NEW DELHI: The Indian auto Industry is optimistic of steady growth in 2024-25 with expectations riding high on normal monsoon and continued emphasis on economic development by the new Government, as it pursues its goal of Viksit Bharat by 2047. The industry’s passenger vehicle (PV) wholesales in India increased 4 per cent year-on-year in May 2024 to 3,47,492 units, recording the highest ever growth in May again, although returning a moderate growth of 3.9 per cent compared to May 2023, going by industry body SIAM’s latest data.

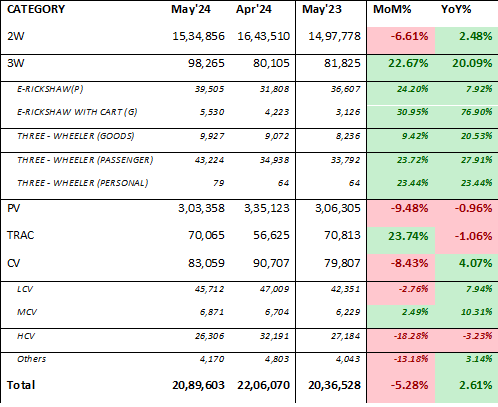

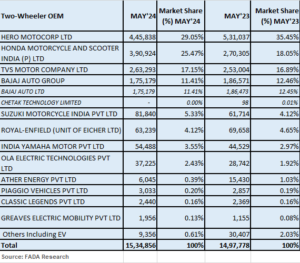

Riding on positive rural demand due to expected good monsoon and improved finance availability, the retail counters kept ticking but the auto retail sector achieved a lower 2.61 per cent yoy growth in May 2024, according to the Federation of Automobile Dealers Associations (FADA) data for May’24. two-wheelers were up by 2.5 per cent, 3W increased by 20 per cent, CVs experienced a growth of 4 per cent, but PVs declined by 1 per cent and tractors de-grew by 1 per cent. Good movement in market loads, cement, iron ore, and coal sectors contributed positively despite supply constraints and lack of OEM marketing activities.

The setback came from extreme heat and elections which significantly impacted footfall, with showrooms seeing an 18 per cent drop in walk-ins. Elections and related uncertainties affected customer sentiment, delaying purchasing decisions while market liquidity issues and high inventory levels strained dealership profitability.

Overall PV dispatches from companies to dealers stood at 3,34,537 units in May 2023. Total production of PVs, three wheelers (3W), two wheelers (2W) and quadricycle in May 2024 was 24,55,637 units. “Passenger vehicles have only witnessed moderate growth, primarily owing to a high base effect of the previous year,” Vinod Aggarwal, President, SIAM notes.

Three-wheeler sales were 55,763 units in May 2024 and two-wheeler sales were 16,20,084 units, posting growth in double digits. Two-wheelers posted a growth of 10.1 per cent in May 2024, compared to last year, but are still lower than 2017-18 levels of the month of May. Domestic sales of three-wheelers in May 2024 grew by 14.7 per cent compared to May 2023, posting the highest ever sales of May, surpassing the previous peak of year 2018-19.

On the retail front, two-wheeler segment grew by 2.5 per cent but declined by 6.6 per cent MoM. Dealers reported supply constraints, lack of OEM marketing activities and impacts from extremely hot weather and elections. The PV segment showed 9.5 per cent MoM decline. Dealers cited the impact of elections, extreme heat and market liquidity issues as major factors. Despite better supply, some pending bookings and discount schemes, the lack of new models, intense competition and poor marketing efforts by OEMs affected sales. Additionally, increased customer postponements and low enquiries further contributed to the challenging market conditions. Due to the extreme heat, the number of walk-ins to showrooms dropped by around 18 per cent. The CV segment showed 8 per cent MoM decline. Dealers reported that elections and extreme climatic conditions heavily impacted sales. Despite growth due to a low base from last year and increased bus rders, the industry faced challenges from wholesale pressures, government policy effects, and negative market sentiment. Additionally, good movement in market loads, cement, iron ore, and coal sectors contributed positively. The FADA near-term outlook remains cautiously optimistic. Post-election stability and a continuity in the Government are expected to boost infrastructure projects and economic activities. “Above-normal rains forecasted by the IMD should enhance rural demand and support economic activities.

However, addressing extreme weather challenges, intense competition, and liquidity issues will be crucial for sustained market improvement,” says FADA President Manish Raj Singhania.

There are also challenges including intense competition, lack of new model launches and poor marketing efforts by OEMs. Liquidity issues and high inventory levels continue to strain profitability for Dealerships. Although discount schemes and good product availability are in place, low customer enquiries and postponements due to seasonal factors remain concerns.