New Delhi

Underlining resilience amidst stubborn global headwinds, India’s real gross domestic product (GDP) growth rose to 7.8 percent on-year in the first quarter of fiscal 2024, the fastest pace in a year, maintaining the strong momentum witnessed in the final quarter of FY23, as private consumption accelerated and investment growth remained high, as per estimates for the April-June quarter (Q1) of 2023-24, by the National Statistical Office. Economists and market analysts are more or less unanimous that the Indian economy’s growth spurt at the start of the new fiscal year was propelled by strong domestic demand, which offset headwinds from a weaker external environment. The Government is optimistic of a 6.5 per cent growth in the current fiscal amidst deficient rain and underlying concern over food price developments.

The higher growth which was domestically driven, towers above the growth rate in several other leading economies and reaffirms two key aspects of the Government’s overall macroeconomic management — India’s overall macroeconomic stability and growth prospects. The growth in Q1 rides, according to V Anantha Nageswaran, Chief Economic Adviser (CEA), “on the shoulders of a boost in capital expenditure both at central and state levels, along with stronger consumption demand, especially in rural areas, and improved performance in the services sector”. Dharmakirti Joshi, Chief Economist, CRISIL finds no surprise in the data for the April-June quarter.

“Most indicators, particularly the government frontloading its aggressive investment target for the current fiscal, were hinting at it,” opines Joshi. The 7.8 per cent growth compared with 6.1 per cent in the previous quarter was the second consecutive quarter of rising growth. For Sujan Hajra, Chief Economist and Executive Director, Anand Rathi Shares and Stock Brokers, India’s GDP growth in Q1 FY24 at 7.8 per cent was slightly behind expectation of 8 per cent. Aditi Nayar Chief Economist ICRA, too believes the GDP data could have been better. “Although a supportive base propelled India’s GDP growth to a four-quarter high of 7.8 per cent, it nonetheless printed below our expectations of 8.5 per cent,” says Nayar.

Industry heads are looking at India’s successful navigation past challenges of high inflation, tight monetary conditions, supply disruptions amidst geo-political issues that major economies are grappling with. ‘It was not as if the Indian economy did not face the headwinds. The India story stands firm on the twin pillars of sustained demand while supply is being augmented with operational efficiencies and new capacities being added. The virtuous cycle of robust demand and investment seems quite close for a take off,” says Assocham Secretary General Deepak Sood.Indeed, the finer layers of the GDP performance indicate that investment projects announced by the private sector have been highest in Q1 of FY2023-24 in 14 years. This signals that private sector capital formation is well underway and augurs well for future employment and income growth of Indian households, the biggest positive for Indian economy, as per the CEA. Fixed investment was 8.0 per cent in first quarter of fiscal 2024 vs 8.9 per cent previous quarter. Investment’s share in GDP remains at close to decadal highs at 35 percent of GDP, Crisil data shows. “The Government’s single-minded focus on capital expenditure over the years has crowded in the private sector and this has spiralled off on state governments too,” agrees Nageswaran.

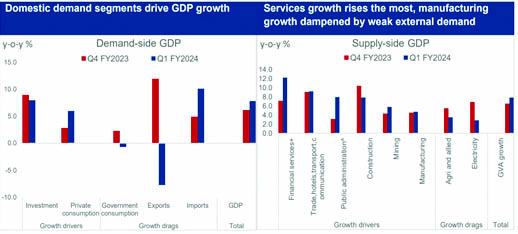

The private sector is poised to contribute to stronger investment growth following the strengthening of corporate and bank balance sheets, supported by the government’s Capex push. Though manufacturing is expanding and income growth is evident in the recovery in rural demand, the sector grew a tad from 4.5 per cent in the previous quarter to 4.7 per cent this quarter. Overall, industrial GVA grew 5.5 per cent versus 6.3 per cent in the fourth quarter. Nayar pins down the lower-than expected GVA growth to largely on account of the manufacturing sector, which saw a surprisingly meek uptick, despite the improvement in manufacturing volumes, as depicted by the IIP for the same, and a deflation in commodity prices.

“The sharp, broad-based contraction in merchandise exports is likely to have weighed on the performance of manufacturing in Q1 FY2024,” says Nayar.

Easing commodity prices and supply constraints, along with resilient domestic demand supported production but declining goods exports dampened industrial prospects. Agriculture, construction, electricity and other utility services showed slower growth in the first quarter compared to previous quarter with sowing starting with a delay, in response to delayed onset of monsoon in June. Among others in manufacturing, construction growth moderated 7.9 per cent as compared to 10.4 per cent, due to a a decline in residential housing activity.

