NEW DELHI: The Indian automobile industry’s value stood at INR 10.22 lakh crore in the fiscal year 2023-24, surging by 19 per cent even as the growth in terms of vehicles produced touched 10 per cent (including 2-wheelers) in FY24. The utility vehicle (UV) and SUV (Sport Utility Vehicle) segments grew the most with value growing by a massive 39 per cent, volume increase by 23 per cent and the average price rising by 16 per cent, finds a report by Primus Partners consultancy. The automobile industry produced 2.8 crore vehicles during 2023-24, with four-wheeler passenger vehicles (PVs) generating the highest value share which contributed to 63 per cent of the INR 10.22 lakh crore value generated by the industry.

However, an outlook for India’s vehicle production by BMI (a unit of Fitch Solutions) forecasts some policy and reform uncertainty over the coming quarters, especially for automotive manufacturing investments in the wake of the election outcome. That said — as the BMI report points out — while the election results will weigh on investor confidence in India over the coming quarters, Modi’s move to reduce import barriers on EVs and the ongoing trade tensions between China and the West will continue to drive investment in India over the medium term.

The year 2023-24 proved to be a strong year for the global automobile industry, Primus reports with the lingering pent-up demand from the pandemic period remaining active while many of the supply chain constraints had eased up.

According to Organisation Internationale des Constructeurs d’Automobiles (OICA), the global auto industry grew by 12 per cent in terms of vehicles sold in 2023 and India ranked as the world’s third-largest market for vehicle registrations, including passenger cars, LCVs, HCVs, and buses for the calendar year 2023. “Currently, India is at the forefront in leading the global automobile race, bypassing lower-priced products and creating more value in feature-rich, higher-priced vehicles, says Anurag Singh, Managing Director of Primus Partners.

India is the number one producer of two-wheelers with more than 20 million units produced last year. The two-wheeler segment dominates in volume with 76 per cent share and value share of 18 per cent. The CV segment accounts for 18 per cent of the industry value with a significant contribution of higher-priced vehicles such as trucks and specialty vehicles. In the two-wheeler segment, India witnessed a 10 per cent increase in volume and 13 per cent in value, while the three-wheeler segment grew by 16 per cent in volume and 24 per cent in value and the commercial vehicle segment rose by 3 per cent in volume and 7 per cent in value.

“The average price increase in the UV/SUV segment was due to general rise in prices, shift to higher segment, shift to hybrid, shift to automatic, popularity of sunroof and shift to EVs,” he adds. Conversely, Singh says, the PV segment saw a decline of 9 per cent in volume due to a slight price increase, resulting in a 4 per cent value drop. Even as the number 3 country in terms of vehicles registered, in value terms India is behind countries like Japan and Germany. The average price of vehicle in India is lower than that of many advanced countries. According to JATO Dynamics, India would rank in the mid-teens in terms of value.

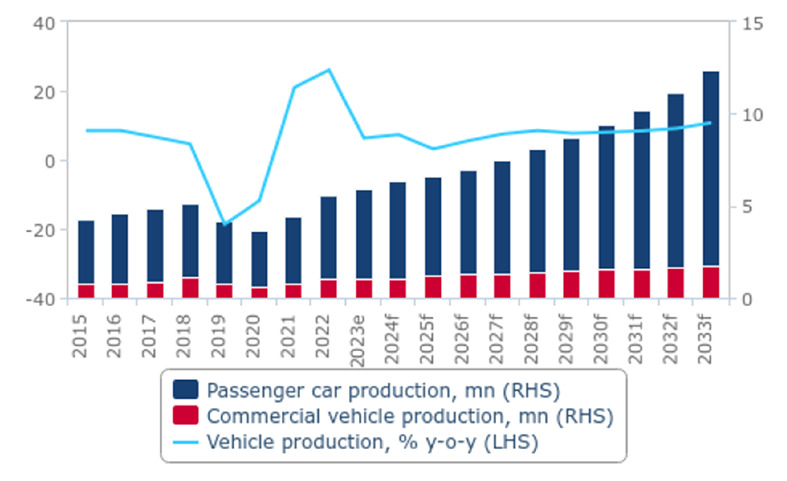

The BMI projection for India’s vehicle production (excluding two and three-wheelers) is an average annual growth of 7.6 per cent y-o-y (down from previous forecast of 11.4 per cent) over the FY2024-2033 period and reach 12.4mn units.

Continued strong government support from policies such as the faster adoption and manufacturing of electric vehicles (FAME) and production-linked incentives, the diversified approach adopted by Indian original equipment manufacturers (OEMs) for alternative fuelled vehicles coupled with India’s expanding trade and investment agreements, will drive sustained growth in India’s vehicle production over 2024-2033.

In Q1 2024, the Government announced that it would temporarily lower the import duties on EVs for OEMs who invest at least USD 500 mn in local manufacturing with a localisation rate (share of EV components sourced locally) of 25 per cent within three years, and reach a localisation rate of 50 per cent by the fifth year. Qualifying OEMs will have a reduced import duty of 15 per cent (compared to between 70 per cent-100 per cent currently) for up to 8,000 (import quotas) EVs valued at less than USD 35,000 annually. Beyond the 8,000 unit limit, imported EVs will face the standard rate of 70 per cent-100 per cent. This will accelerate growth in India’s EV manufacturing over the medium to long term.