NEW DELHI: Indian refined sunflower oil volumes are expected to decline 8-10 per cent in fiscal 2025, with domestic consumers shifting back to soybean oil amid a price correction on back of a healthy soy harvest. The profitability of sunflower oil refiners, however, will expand 50-60 basis points (bps) on stable prices, hedging policies and the government’s announcement of continuing duty-free imports.

Strengthened balance sheets with strong accretions in fiscal 2021 and 2022 and the absence of major debt-funded capital expenditure over the medium term will keep the credit risk profile of refiners stable, suggests a CRISIL Ratings study of 10 companies that account for more than 70 per cent of the Rs 31,000 crore domestic sunflower oil industry.

The Indian edible oil industry is dominated by palm oil with a share of 40 per cent in volumes followed by soybean oil with a 20 per cent share and sunflower oil with 5 per cent share respectively. Demand for sunflower oil depends partly on the price movement of its substitutes such as palm oil and soybean oil. Jayashree Nandakumar, Director, CRISIL Ratings expects that with a bumper crop, the price of soybean oil is likely to correct by USD100 per tonne on-year and be on par with sunflower oil in fiscal 2025.

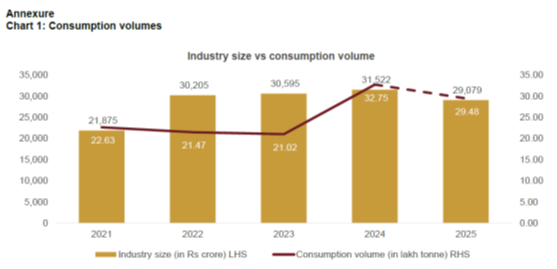

The resultant shift in consumption towards soybean oil will lower sunflower oil volume to 28-29 lakh tonne in fiscal 2025 (see chart1 in annexure) from 32 lakh tonne in fiscal 2024, although volume would remain higher than the historical average of five years through fiscal 2024. Despite declining volume, the crude prices are expected to remain firm this fiscal as shipping and freight costs continue to be high amid the Red Sea crisis resulting in geopolitical uncertainties in the Middle East. This, coupled with robust domestic demand, will result in sustenance of refined sunflower oil prices at current levels. Given lower volume and firm prices, the industry is expected to grow 6-8 per cent in fiscal 2025.

Despite the degrowth, profitability of refiners would improve 50-60 bps supported by favourable spreads on robust demand and no anticipated sharp fluctuations in prices. Also, refiners have firm hedging policies in place to avoid downside price risks. This, coupled with the government announcement on continuation of duty-free imports of crude sunflower oil will support the margins of refiners.