Rising consumption was triggered by easing inflation in the first quarter which added to the purchasing power of consumers. The rural demand for FMCGs has increased especially for high value goods. The same trend is evident for small towns, contributing to growth, as per CEA. According to Crisil, private consumption recorded a sharp uptick of 6.0 per cent as compared to 2.8 per cent. A sharp fall in retail inflation indicated by 4.6 per cent consumer price index-linked (CPI) inflation in the first quarter vs 6.2 per cent in the previous quarter, added to consumers’ purchasing power. This particularly helped the rural economy catch up with strong urban demand. Support also came from bank credit, which has sustained double digit growth despite elevated interest rates.

The CEA credits said that despite global slowdown, the services sector exports have shown a remarkable performance despite slowdown in global trade which impacted the goods demand more than services. Services saw the sharpest rise in growth at 10.3 percent on-year in first quarter versus 6.9 per cent in the previous quarter as rising consumption passed off the gains to services the most, which saw highest growth among supply-side sectors. On the supply side, gross value added (GVA) grew 7.8 per cent in the first quarter compared with 6.5 per cent in the previous quarter. Within services, growth was the highest in financial, real estate and professional services at 12.2 per cent in Q1 as compared to 7.1 per cent previous quarter. Other services segments which saw rising growth were trade, hotels, transport and communication services which grew 9.2 per cent as against 9.1 per cent, and public administration, defence and other services which grew 7.9 per cent in the first quarter compared to 3.1 per cent.

The other worry is external demand which dragged down export growth. Exports fell into the red, recording a decline of 7.7 per cent from 11.9 percent, as a result of a slowdown in the world’s major economies as well as drop in prices compared with last year. However, imports remained strong on the back of resilient domestic demand with imports of goods and services recording the highest growth of 10.1 per cent in the first quarter vs 4.9 per cent in fourth quarter. This, coupled with falling exports led to a bigger external drag on growth in the first quarter.

According to Crisil, “support remained weak from government final consumption expenditure, which plunged to -0.7 per cent compared with a growth of 2.3 per cent in the previous quarter”. The Government expects expansion of public digital platforms, PM GatiShakti, the National Logistics Policy and the Production-Linked Incentive schemes to boost manufacturing output but Crisil expects external demand will remain a drag on growth as western advanced economies undergo a more protracted slowdown.

Though inflation developments are under control, they would need a close watch, agrees Nageswaran who is optimistic that food inflation may subside with the arrival of fresh stock in the market and government pre-emptive measures.

Monsoon is the biggest risk for domestic demand as it turned deficient in August under the pressure of El Niño. Further weakness in September could mean hit to rural incomes and rising inflationary pressures, according to Crisil. Nayar projects moderation in GDP growth over the next few quarters, on the back of what is likely to be a below normal monsoon. The other indicators are “narrowing differentials with year-ago commodity prices and possible slowdown in momentum of Government capex as India approaches the Parliamentary elections”. Nayar maintains FY2024 GDP growth estimate at 6.0 percent which is lower than the Rbi’s 6.5 per cent for the fiscal.

Joshi suggests that the 7.8 per cent surge is likely to be the peak growth performance for this fiscal. “Growth in the July-September quarter will be moderated by softening consumption as spiking inflation will dent discretionary-spending power. For the rest of the year, headwinds from slowing global growth and the lagged impact of interest rate hikes will play out,” cautions Joshi. Additionally, if dry weather conditions seen in August continue in September, agricultural output could be impacted,” he adds. Factoring in robust capex to cushion growth to some extent, Joshi keeps the forecast at 6 per cent GDP growth for this fiscal which would make India the fastest-growing G-20 country this year.

Hajra feels India will maintain 6.2 per cent growth in FY24 and its position as the fastest growing. This takes into account the expectation of slowdown in investment. “This is likely to recover in FY25. With strong growth and elevated inflation, the RBI would be hard pressed to tighten monetary policies. If retail inflation does remain high in August, we would expect a symbolic rate hike,” he says.

Sood remains bullish about the Indian economy which should pick up further momentum in subsequent quarters particularly with the onset of the festive season. While the services sector continues to hold promise manufacturing would build on fresh investment being aided by incentives like PLI and the China Plus policies of the global manufacturers.