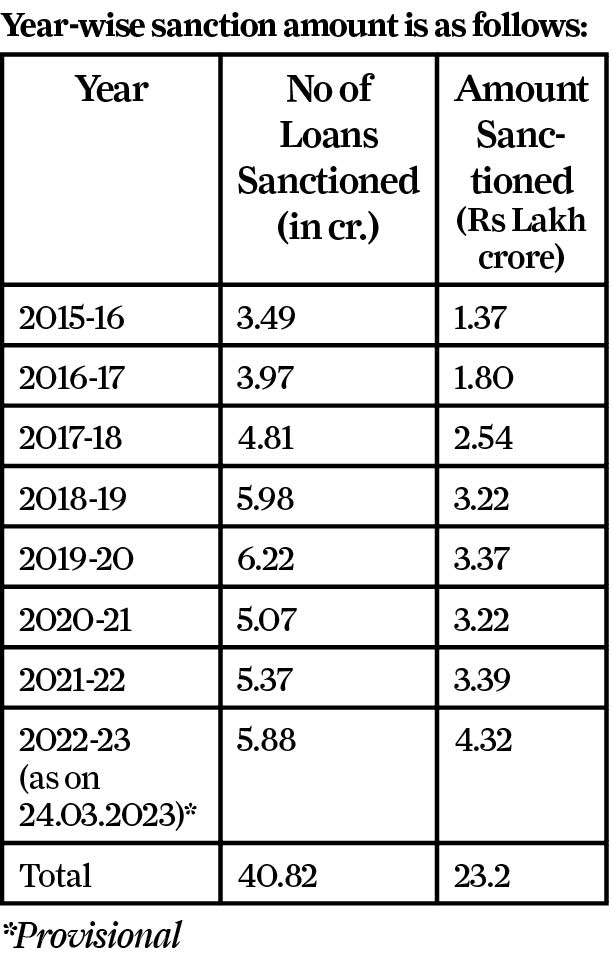

NEW DELHI: In eight years, women entrepreneurs have come to comprise nearly a whopping 70% of the loans under Pradhan Mantri MUDRA Yojana (PMMY) which, on Saturday, marked eight years of the government’s aim of empowering the “Atmanirbhar Nari Shakti” and sanctioning more than 40.82 crore loans amounting to Rs 23.2 lakh crore (as on 24 March 2023), for men and women entrepreneurs. Launched on 8 April 2015 by Prime Minister Narendra Modi with the aim to facilitate easy collateral-free micro credit in a seamless manner to micro enterprises in the country and allow borrowers to fulfil their entrepreneurial dreams, the PMMY enables easy and hassle-free access to credit of up to Rs 10 lakh to non-corporate, non-farm small and micro entrepreneurs for income generating activities.

Describing the achievement as “commendable, and tribute to the hard work of people”, PM Modi tweeted, “PM Mudra Yojana has played a vital role in funding the unfunded and ensuring a life of dignity as well as prosperity for countless Indians. Today, as we mark 8 years of Mudra Yojana, I salute the entrepreneurial zeal of all those who benefitted from it and became wealth creators.” According to a 2013 NSSO survey, India comprised 5.77 crore small/micro units, wherein a majority were sole proprietorships/own account enterprises, which employed 12 crore people. Of the total small/micro units, 60% were owed by people from Scheduled Castes, Scheduled Tribes and Other Backward Classes. However, due to low credit availability, which was mostly generated from informal lenders such as friends and relatives, the government decided to provide micro/small business units with access to institutional finance to help create a significant potential for small businesses to generate employment opportunities and drive the country’s economic growth.

The PM MUDRA is structured to meet both term loan and working capital components of financing for income generating activities in manufacturing, trading and service sectors, including activities allied to agriculture such as poultry, dairy, beekeeping, etc. The loans have been divided into three categories based on the need for finance and stage in maturity of the business. These are Shishu (loans up to Rs 50,000), Kishore (loans above Rs 50,000 and up to Rs 5 lakh), and Tarun (loans above Rs 5 lakh and up to Rs 10 lakh).

The PMMY data shows women entrepreneurs accounting for 68% of accounts under the scheme while 51% of accounts belong to entrepreneurs of SC/ST and OBC categories. Every five seconds, loans worth Rs 5 crore are disbursed under PM Mudra. Of the more than 40.82 crore loans, approximately 21% has been sanctioned to New Entrepreneurs and 83% loans have been provided to micro units/enterprises in Shishu category. The Small Industries Development Bank of India has disbursed Rs 636.89 crore to MLIs for onward credit of subvention amount into accounts of borrowers. About eight crore beneficiaries are first time entrepreneurs. The programme has created nearly 41 crore entrepreneurs.

The loans are provided by member lending institutions (MLIs) which include banks, non-banking financial companies (NBFCs), micro finance institutions (MFIs) and other financial intermediaries. The rate of interest is decided by lending institutions in terms of RBI guidelines. In case of working capital facility, interest is charged only on money held overnight by borrower.

The PMMY also serves the financial inclusion agenda of the government through three pillars—banking the unbanked, securing the unsecured and funding the unfunded which is being implemented with the objective to provide access to credit for small entrepreneurs. The three objectives are being achieved through leveraging technology and adopting multi-stakeholders’ collaborative approach. To further this objective, the government has extended interest subvention of 2% on prompt repayment of Shishu loans for a period of 12 months to all eligible borrowers and an overdraft loan amount of Rs 5,000 has been enhanced to Rs 10,000 since September 2018 and sanctioned under Pradhan Mantri Jan Dhan Yojana (PMJDY) accounts.

40.82 cr Mudra loans approved in 8 years, 70% for women-run businesses

- Advertisement -