Passenger vehicle (PV) wholesales are expected to grow 10 per cent yoy in March 2024 to 371,000+ units, but retails to be lower than that, marking a departure from the tradition of higher sales in the third month of a year than February — given more selling days – but that is unlikely this time as inventory is likely to have risen further to close to a month.

According to industry voices and analysts, there are no significant waiting periods and discounts have increased sharply, notably, for some recently launched SUVs like the Honda Elevate, Maruti Grand Vitara and Maruti Fronx.

Vehicle registration as per Vahan, was soft in March with PVs down 11 per cent yoy, partly impacted due to the shift of Navratri from March-23 to April-24. “In terms of domestic sales, the Indian PV industry constitutes 18 per cent of the country’s total automobile industry and PV domestic sales grew by 7.4 per cent y-o-y in 9 months of FY24. The segment’s growth trajectory continued for two consecutive fiscal years with improved vehicle availability and an influx of new and refreshed models from various OEMs. This uplift was further supported by enhanced supplies and an increasing variety in the product portfolio, diversifying consumer demand.

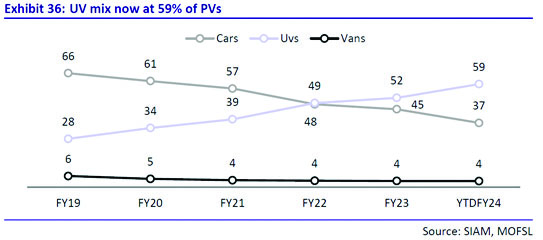

Maruti Suzuki’s domestic PV wholesales are set to increase 15 per cent yoy and MSIL’s wholesale market share at 41 per cent. The company’s retail growth is estimated to be in mid single digits driving 5-10,000 inventory addition. One reason for MSIL’s growth to be slower in FY25F is that the new model cycle is not as strong as last year and there will be more new launches by competition. Motilal Oswal in its observation of the PV study highlights that despite a 12 per cent decline in MSIL cars, accounting for 56 per cent of its mix, the company has been able to marginally gain share in PVs to 41.8 per cent, led by a strong outperformance in UVs, the sales of which were up 77 per cent.

Nomura’s estimate is that M&M’s UV volumes will rise 20 per cent yoy at 43000 units and the company will be able to grow well ahead of the industry in FY25F, given its healthy order book (226000 in February 24) and ramp-up of capacity to 49000 per month by March 2024. Tata Motors PV sales is expected at 51000, up 16 per cent yoy with the potential to have two models among the top three SUVs in India.

Overall, as Nomura indicates, March 24 numbers imply that the PV industry will touch 4.2 million units in FY24, a yoy growth of 8 per cent which is higher than the Nomura estimate of 6 per cent yoy. Tanvi Shah, Director of CareEdge Research underlines the pent-up demand levelling off amid hike in vehicle prices as reason for the PV industry to record a volume growth of around 8-10 per cent in FY24. “This growth is anticipated to moderate in FY25 owing to tapering down of pent up demand while supported by healthy order book, improvement in the supply chain, new model launches and increasing demand in the UV segment,” said Shah. While demand for premium variants is expected to remain healthy, led by increasing demand for the luxury and premium models, that for entry-level variants is expected to remain muted due to high interest rates and an inflationary environment, Shah observes.

Shamsher Dewan, Senior Vice President & Group Head – Corporate Ratings, ICRA, is of the view that aided by a preference for personal mobility and stable semiconductor supplies, PV industry volumes are estimated to reach 4.1 million units in FY2024, representing a growth of 6-9 per cent yoy over FY2023. Even as the underlying demand drivers remain supportive, the volume growth for the segment is likely to moderate to 3-6 per cent, from an elevated base. According to Dewan, lower growth expectation for next year partly stems from a high base and, to some extent, by waning pent-up replacement demand, which supported the industry over the past couple of years. “In addition, the build-up of inventory at dealerships at 55-58 days (as of the end of December 2023) also suggests potential moderation in demand for PVs,” notes Dewan.

A key concern for industry is the incidence of Government lowering tax on hybrid cars to 12 per cent vs 43 per cent currently. Singh and Bera of Nomura point out that any such proposal needs to have support from the Finance Ministry following which it will be brought to the GST Council for deliberations. There may also be a need for industry OEMs and suppliers to be consulted and a reasonable timeframe for implementation to be provided.

All that, though, is some distance away, agree the experts, as the decision on whether the government wants to include hybridisation targets in its long-term auto policy may only be taken up post the election of the new government.