 2008. Notably, both output and new orders experienced substantial growth, reaching the highest levels in nearly three-and-a-half years. Moreover, buying levels surged significantly, attaining their strongest position in nine months. This uptick facilitated firms’ restocking endeavours, with input inventories expanding at an accelerated pace. Employment also witnessed a moderate increase during this period. Finally, business sentiment improved, reflecting growing optimism among manufacturing firms regarding future prospects.

In March, India’s services sector hit a peak, with exports surging to a fiscal year high. The HSBC India Services PMI soared to 61.2, marking one of the sector’s most significant expansions in sales and business activity in nearly 14 years. Employment in the sector continued to grow for the twenty-second consecutive month, driven by strong demand and rising new orders. Service providers capitalised on export opportunities and new business intakes, propelled by positive domestic and international demand trends. Combined with a 16-year high growth in India’s manufacturing industry, the HSBC final India Composite PMI Index reached an eight-month high of 61.8, indicating bright growth prospects for the economy.

Consumer durables emerged as a standout performer, registering an impressive growth rate of 12.3 per cent. This significant increase contrasts sharply with the negative growth observed in the same period last year. However, consumer non-durables experienced a decline of 3.8 per cent in the latest period, explained by fluctuations in consumer demand patterns. Overall, the industrial landscape demonstrates resilience and adaptability, showcasing promising growth trends across various sectors. This reinforces confidence in the underlying strength of the Indian economy, poised for continued growth and development.