With economic activity holding up well and expected to be boosted by an expected boost in festive demand conditions, an uptick in investment intentions, revival in rural demand and improving business outlook, the RBI reinforced its commitment to align inflation to the target of 4 per cent and support growth by keeping the Repo rate at 6.50 per cent, while signalling vigilance on global headwinds. The RBI also retained standing deposit facility at 6.25 percent and marginal standing facility at 6.75 per cent. The projection of real GDP growth for 2023-24 is at 6.5 per cent, of which Q2 of the financial year will contribute 6.5 per cent, Q3 will bring in 6.0 per cent and Q4 a share of 5.7 per cent. Real gross domestic product (GDP) posted a growth of 7.8 per cent year-on year (y-o-y) in Q12023-24 (April-June), underpinned by private consumption and investment demand.

One reason for the monetary policy committee of the RBI to vote on retaining the status quo is that the cumulative policy repo rate hike of 250 basis points is still working its way through the economy. “The MPC decided to keep the policy repo rate unchanged at 6.50 per cent in this meeting, but with preparedness to undertake appropriate and timely policy actions, should the situation so warrant,” RBI Governor Shaktikanta Das said, unveiling the MPC decisions.

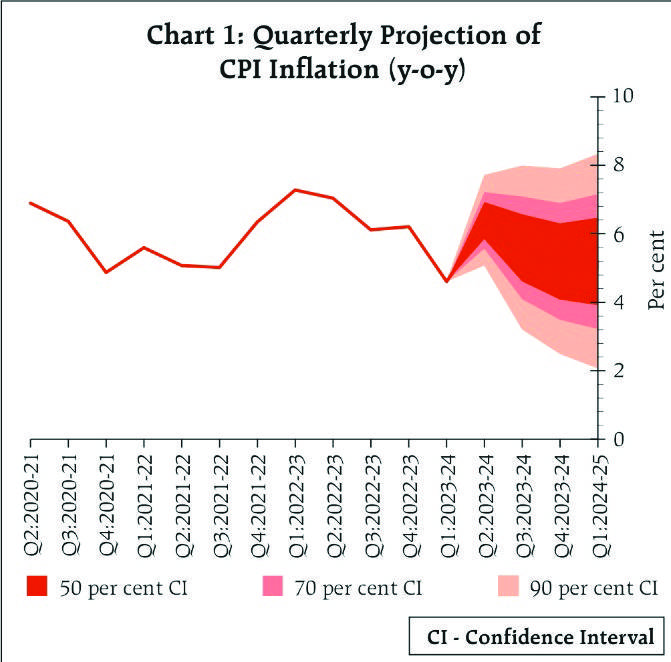

For economists, largely the steady interest rates with no change in stance was widely expected and par for the course, as pointed out by Dharmakirti Joshi, Chief Economist, CRISIL. Joshi observes that despite the second quarter bulge in inflation, the RBI kept its inflation forecast for the current fiscal unchanged at 5.4 per cent.

This is the fourth consecutive pause on the policy rates by the RBI to balance the need to build on the growth momentum and contain inflation, notes FIEO President.

A Sakthivel, defining it as a move that will further help in building up on the growth momentum and contain inflation at the same time. In fact, the RBI has been maintaining the policy rate at 6.5 per cent for 8 months now. The longest transitory period in repo rate’s history, when it was kept on pause prior to a cut, was 12 months, in 2014. This was followed by a 25-bps cut in an out of schedule meeting in January 2015. “A similar event cannot be ruled out this time, especially if the impact of food prices from lower kharif acreage does not impact RBI’s forecast for overall inflation during the rest of FY24,” says Debopam Chaudhuri, Chief Economist of Piramal Group.

The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth. All members of the MPC including the RBI Governor, Jayanth R Varma, Michael Debabrata Patra, Shashanka Bhide, Ashima Goyal and Rajiv Ranjan unanimously voted to keep the policy repo rate unchanged at 6.50 per cent to ensure that inflation progressively aligns to the target, while supporting growth, with all, except Varma, voting to remain focused on withdrawal of accommodation.

