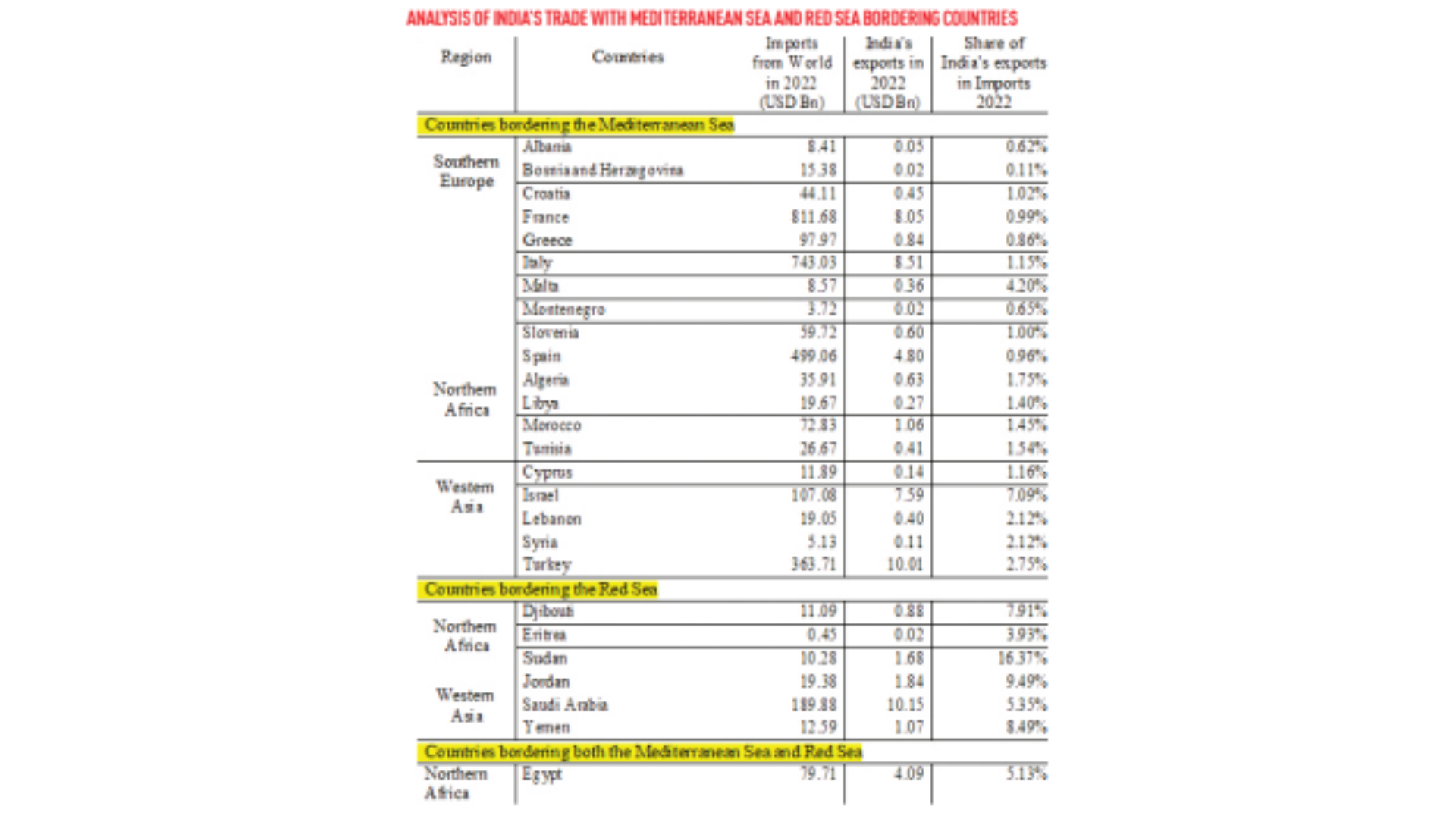

Even as the National Statistics Office (NSO) data on GDP growth for the third quarter of financial year 2023-24 (3FY24) underlines moderation in both exports and imports, a survey of India’s trade with Mediterranean Sea and Red Sea bordering countries, by the Federation of Indian Export Organisations (FIEO) confirms that India’s exports to these countries worth USD 64 billion are directly affected.

“Export growth moderated to 3.4 per cent in the third quarter from 5.3 per cent in the previous one,” observes Dharmakirti Joshi, Chief Economist, CRISIL, on the NSO data relating to exports. However, as Joshi points out, import growth fell to 8.3 per cent following 11.9 per cent growth in the previous quarter.

“Net exports (exports minus imports) continued to drag GDP growth, but to a lesser extent in the third quarter versus the second,” Joshi adds. While merchandise trade braved choppy Red Sea waters in January, Nomura Ratings data of 15 February, 2024 did show an improvement in merchandise export and import growth and record-high services trade surplus. However, the pan India FIEO survey covering more than 170 exporters across the country shows the widespread impact on a diverse range of products in key export destinations.

Various inputs received from exporters flag the serious challenge of increased costs as ocean freight costs have skyrocketed, leading to doubling or even tripling the usual rates. Shipping lines are implementing contingency adjustment charges (CAC) above existing ocean freight which will further impact profitability, especially for projects with tight margins.

These are further prone to other charges such as demurrage, storage, PSC, late delivery penalty charges, increased insurance, and more. A closer look at the shipping surge faced by cotton yarn exporters to various destinations shows 600 per cent increase in the case of Egypt, amounting to USD 450 to USD 3100, a 400 per cent increase to Europe at USD 700 to USD 3500 and 50-75 per cent hike worth USD 375 to USD 575-650 on shipments to Bangladesh. Exporters are burdened with booking difficulties due to nonavailability of vessels, difficulty in securing booking slots with shipping lines which in turn is causing delays in shipments and impacting order fulfilment as per customer desired ETA.

“Freight rates have gone up unimaginably high, with further burden of various surcharge, pushing Indian exporters to hold back around 25 per cent of the outbound shipments transiting through the Red Sea, which added to the sense of scepticism and nervousness among the businesses and markets across the world,” says Israr Ahmed, FIEO president (officiate).

Besides, there are increasing transit time delays with rerouting around the Cape of Good Hope to the extent of 2 to 4 weeks, thus extending delivery window dates and affecting cash flow. The issue has further implications like affecting the shelf life of perishable goods like fruits, delays in packing and shipping and disruption in harvest procurement, profit margins for farmers and operations like labour management and cold storage for export-quality fruits.

The survey highlights challenges like European importers of leather goods now demanding shipments two weeks early (in view of extended transit times or reroutes) which further strains production timeframes. The situation can further aggravate, cautions Joshi, as uneven economic growth in key trade partners such as the United States and the European Union, and an escalation of the ongoing Red Sea tensions can act as drag on exports.

Exporters have called for logistical interventions by the Government, collaboration with insurance providers to develop specialised policies for trade disruptions and delays, 30 per cent reduction in CONCOR rail freight for a period of 12 months, establishing a strong Indian shipping line with sufficient capacity to cater to major export destinations, reducing reliance on foreign lines and regulating air freight prices to facilitate emergency imports and exports.