Indian equity benchmarks traded on a lacklustre note and closed in the red on the back of caution, as traders were not keen to raise bets at the prevailing record index levels. Despite the positive start of May series in the Futures and Options segment of the derivative market, the interest was not seen among traders. Probably the three holidays till Monday kept traders away from the stock market, who were not building any further open positions. The CNX Nifty ended the week at 9304 levels, down 37 points and analysts further expect the continuation of this consolidation phase to follow in the near term. Portfolio investors have been researching for fundamentally strong foreign companies listed on the exchanges and purchasing these stocks for long term investment.

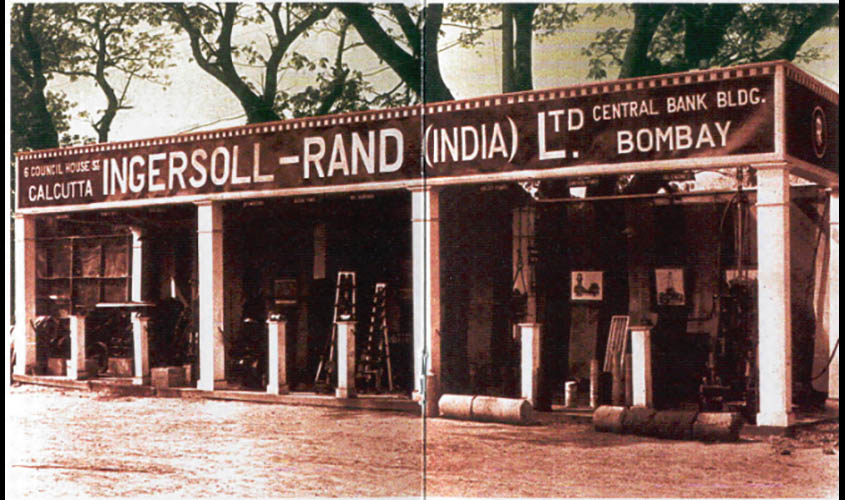

Ingersoll Rand India Private Limited was founded in Kolkata in 1921, one of the first US investments in India. In 1958, the company opened a branch office in Ahmedabad and in 1963 the head office was shifted to Mumbai. Ingersoll Rand established its first manufacturing plant in Naroda, Ahmedabad in 1965 and in 1977 it became a public limited company. Ingersoll provides products, services and solutions that enhance customers’ energy efficiency, productivity and operations. The product range for the sector comprises air compressors and compressed air solutions, with a major emphasis on “innovation” to drive “productivity”. Ingersoll Rand is a pioneer in bringing centrifugal technology to India way back in 1989, when centrifugal technology was hardly known and accepted. In recent times, with the focus shifting to energy efficient compressor technology, Ingersoll Rand has launched the award-winning energy saving rotary compressors. The company continues to bring latest technologies to India and launch localised products, keeping in mind the requirements of the Indian market. Not just path-breaking technologies and products, Ingersoll Rand’s key strength is its world class service that it provides to its customers across the country. Today, Ingersoll-Rand (India) Limited is based out of 22 locations in the country and its stock is listed on the National Stock Exchange of India and the Bombay Stock Exchange. Ingersoll-Rand (India) Limited has recently rolled out an aggressive plan for growth in India. The foundation of this growth will be customer driven innovation, a robust infrastructure to support after sales services and a significant investment in the facilities to transform them into world class manufacturing operations.

The company posted a good set of third quarter financial numbers for FY 2017, with a total revenue at Rs 185.36 crore and a net profit of Rs 21.20 crore. This compares better than of last year and also of last quarter. With the company also going into the retail air conditioning market, with their world class brand Trane, Ingersoll Rand can capture the Indian market in a big way in the coming years. The stock currently quoting at Rs 900 on the Indian stock exchanges can give steady returns to portfolio investors over the long term.

Rajiv Kapoor is a share broker, certified mutual fund expert and MDRT insurance agent.