Economic data now brings more gloom than ever before. The global party that started from 2009 and saw high growth levels on the back of massive liquidity ended last year and since then, economic indicators have been disappointing. Add to it the coronavirus induced lockdown that brought economies to a grinding halt. April-June was worst effected as countries shut all economic acitivity to stop the spread of the deadly virus that originated in China. So analysts were prepared for a fall in global growth. But the figures released have been worse than what policy-makers, analysts and investors have been bracing themselves for. All major economies have reported a double digit fall in GDP. The Eurozone’s gross domestic product fell 40.3% annually in the three months through June, exceeding the U.S. economy’s 32.9% contraction, according to recently released data. This is by far the sharpest decline since comparable records began in 1995. To put it simply, while the US economy has been set back by five years, incomes in European nations like Spain are at 2002 levels. Southern European countries have been particularly hit since they are less industrialised, depend more on tourism and witnessed higher number of cases. Germany—Europe’s largest economy— suffered a 10% contraction in this period. What’s worse is that a recovery is unlikely to happen soon given that infections are still being reported, albeit more in the US than in Europe. This explains why the euro has risen steadily against the dollar—indicative of investors’ expectation that Europe will be able to tide over the health crisis sooner than US where fresh cases continue to surge at an alarming pace. This suggests the next few months will see nations going back and forth on lockdowns as fresh cases of coronavirus continue to be reported. Obviously, economic activity will remain subdued till the health crisis is not completely overcome. These data points indicate that the efforts taken by developed countries to bring the global economy back on track must continue. But let’s be clear: the global economy is now very precariously perched. It is staring at a fiscal cliff, governments are now massively over-leveraged after the first round of stimulus packages and any attempts to kickstart economic activity get defeated due to the surge in coronavirus cases. Add to it the limited scope of central banks to boost activity much from here on. They have run out of ammunition and fire power.

But this author expects multiple stimulus packages in the next few weeks. First will be the second stimulus to rev up the American economy. The previous $3 trillion package expires this week and has failed to lift the world’s biggest economy. Some experts say the U.S. economy is being supported by a massive fiscal stimulus that will likely translate into a 2020 government budget deficit roughly twice as large as Europe’s.

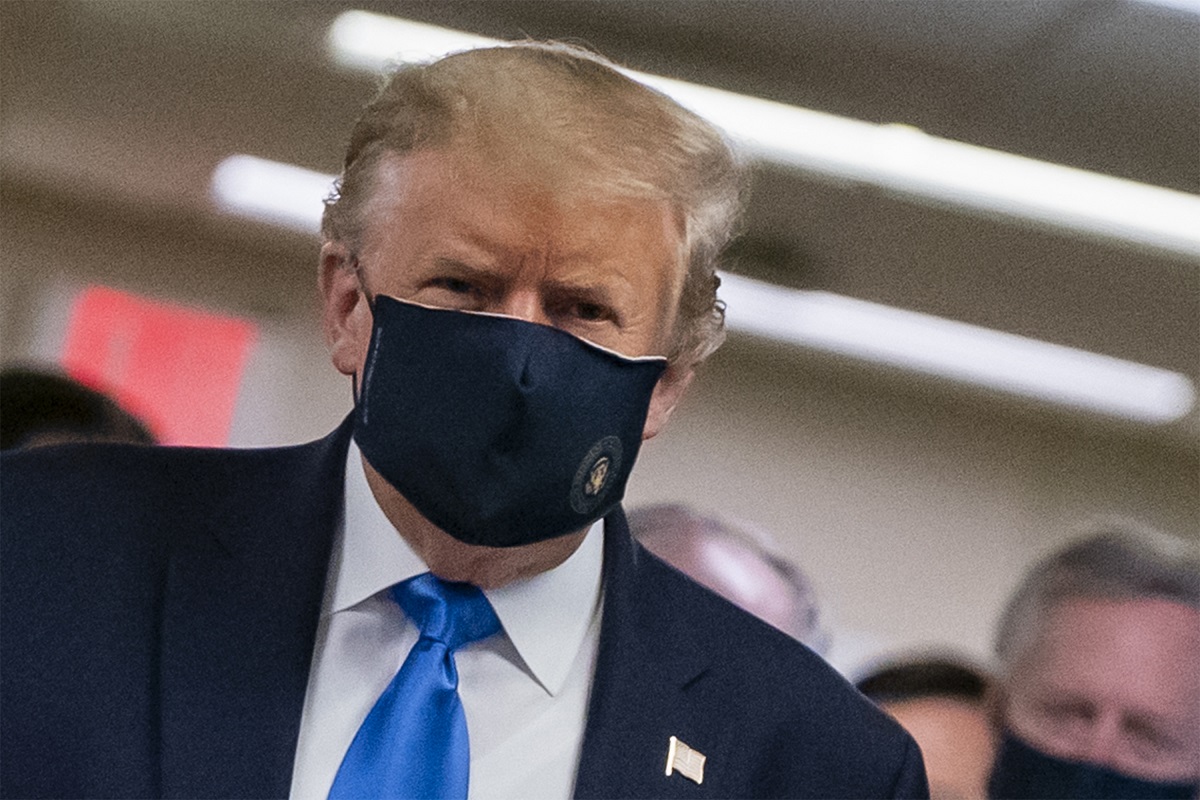

With President Trump trailing in ratings and with no prospect of a delay in the presidential election, it is expected that the next stimulus will be equally big, hopefully better targeted. Consumer spending which accounts for over two-thirds of the American economy fell by over 37% this quarter, indicating that households saved the additional money instead of spending it. Likewise, companies have already exhausted their loans with no major green shoots being seen. All eyes are on the US stimulus that will pave the way for other governments to respond in a similar fashion.

As for China, the over $13 trillion economy relies heavily on manufacturing which was worst effected due to shuttered factories and cancelled orders. Chinese official economic parameters—which have always been dubious and questionable—showed the second largest economy growing at 3.2% in April-June. Time will tell whether the second largest economy in the world managed to beat a global trend or whether it was part of a larger narrative from Beijing.

Gaurie Dwivedi is a senior journalist covering economy, policy and politics.