Inflation is the RBI’s overriding concern, driving decisions in consonance with achieving the medium term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2. Inflation risks global growth losing momentum even amidst signs of gradual easing as it remains well above target in major economies. In India, CPI headline inflation surged to 7.4 per cent in July due to a spike in vegetable prices, before moderating somewhat in August to 6.8 percent which still breached the MPC’s upper tolerance band of 6.0 per cent.

This was because of food inflation rising a sharp 10.7 percent during the two months, and within the basket, volatile vegetables, which rose 31.8 per cent, shows Crisil data.

“Food inflation remains a key monitorable not only because it is in double digits, but also because sub-normal monsoon and muted sowing can impact kharif output and prices.

Additionally, low reservoir levels do not augur well for the rabi crops,” notes Joshi. Industry too feels that keeping Repo rate and overall stance unchanged was largely expected. Subhrakant Panda, President, FICCI is of the view that inflation needs to be closely monitored, though it seems to have peaked and a correction in prices over the near term looks probable.

A related concern flagged by RBI is the unprecedented global food price shocks as such recurrence has the risk of impacting both the inflation trajectory and its persistence. The Bank therefore advises high alert, given the prevailing environment of elevated global food and energy prices and global financial market volatility. In the Indian context, which can’t be isolated from global currents, while vegetable prices in the country may undergo further correction and core inflation is easing, the headline inflation is ruling above the tolerance band and its alignment with the target is getting interrupted. “De-risking food supply chains from weather related disruptions should be a priority. This calls for a comprehensive roadmap and coordinated action at multiple levels,” suggests Panda.

The risks are evenly balanced in geopolitical tensions, volatile financial markets and energy prices as well as climate shocks which challenge the growth outlook. According to the Crisil economist, tightening of US bond yields, capital outflows and strengthening dollar also tilted the balance in favour of ‘withdrawal of accommodation’ stance. “We expect rates to remain at these levels and foresee a rate cut only in the first quarter of next fiscal,” says Joshi. Emerging market economies (EMEs) like India are also experiencing currency depreciation and volatile capital flows.

Worryingly, merchandise exports and non-oil non-gold imports remained in contraction in August, although the pace of decline eased and services exports improved in August. Sakthivel sees this as a timely intervention. “With both the US Fed and UK Central Bank pausing the interest rates, the decision of the Central Bank is on expected lines of continuing to maintain the status quo on policy rates front,” points out the FIEO chief.

The RBI policy move is an impactful one. The decision to keep the policy rate unchanged will continue to give a boost to growth through increasing investments which will lead to further enhanced manufacturing and production thus easing supply and reducing inflation in coming months. It will also benefit exports, a key worry highlighted by the RBI. ”The status quo in rates will help the exporting community, whose cost of credit has gone up substantially due to upward revision in rates during the last one and half year leading to the demand to increase the interest subvention,” says Sakthivel.

Arun Kumar Garodia, Chairman of the Engineering Exports Promotion Council. “In the wake of slowing trade, exporters need the necessary cushion to withstand external shocks and uncertainties. The current financial year has been quite challenging for engineering exporters even as August shipments registered an uptick mainly due to favourable statistical base. From now on, we see this trend continue which will help the engineering industry grapple with weak demand from key markets,” says Garodia.

While there is room for cheer, RBI clearly advises against exuberance amidst its expectation of improvement in near-term inflation outlook on the back of vegetable

price correction and the recent reduction in LPG prices. The future trajectory will be conditioned by lower area sown under pulses, dip in reservoir levels, El Niño conditions and volatile global energy and food prices.

Going ahead, there are other road bumps. According to the RBI’s enterprise surveys, manufacturing firms expect higher input cost pressures but marginally lower growth in selling prices in Q3FY24, services and infrastructure indicate moderation in growth of input costs and selling prices.

Nomura analysts remain cautious over headwinds to domestic demand from weaker rural demand, a likely slowdown in government capex as the election calendar heats up, lacklustre private capex and spillovers from sluggish global growth.

“Contrary to the RBI, we expect GDP growth to average 5.9 per cent in FY24 and 5.6 per cent for FY25 (RBI: 6.5%), the latter also reflecting our outlook of weaker global growth next year. Overall, the RBI is expected to continue with its extended policy pause and stance for now, at the same time, risks from elevated food and oil prices mean that easing is not on the table for now.