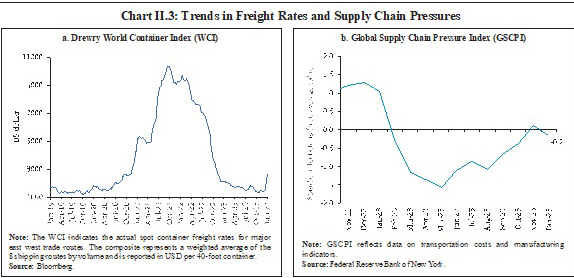

The Reserve Bank of India has in a recent report on 19 January highlighted concern over global supply chains coming under pressure due to the recent attacks on commercial ships in the Red Sea trade route, necessitating rerouting via the South African Cape of Good Hope. “Geopolitical risks remain elevated, posing both upside risks to commodity prices and downside risks to growth. This is raising transit times and war-risk premiums. This is also raising freight charges which have suddenly come under renewed pressure due to hostilities around the Red Sea,” the RBI cautions in the January report, also noting that these developments are reflecting in the daily trade volume transiting through the Bab el-Mandeb Strait and the Suez Canal which has fallen considerably.

The impact of this disruption has most felt in petroleum, chemical and non-metallic mineral products, mining and quarrying and agriculture sectors. These developments impart considerable uncertainty to the near-term outlook for India’s merchandise trade. In the context of recent increases in freight costs, it is worth noting that the ratios of transport costs to India’s goods imports and exports stood at 2.8 and 4.8 per cent, respectively, in Q2 of FY2023-24, declining from highs recorded a year ago. According to the RBI report, crude prices

The worry over the risks of a long drawn conflict also resonates in a global trade research initiative (GTRI) report which calls for India to be prepared for long term shipping disruptions at the Bab-el-Mandeb Strait. The report suggests that India’s approach should include looking for alternative trade routes that bypass the Bab el Mandeb strait, negotiating contracts for oil and LNG with alternate suppliers, negotiating freight with international shipping companies and paying part of increased insurance expenses. This is imperitive in view of the fact that the escalating tension in the Red Sea following drone attacks by Houthies on global shipping lines at the Bab-el-Mandeb Strait are a microcosm of a complex middle-eastern power rivalry which may continue to escalate till the end of the Gaza war, as per GTRI forecast.

The hostilities, is seen as an attempt by these groups, with Iran’s backing, to increase the costs of their continued engagement in these conflicts which have been successful to the extent of the US and several other countries having to deploy warships for patrolling and securing this crucial chokepoint. The disruption of the Red Sea shipping lanes significantly impacts Indian trade, especially with the Middle East, Africa, and Europe. India, heavily reliant on the Bab-el-Mandeb Strait for crude oil and LNG imports and trade with key regions, faces substantial economic and security risks from any disruption in this area.

The worry over the risks of a long drawn conflict also spills over into India’s key trade body, the Federation of Indian Export Organisations, with President (Officiate) Israr Ahmed expressing concern over almost all countries’ exports exhibiting a declining trend, with many witnessing a double-digit dip. “Recent tensions in West Asia especially the threat for consignments routing through the Red Sea has further added to woes of the exporting community, as