A crackdown on the counterfeit products market in India by bringing in stricter laws will not only ensure fair competition among brands, but will also reduce tax losses incurred by the government.

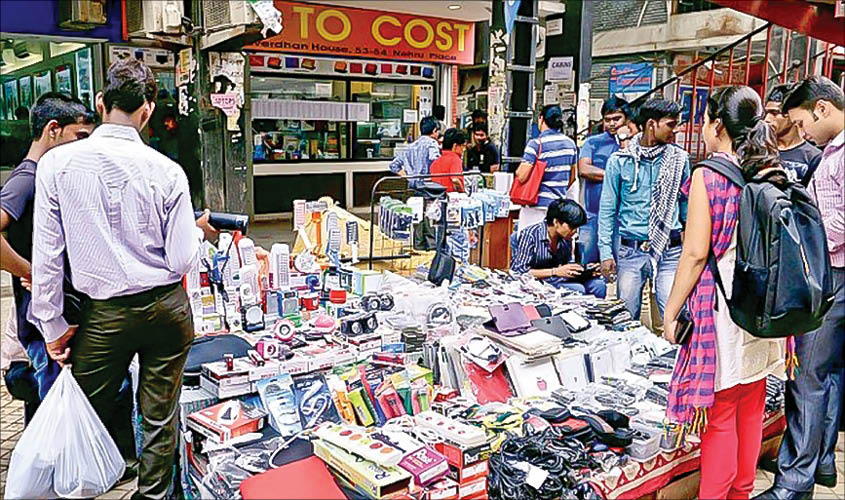

The menace of fake or duplicate copy of original products has been plaguing the market for long. According to a recent survey byLocalCircles, a private organisation that conducts researches to provide credible information to citizens and government bodies, one out of every five products sold on e-commerce platforms are counterfeit, and the chances of a fake are highest when it comes cosmetics and fragrances. Counterfeiting is one of the biggest challenges brand owners face today. It not only erodes the brand value of popular brands, but it also impacts their revenue margin. When fake or duplicate copies of branded products exist in the market, that particular brand’s reputation also takes a hit and affects the loyalty of the customers towards that brand. Raw materials of sub-standard quality are used to make cheap imitations of products of reputed brands that customers trust. One can find many such fakes in the market today. This is also creating a parallel economy for those who deal in fakes or first-copies of branded stuff. One way to check this is to restrict the import of these fake products into India.

Imports of various products across categories contribute a significant percentage of revenue to the economy of any country. However, many players work around the rules to avoid paying custom duties on the imported products, which results in significant loss of revenue to the government. Various media reports have alleged that some of the companies operating in India are delivering goods via couriers and postal gift shipments to bypass and evade a range of Indian laws on payment gateways, custom duties and GST. While the average customer purchasing any imported product in India is still paying a premium on it, the government unfortunately is not getting its due share on these transactions. To iron out issues like these, the government is bringing in several new rules which would restrict such unlawful practices. One example is the latest amendment to the Drugs and Cosmetics Rules.

As per the latest ruling, the government has increased the application fees for the grant of various import licenses and registration certificates, which are charged as custom duty for each brand of cosmetics product. That is not all, one needs to pay a separate fee for each category of brand. So, if a player wants to sell a brand of lipstick and mascara, he needs to pay a separate fee for both the goods, namely the lipstick as well as the mascara. While a cosmetics fee of two $250 was charged earlier, it is now being increased to $2,000. This steep increase in price to grant the import license in case of cosmetics, will now ensure that only serious players continue to operate in the market. The Indian market, which was flooded with many fake variants of original products earlier, can now be checked, thanks to these amendments in the Drugs and Cosmetics Rules.

The reason we find that some products are available at comparatively cheaper prices on some platforms is because custom duties are not being paid on them. Hence those platforms can afford to sell them at a discounted rate as they have already saved on the margin by somehow avoiding paying the custom duty. Once stricter rules are in place, it would ensure that all imported products mandatorily pay the custom duty, and when all industry leaders start following the rules, then the cost incurred to bring the product to the end customer will remain the same across the board. Considering this case, no player will be able to offer any significant price difference in comparison to its competitor. This will create a level playing field

Custom authorities also need to be more vigilant while clearing the shipment from foreign countries and check for any discrepancies in the product description and the actual product. There have been reported cases of undervaluing the products, so that the custom duty paid on them is low. These products then make it to the grey market, where they are sold at competitive prices as compared to Indian products. Such practices need to be checked and discouraged to avoid the manipulation of product pricings.

The Indian cosmetics industry is growing rapidly, at a rate of 13-18% annually. This is largely due to the rising awareness of beauty products among Indian consumers and the various brands available in the market, including imported ones. Cosmetics products from markets like Thailand, Japan, Germany and Malaysia are now getting extremely popular in India. Once the new rules kick in, only original and authentic products will be able to make their way into the Indian market—thus, both the customer and the seller stand to gain. These new rules are a welcome step, which will incentivise those who play by the rules, making it beneficial for the market in the long run.

The author is co-founder and CEO, LaYuva, an e-commerce firm