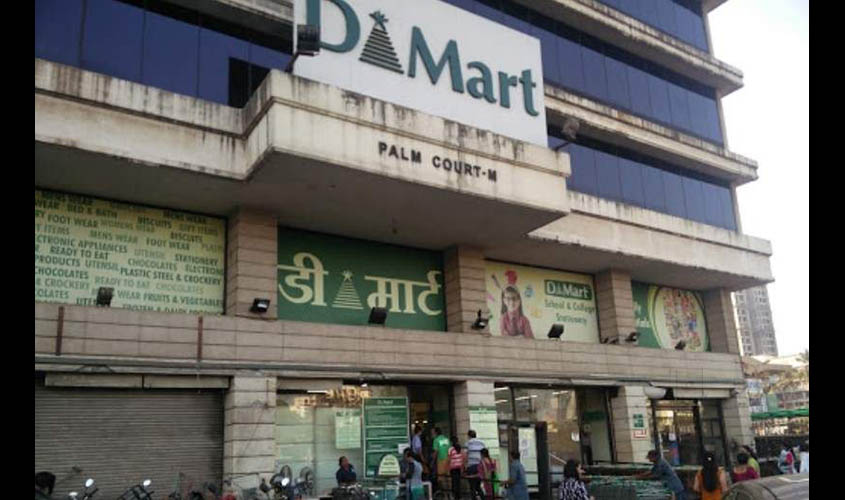

DMart is a one-stop national supermarket chain that offers customers a wide range of basic home and personal products under one roof. The supermarket chain of DMart stores is owned and operated by Avenue Supermarts Ltd with its headquarters in Mumbai. Avenue Supermarts Ltd’s stock is listed on both NSE and BSE. Each DMart store stocks home utility products such as food, toiletries, beauty products, garments, kitchenware, bed and bath linen, home appliances and many more items. All these are available at competitive prices which Indian customers appreciate by thronging the stores throughout the day. The core objective of DMart is to offer customers good products and at great value. It was started by the Damani family to address the growing needs of the Indian customer. From the launch of its first store in Powai in 2002, DMart today has a well-established presence in 158 locations across Maharashtra, Gujarat, Andhra Pradesh, Madhya Pradesh, Karnataka, Telangana, Chhattisgarh, NCR, Tamil Nadu, Punjab and Rajasthan. With a mission and strong focus to be the lowest priced retailer in the region it operates, DMart’s business continues to grow at a handsome pace. The retail merchandise market is expected to grow from approximately US$600 billion to US$960 billion in the next few years. The share of urban retail should show a sharp improvement due to increasing urbanisation, a higher increase in urban household income and increasing penetration of organised retail in urban centres. Currently, the food and groceries segment constitutes around two-third share of the retail market. Sixteen Indian states contribute approximately 85% of the total retail spend and is expected to continue having a significant share of the total retail consumption. Maharashtra contributes the highest share of around 20% among these leading states. Avenue Supermarts declared financial results for the quarter ended 30 June 2018, with total revenue at Rs 4,559 crore as compared to Rs 3,598 crore in the same period of last year. EBIDA for Q1FY2019 was Rs 423 crore, as compared to Rs 303 crore in the corresponding quarter of last year, with the EBIDA margin also improving from 8.4% to 9.3%. Avenue Supermarts reported a net profit of Rs 251 crores for Q1FY2019 as against Rs 175 crore in the corresponding quarter of last year. The earnings per share (EPS) stood at Rs 4.02 for Q1FY19, as compared to Rs 2.80 for the same period last year. The company is of the view that a mild inflation may be good for their consumer business as it provides higher value growth and lends some sort of leverage and margin support. DMart is actually a business with a long growth runaway—a quintessential earnings compounder. The stock quoting at Rs 1,650 is a very good buy by portfolio investors for long term price appreciation.

Rajiv Kapoor is a share broker, certified mutual fund expert and MDRT insurance agent.