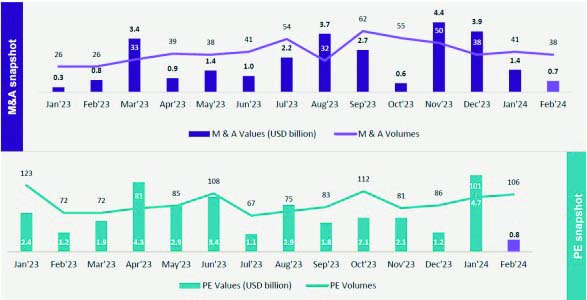

Mergers and acquisitions and private equity activity in India took a backseat in February 2024 with the country witnessing 144 deals amounting to USD 1.4 billion, reflecting stable deal activity but a significant decline in values by 77 per cent and only a slight increase in volumes compared to January due to absence of major transactions and undisclosed deal values last month. Start-ups drove the deal activity, leading in both volumes and values.

Notably, there were no billion-dollar deals last month and the number of high-value deals dropped significantly, with only one deal surpassing USD 100 million compared to six in January 2024 even as strategic and financial

The month of January 2024 was also marked by an uptrend in deals valued at USD 6.1 billion across 142 transactions, driven by PE activity which soared due to the presence of two billion-dollar investments totalling USD 3.6 billion. With a fourfold increase compared to the previous month, January 2024 recorded the highest PE monthly values since June 2022. However, M&A deal activity was subdued, with 41 deals valued at USD 1.4 billion. In February 2024, the M&A space saw a 52 per cent decline in values and a 7 per cent decrease in volumes, with domestic and